Brazil Central Bank Unveils CBDC, Tokenization ‘Events’ – Digital Real Rollout Imminent?

Brazil’s Central Bank, the Banco Central do Brasil (BCB), has unveiled a “roadmap” of events ahead of the nation’s CBDC rollout.

In an official BCB release, the bank stated that it would also begin assessing the possibility of enabling the launch of tokenized assets.

The BCB unveiled a list of “monthly webinars” as part of its digital real platform development.

The events will run until November and will see the bank, fintech experts, and BCB partners discuss CBDC rollouts, as well as the results of the BCB’s own digital real pilot.

The pilot is now moving into advanced stages ahead of a slated rollout next year.

Several high-profile companies were unveiled as digital real partners last month.

These include the crypto-keen neobanking unicorn Nubank.

A small number of domestic crypto firms were also included as consortium members.

Policy-making “working groups” will also meet until November to discuss tokenized assets and CBDC-related matters.

The BCB said the groups would look to compare “the Brazilian experience” with “international scenarios.”

They also want to “study of the impact of the use of distributed ledger technology and blockchain technology” on “services and markets.”

And the central bank said it wanted the groups to examine the cybersecurity credentials of existing tokenization solutions.

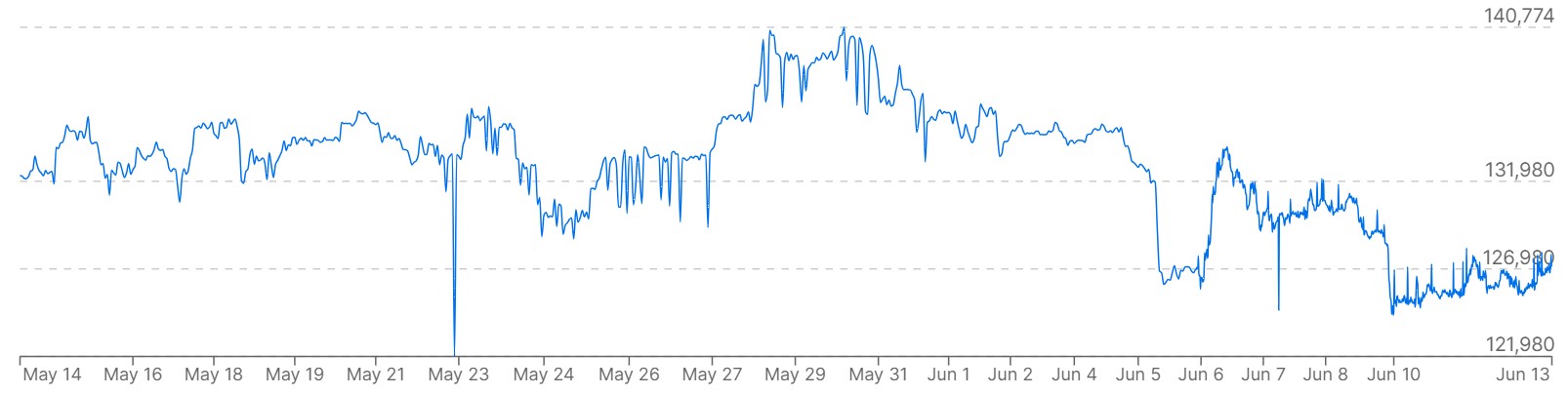

Bitcoin prices versus the fiat BRL over the past month. (Source: XE.com)

Brazil Central Bank’s CBDC and Tokenization Plans

The working groups will also be tasked with examining “the legal framework” surrounding tokenization and the “eventual proposal of regulatory amendments.”

A discussion forum with “other regulators and market participants” was also touted.

Academic, industry insiders, regulators, and international organizations will be invited to contribute to the webinars and meetings, the bank said.

The central bank has previously stated that it wants to launch a digital fiat in 2024 following its behind-closed-doors pilot.

The bank has also promised that its CBDC will differ from others by aiming to aid domestic startups.

The BCB said that while other banks’ CBDC projects are focusing on retail markets, the Brazilian token will “foster new business” in the financial services sector.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur