Blockchain Technology: The Future of Latin America’s Financial System

Roger Manuel Benites is a development director at The Blockchain Center, a 503(c) non-profit organization specializing in the education and adoption of blockchain, cryptocurrency, and digital asset technologies.

__________

I returned to Lima (Peru) in the year 2013 when I was introduced to Bitcoin by my brotherRoger Gabriel Benites. It was while living in Argentina that Roger Gabriel was first exposed to a digital currency known as Bitcoin and the inflated premium dollar, “dollar blue”. The Bitcoin currency network, backed by blockchain technology, empowers the unbanked and the banked alike by freeing them from central banking and unstable national currencies. In 2013, Bitcoin had grown in prominence as Argentina struggled with hyperinflation brought about by financial policies and complex government politics. It was clear to my brother and me that Bitcoin had the potential to alleviate many of the monetary issues holding back developing economies around Latin America and the globe.

Experience proved to me that economic development was only possible when people could trust their monetary system and the rule of law. It was clear that Bitcoin as a currency and monetary network, which was beyond the reach of challenging politics, could accelerate developing economies.

No other group stood to benefit more from access to the Bitcoin global monetary system than the unbanked, who make up a significant percentage of people in Latin America.

The only question was how best to implement a technology that in 2013 was still so new and experimental.

The primary goal of this technology was to reduce the costs and burdens imposed by legacy systems that control and oversee the remittance payments of the world’s underdeveloped economies. Bitcoin technology had the potential to move money seamlessly, increasing economic growth in every country that would adopt it and build on top of it. By having the technological prowess to replace the current outdated legacy financial network known as SWIFT, our nations would save the people of Latin America millions every year by enabling stable remittance payments and real-time currency exchanges. Remittance companies in Latin America that were subject to hyperinflated currencies, outdated political systems, and high costs were ripe for disruption.

US blockchain Research and Development — The North and South of the Americas

I returned to the US, New York and Connecticut, to continue my research in blockchain technology in 2016 and was able to be part of various blockchain smart contract pilot projects specializing in decentralized finance, real estate, medical, and government applications. My team and I were able to research and develop various blockchain use cases and practical applications for real-world problems. Much of this research was published as part of a Blockchain education book, titled “Blockchain for Accounting and Business”, written by Saurav Dutta and distributed globally to academic and financial institutions. In 2018, the opportunity arose in Miami to create a Bitcoin center which later evolved into The Blockchain Center. The Blockchain Center is a non-profit organization developed to facilitate the mainstream adoption of blockchain and cryptocurrency technology through political, financial, and media impact projects at national and international levels. The Bitcoin center was founded in 2014 by Bitcoin pioneer Nick Spanos under the name “The Bitcoin Center”, and was featured in the Netflix documentary “Banking on Bitcoin”.

“The Blockchain Center Miami was created in order to form an economic and innovation hub in downtown Miami, attracting blockchain and tech companies from New York, San Francisco, and worldwide. We’ve had great support from the local city office since the beginning and to this day they have been a strong advocate of cryptocurrency and blockchain innovation.” — Nick Spanos

The initial goal was for the city of Miami to become the “Silicon Valley of Latin America” to increase economic growth, talent development, and innovation. As the city continues to push cryptocurrency and blockchain technologies in its agenda, Miami is poised to become the most disruptive city when it comes to decentralized government blockchain applications such as voting and public asset management via smart contracts. Miami is the center for Latin America’s imports & exports, cellular/satellite communications, and, most importantly, Latin American financial institutions that hold a majority of the continent’s wealth.

This positions Miami as the perfect neutral zone for all the countries in Latin America and the starting point for a Latin American union.

From experiencing firsthand the growth of blockchain technology supporters, it became clear that Latin Americans believe in a union that would turn our developing countries into flourishing ones. This can be done by uniting and leapfrogging over inefficient systems of government and money.

A more united Latin America

To better understand the current situation of Latin American continental progress, there are currently three organizations that have been developed to create a more united Latin America, the Alianza del Pacifico, Mercado Comun del Sur (Mercosur), and Mercados Integrados Latino Americanos (MILA). These organizations were designed to converge Latam countries to provide economic prosperity by enacting financial and monetary policies but are divided due to foreign interests related to the US, China, and Russia. The west of Latam is supported by Alianza del Pacifico, while the east is supported by Mercosur. MILA is an organization created to integrate the financial markets of Latin American countries. Currently, there are four countries signed up: Peru, Colombia, Chile, and Mexico. The integration aims to strengthen capital markets to increase investor confidence in the supply of securities, and issuers, and increase larger sources of funding.

The first milestone of the initiative is implementing a new organization where all Latin American countries accept and promote economic growth and innovation using decentralized financial infrastructures and blockchain technologies, as well as strong public and private partnerships for the overall goal of a strong united Latin America.

In order to build the future, we must understand the past

In the 1920s, the German government, under the Weimar Republic, was experiencing hyperinflation following World War I. The country desperately needed to rebuild its economy but lacked the necessary gold reserves. To overcome this challenge the Weimar Republic developed a new type of currency known as the “Rentenmark”, which was redeemable for bonds of land and industrial plants in order to stabilize the currency and bring back the confidence of foreign investors. The Weimar Republic also introduced new fiscal measures to insure the Rentenmarks stability. Credit was not offered to the German industry to prevent widespread speculation through leverage and subsequent inflation. With the currency in short supply, banknotes that were issued returned to acceptable levels, and confidence was returned to the German economy temporarily. This initiative was successful for a number of reasons but primarily due to the support of American bankers known as the Dawes Committee.

The Dawes Committee created a novel solution for managing the funds raised from the sale of the Rentenmark. The process began with the German government raising money for war reparations and then transferring said funds into a special escrow account in the Reichsbank which would be managed and overseen by an American Agent-General. This new office would then decide how the funds should be put to use, either to pay back debt, buy German goods, or provide credit to local businesses.

This ingenious mechanism ensured these assets were properly distributed and invested.

Another case study of how a nation or state can leverage its natural resource wealth can be seen in the Alaska Permanent Fund. The Alaska Permanent Fund was established by the State of Alaska through a constitutional amendment in 1976 before the trans-Alaska pipeline began production. The goal of the fund was to monetize a portion of the state’s oil revenues for the needs of future generations of Alaskans. A few years later after induction, the Alaskan government formed the Alaska Permanent Fund Corporation (APFC) to manage investments of the Permanent Fund outside of the State Treasury. The investments were then guided by a six-member board of trustees appointed by the Governor. The Fund uses oil royalties to make investments in bonds, stocks, real estate, infrastructure, and private entities. Every year payouts of the fund are made to Alaskan residents which are used for college savings, retirement accounts, charities, and basic living expenses.

APFC successfully injected millions into the economy (billions by 2023) in the early years of the fund’s creation and this past year alone injected 2.1 billion into the economy.

Studies have shown that it has reduced the state’s poverty rate since its approval by the Alaska Constitution. According to the Institute of Social and Economic Research from 2011-2015, the fund reduced the poverty rate in Alaska from 11.4% to 9.1%. The Permanent Fund has been able to generate continuous revenue for the State of Alaska and future generations of its people.

A similar mechanism could be applied to developing economies with vast untapped natural resources.

Ingenious mechanism, escrow accounts, and multi-party agreements?

These are known financial banking terms that have been used and implemented for ages, which asks the question: could blockchain and tokenization help increase transparency and efficiency and unlock the potential of illiquid assets?

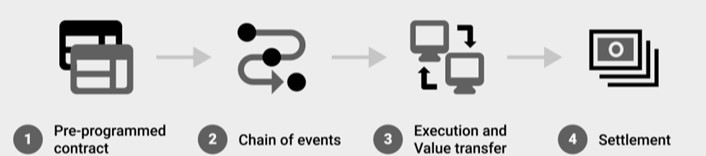

We will begin by explaining what a blockchain smart contract is, and according to IBM, “Smart contracts are simply programs stored on a blockchain that run when predetermined conditions are met. They typically are used to automate the execution of an agreement so that all participants can be immediately certain of the outcome, without any intermediary’s involvement or time loss. They can also automate a workflow, triggering the next action when conditions are met”.

To simplify this, smart contracts can help transactions between various parties be more transparent, efficient, and most of all fair, since every decision is governed and verified by computer code and all parties need to agree in order to move to the next event.

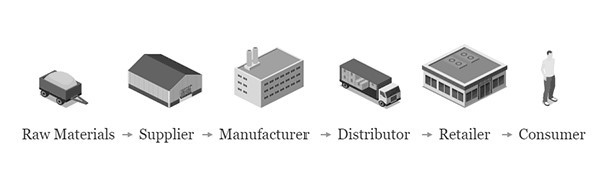

There are several steps in the supply chain of natural resources such as the mining of gold or the farming of soybeans. Many parties are involved in this process and being able to verify certain amounts of the supply are valid are key factors that blockchain smart contracts could help validate, as well as provide a more precise real-time total value locked of assets in a digital or physical vault or better yet, phygital vaults. For example, the Dawes Committee could have used smart contracts when dealing with the various parties involved for instant settlement transactions and verification of assets if the technology was available at the time. The parties in the smart contract would consist of the German government, the Dawes committee, and the buyers of the Rentenmark. The Alaska Permanent fund could use Blockchain smart contracts to verify the supply chain of the oil reserves from the Alaska pipeline, or even tokenize each barrel of oil based on an individual oil field such as the Sourdough or Prudhoe streams for inventory and logistics management.

Latam Initiative: Bitcoin and DeFi: a bright future for underdeveloped economies

The Bitcoin blockchain’s decentralized and secure nature, as well as its wide acceptance by financial institutions and large trading volume, make it an ideal foundation for a new solution that aims to improve the economic and government systems in Latin America. By applying Bitcoin’s network metrics to monitor a country’s natural resources production rate and validate asset reserves, transparency and trust can be established in the network.

The proposed Nuevo Sol network aims to build a network of trusted resource providers, including private corporations and public organizations, that must meet a delivery quota to maintain reliability and strength.

By implementing a decentralized financial network governed by smart contracts, the Nuevo Sol network can promote price stability, increase liquidity, and drive economic growth for all citizens.

This new mechanism will allow developing Latin American nations with untapped potential to properly value each country’s natural resources by means of tokenization. It will be able to provide the people with a stable means of exchanging value and provide economic equality to all its citizens by providing access to decentralized financial technologies for the unbanked.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  0x Protocol

0x Protocol  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur