Blockchain gaming sector thrives despite FTX meltdown, new data reveals

Although the cryptocurrency market has only just started to recover from the aftermath of the FTX collapse and the ensuing crisis, the underlying technology has remained strong, especially where blockchain games are concerned.

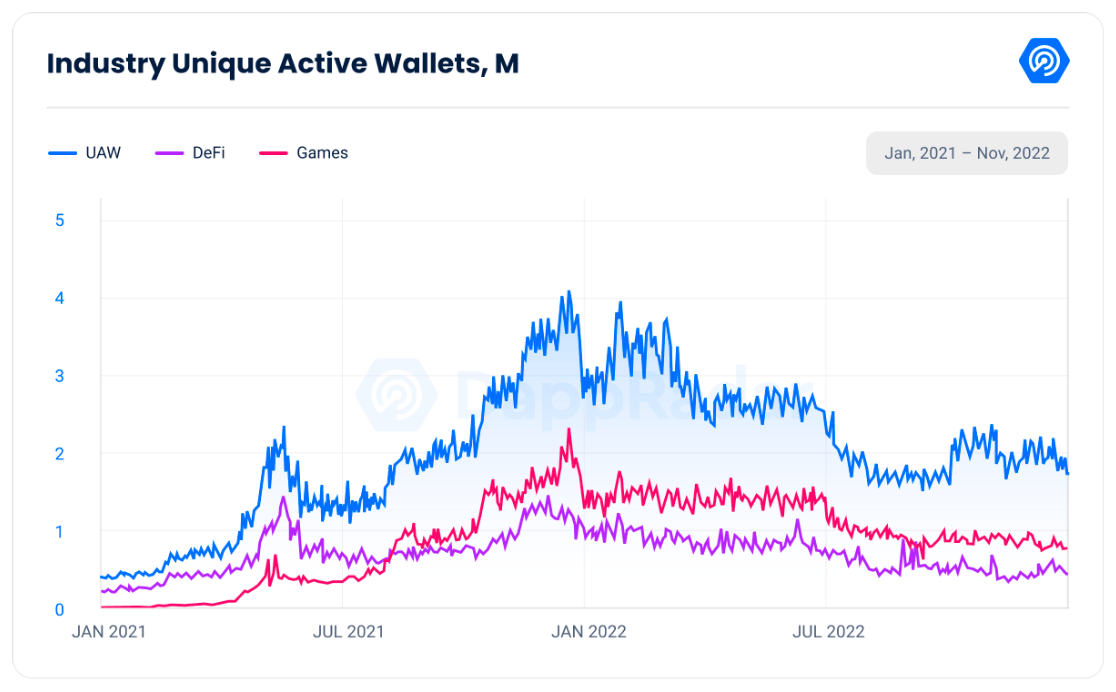

Indeed, the user activity in Web3 games during October and November has accounted for nearly half of all blockchain activity (42.67%) across 50 networks, according to a new DappRadar report shared with Finbold on November 30.

In November alone, an average of 800,875 unique active wallets (UAW) were interacting with games’ smart contracts each day, recording a decrease of only 12% since September, during which the industry had 911,720 active wallets.

That said, the current state still represents a decline as compared to the end of 2021 and early 2022. The Solana (SOL) blockchain suffered the most significant blow of all the relevant networks, as it saw a whopping decline in unique wallet activity of close to 90% during the month, with an average of 2,326 daily active wallets.

Funding continues on smaller scale

Despite the crisis, funds continued to pour into the blockchain games and metaverse projects, which raised $534 million in October and November, with the most investments directed toward building and maintaining infrastructure.

So far, the running expectations of investing in blockchain games for this year stand at around $8.16 billion, a 104% increase from the total of $4 billion in 2021. The fourth quarter of 2022 recorded the lowest amount of funding – $500 million.

As Finbold earlier reported, blockchain games and metaverse projects raised $1.3 billion over the course of the third quarter of 2022, which represents a decrease of 48% compared to Q2 2022.

Meanwhile, the total in-game trading volume of non-fungible tokens (NFTs) amounted to $55 million in October and November, with the popular blockchain card game Gods Unchained topping the list by generating 64.25% of the total trading volume, reaching $21.6 and $13.45 million in the two months, respectively.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur