Bitcoin, ether whipsaw as Fed Chair’s comments roil markets

Crypto markets whipsawed alongside traditional counterparts after Federal Reserve Chair Jerome Powell said it’s premature to think about pausing rate hikes, even after the Federal Open Market Committee indicated its latest rate hike signaled a possible end in sight.

The ultimate level of rates will be higher than previously expected, Powell said after the announcement of the latest 75-basis point hike. That said, the rate of increases may begin to slow as soon as December.

It’s «very premature to be thinking about pausing,» Powell said at a press conference following the rate decision. “Incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.”

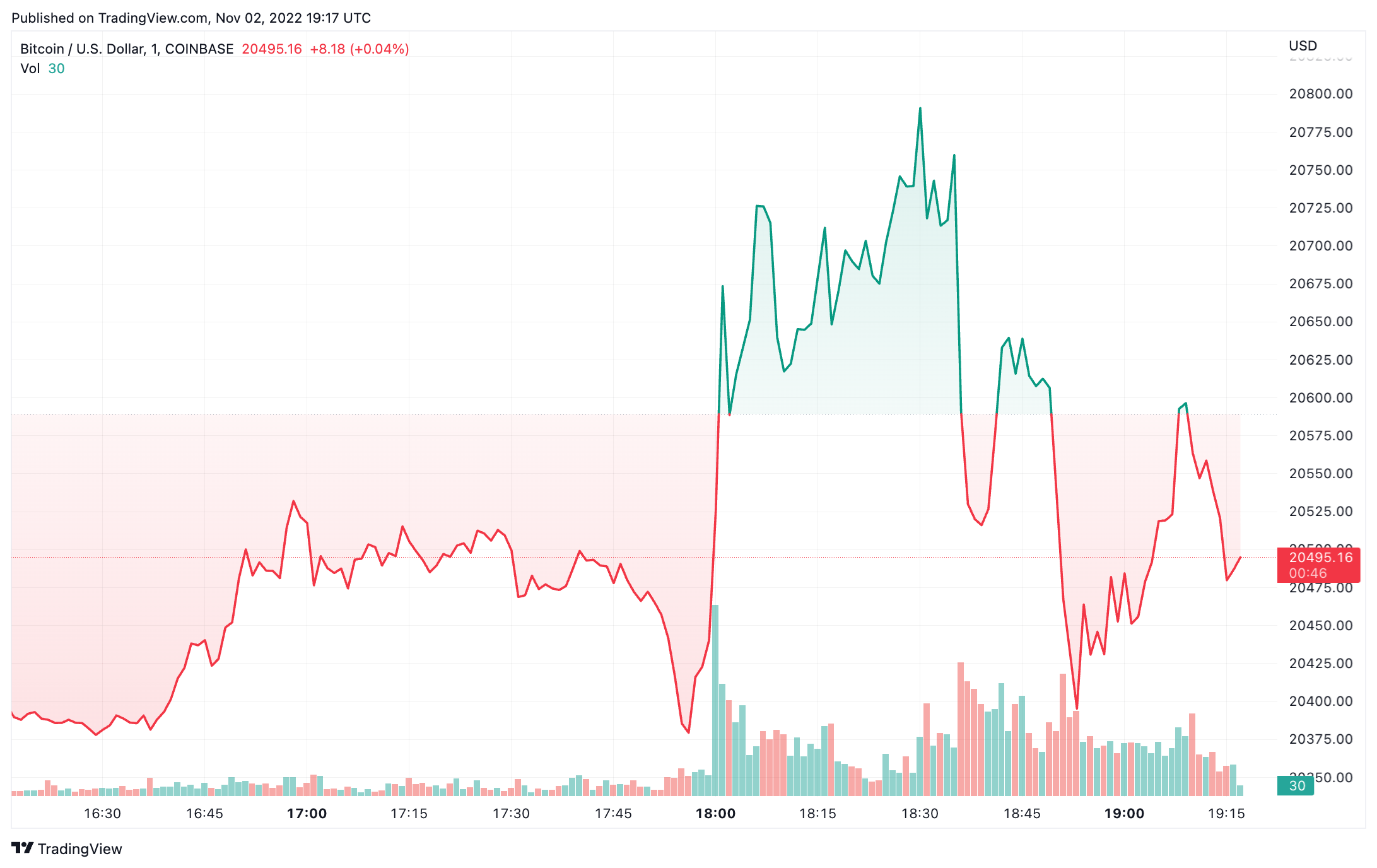

Bitcoin initially traded higher following the rate decision but dropped 1.8% after his statement. Bitcoin was trading at $20,495 at the time of writing, according to data via Coinbase.

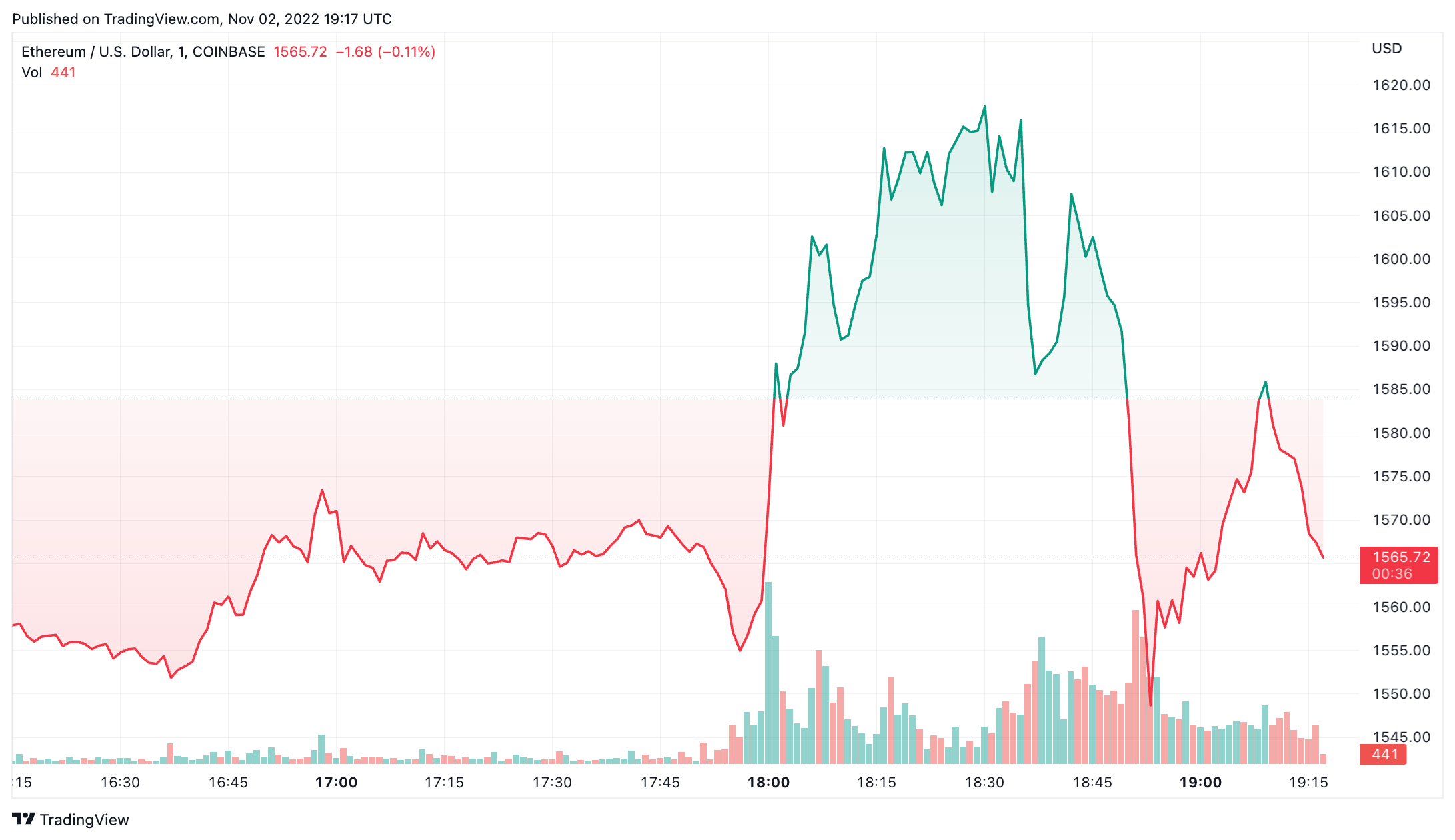

Ether also whipsawed, albeit more modestly.

The hike was in line with expectations, but many speculators were looking for something else in the FOMC’s release — namely, signs of a pivot. The FOMC said it anticipates ongoing increases in the target range will be appropriate to return to 2% inflation.

Crucially, the Fed said it would consider various factors concerning future hikes, including «the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Hive

Hive  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD