‘Significant risk’ of US Treasury running ‘out of funds’ soon: Report

The United States government faces a “significant risk” of no longer being able to meet all of its financial obligations as early as June, as per a recent report.

According to a May 12 report published by the U.S. Congressional Budget Office (CBO), the risk of the U.S. government defaulting on its debt in the near future stems from it having reached its statutory debt limit of $31.4 trillion, on Jan 19.

The CBO predicts that if the debt limit remains unchanged, there is a risk that the U.S. government will be unable to meet its financial obligations as early as June. It noted:

“CBO projects that if the debt limit remains unchanged, there is a significant risk that at some point in the first two weeks of June, the government will no longer be able to pay all of its obligations.

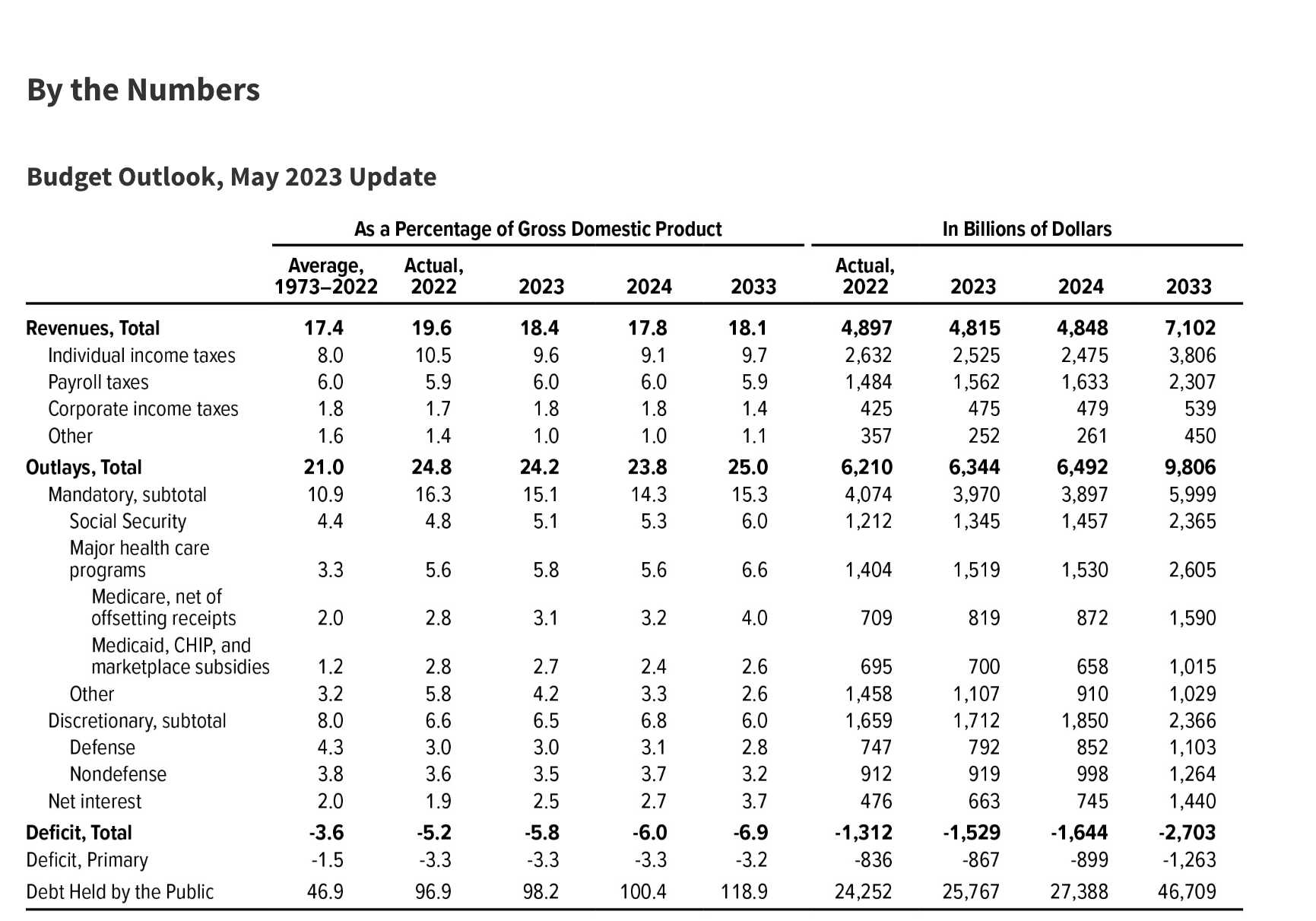

TheCBO currently predicts a federal budget deficit of $1.5 trillion in 2023, which is $0.1 trillion more than it estimated in February.

CBO’s Budget Outlook, May 2023 Update. Source: Congressional Budget Office

It was emphasized that the outcome of the ongoing Supreme Court case regarding the cancellation of outstanding student loan debt could have a significant influence on the total revenue for 2023.

A shortfall in tax receipts recorded through April has the potential to also lead to a larger deficit than initially predicted, the report noted.

Related:How would a US debt default impact Bitcoin?

However, based on its projected data, the CBO does not anticipate a decrease in the deficit in the immediate future – in fact, it is predicted that the annual deficits will “nearly double over the next decade,” reaching $2.7 trillion in 2033.

CBO predicts that debt held by the public will also increase over the next ten years. It was noted:

“As a result of those deficits, debt held by the public also increases in CBO’s projections, from 98 percent of GDP at the end of this year to 119 percent at the end of 2033.”

Magazine:Alameda’s $38B IRS bill, Do Kwon kicked in the assets, Milady frenzy: Asia Express

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Monero

Monero  Maker

Maker  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  Enjin Coin

Enjin Coin  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Zcash

Zcash  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  DigiByte

DigiByte  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Steem

Steem  Hive

Hive  OMG Network

OMG Network  Huobi

Huobi  Ren

Ren  BUSD

BUSD  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur  HUSD

HUSD