Ripple Rival Stellar (XLM) Among Top Unprofitable Cryptocurrencies of Week as of Now

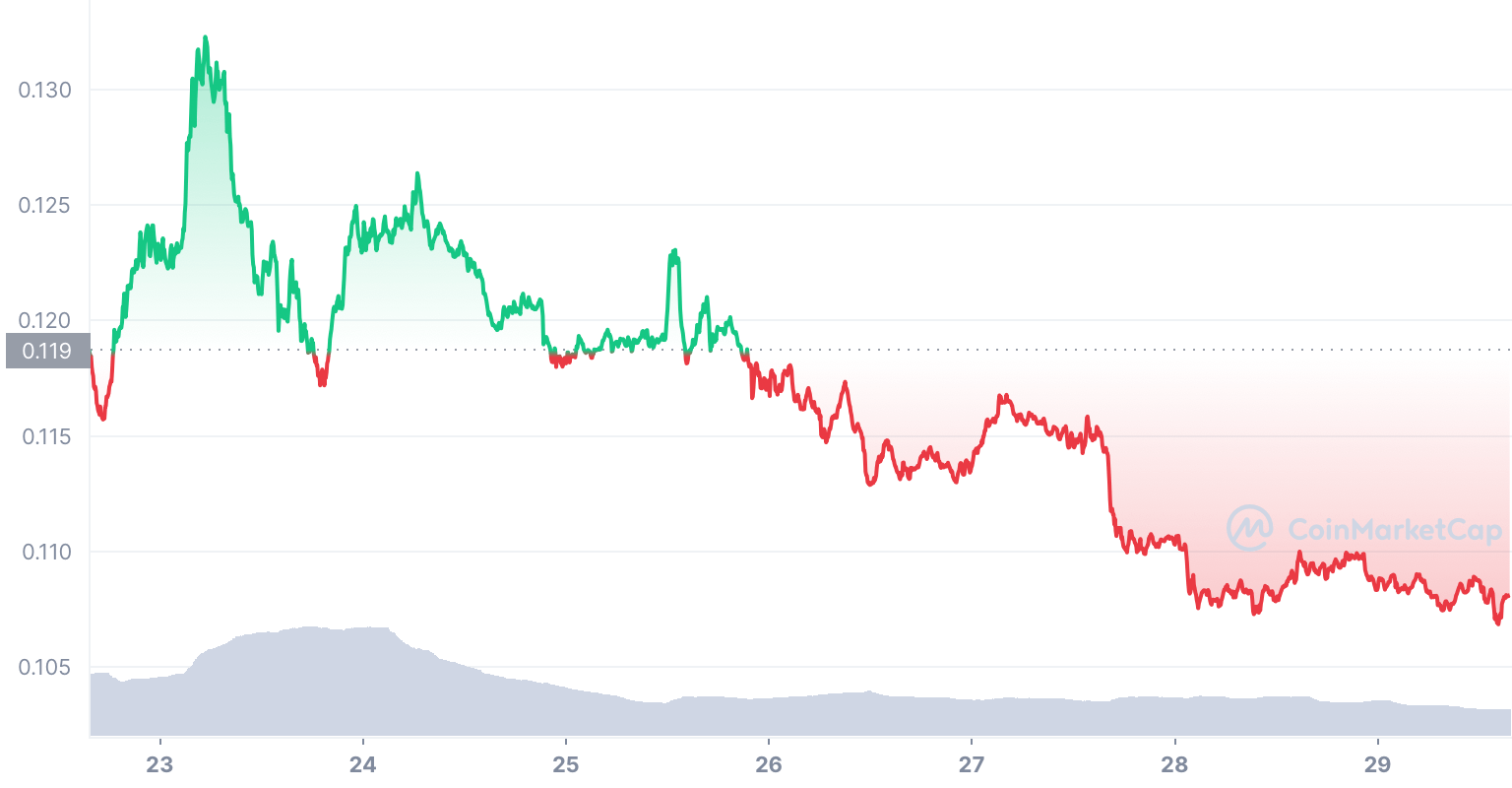

Stellar’s Lumens, or XLM token, is currently at the bottom of the five-most-affected cryptocurrencies for the week. Despite a universally unfavorable crypto market environment, the project founded by former Ripple director Jed McCaleb has shown extremely poor performance. What makes the numbers on the Stellar chart particularly heavy is the almost 25% rise in quotes last week, driven by positivity about rival Ripple and its litigation with the SEC.

It is unclear what prompted investors to buy XLM at levels of $0.13 and above, even despite the positivity around the Ripple case against the SEC. The project has not been distinguished by loud announcements for a long time and has even come under the radar of that very regulator for being a security.

That XLM could be considered a security follows from leaked correspondence from a large investment fund, Grayscale Investments, to employees. Although the fund did not officially comment, such a state of affairs would not be surprising. Jed McCaleb left Ripple over dissatisfaction with too much centralization there and founded Stellar, but Stellar is not so decentralized either.

Stellar (XLM) price action

XLM is currently trading at $0.108 per token, 85% below its all-time high. At the same time, interestingly, the token for the last most severe four months was not particularly volatile and did not fall below $0.98 per XLM.

You could say that XLM has already hit bottom, but it is worth keeping in mind that the recession and the SEC could knock from that position.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  BUSD

BUSD  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD