These Bored Apes Will Melt in Your Mouth: M&M’s Releases NFT-Inspired Candy

Bored Ape Yacht Club owners have used their permissive commercialization rights to turn their Ethereum NFT imagery into everything from apparel to toys, alcohol packaging, and restaurants. But now you can actually eat a few Bored Apes via limited-edition M&M’s.

Candy brand Mars today announced that it has signed a deal with Universal Music Group (UMG) label 10:22PM to create limited edition M&M’s based on Kingship, its virtual band made up of Bored Ape Yacht Club and Mutant Ape Yacht Club avatars.

«Consumers’ expectations for what they want from their favorite brands [have] shifted, and at Mars, we know we need to be more innovative than ever with such a culturally famous brand like M&M’s,» said Mars Wrigley Global Vice President Jane Hwang, in a release.

Kingship was revealed last November as a “metaverse band” created from NFTs owned by investor and entrepreneur Jimmy “j1mmy” McNelis. The label 10:22PM has created personalities around the Bored Ape illustrations and is developing original music for the group—following the model set by popular virtual band Gorillaz—which will perform concerts in metaverse worlds.

“Rider” — #KINGSHIPxMMS pic.twitter.com/dw0Igoo1Py

— KINGSHIP (@therealkingship) August 24, 2022

The band has also released its own NFT “key cards” that provide exclusive benefits and access to holders. NFT owners were given early access to purchase the M&M’s candy.

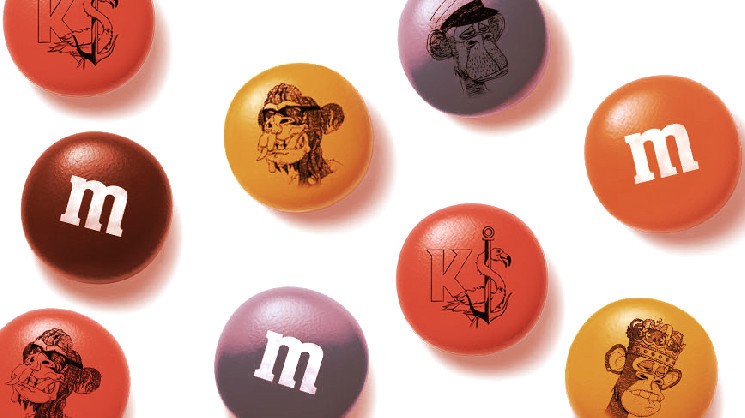

As part of the deal, Mars has released limited quantities of the branded M&M’s chocolate candies, which feature images of the Bored Apes and Kingship iconography on them. All told, Mars will sell just 10,000 total packages of the candies between gift boxes and gift jars.

Decrypt reached out to UMG representatives for additional details on terms of the deal and how the partnership came together, but we did not immediately hear back.

Universal Forms Metaverse Band Based on Bored Ape Yacht Club NFTs

An NFT is a blockchain token that acts like a deed of ownership to a virtual item, and can be used for things like profile pictures, artwork, and collectibles. As the NFT market has grown in scale, reaching $25 billion worth of trading volume in 2021 alone, brands have increasingly entered via collaborations or their own digital collectible drops.

The Bored Ape Yacht Club is arguably the most popular project in the space. Yuga Labs’ NFT collection has generated nearly $2.4 billion in secondary trading volume to date, per data from CryptoSlam. Combined with follow-up and spin-off projects, Bored Ape-related NFTs have collectively yielded more than $5.6 billion in secondary trading to date.

To be clear, this M&M’s deal isn’t a partnership with Yuga Labs or the actual Bored Ape Yacht Club brand. Instead, Bored Ape NFT holders are able to use their owned images to create products and projects, and can license that artwork to brands if they please.

The Kingship deal with UMG’s 10:22PM label is one such example of a licensing deal, and this new Mars alliance adds a further layer to it. Bored Ape images have also been used for fast food restaurants, marijuana and alcohol packaging, clothing, collectibles, and more.

Bored Apes have also made a big splash in the music scene. In addition to Kingship, popular producer and musician Timbaland has released music around his own Bored Ape avatar, and launched a record label for other artists to do the same.

Rappers Eminem and Snoop Dogg have also released a music video together featuring their Apes—and Snoop is opening a dessert spot themed around one of his Apes.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren