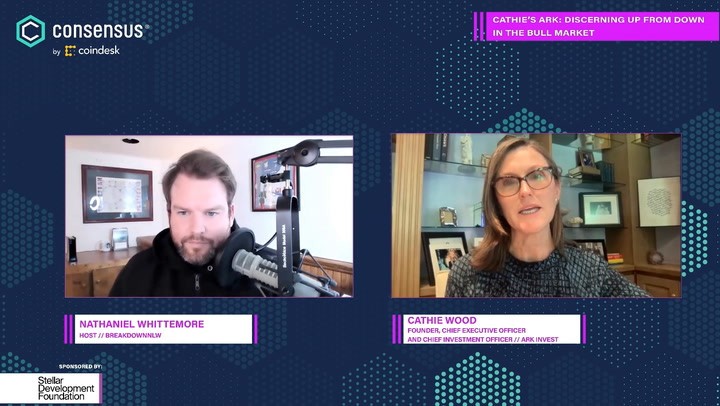

Cathie Wood Continues Buying Coinbase’s Dip With $5 Million Stock Purchase

ARK Invest, a technology and fintech fund run by Cathie Wood, has purchased $5 million of Coinbase’s stock.

This is the fourth recent buy for the investment fund, as the company’s ARK Fintech Innovation ETF (ARKF) adds 158,000 shares to its balance sheet. Wood’s most recent purchase came in mid-December, when it added $3.2 million in the exchange’s shares to its balance sheet.

Coinbase’s stock closed at $34.78 in New York Thursday, up roughly 7%. Shares in the exchange have been hit hard by the crypto bear market, falling 86% this year. COIN has underperformed both bitcoin and ether, with the world’s largest digital asset falling by 65% year-to-date and the eponymous token of the Ethereum protocol falling by 66%.

In late November, Wood continued to demonstrate her bitcoin conviction by purchasing 176,945 shares ($1.5 million) of Grayscale’s Bitcoin Trust (GBTC). Currently, shares of GBTC are trading at a 48% discount to the net asset value of bitcoin.

Grayscale is owned by Digital Currency Group, which is also CoinDesk’s parent company.

A trade report email from Dec. 30 shows that Wood also purchased 22,514 shares of Tesla’s (TSLA) stock for ARK’s Innovation ETF (ARKK), worth about $2.74 million. TSLA is down around 69% this year, as investors worry that high inflation and a possible recession will reduce demand for expensive electric vehicles.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Ontology

Ontology  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren