Celsius used $558m in customer deposits to purchase CEL

Celsius Network, a lending company, is facing claims that it made CEL purchases worth $558 million using customer deposits.

Celsius purchases spikes demand

Cam Crews, on Twitter, mentioned that in previous posts, Zach Wildes, Celsius Network’s head of community, claimed Celsius’ improper sales of $558 million in customer deposits to purchase $CEL did not pump the price.

The reason was that the platform decreased the CEL treasury by an undisclosed amount, according to Crews.

Celsius Network set the CEL supply at 700 million, and to this day, it still owes 378 million CEL.

Celsius has been buying every CEL token at least once and spending over fourteen times its 2019 market cap on purchases. As a result, demand increased and CEL prices have risen.

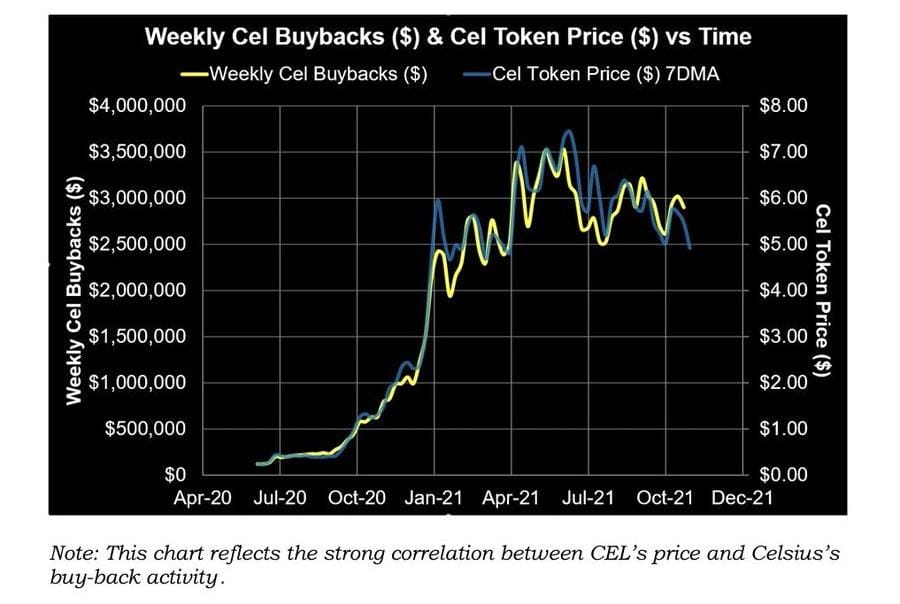

Meanwhile, a prior report visualizes the correlation between the Celsius purchases and the price. The report supports the hypothesis that the platform’s purchases increased the CEL prices.

CEL buybacks chart | Source: Examiner’s report

In addition, employees intentionally purchased CEL to enable a surge and admitted to the action. Johannes Treutler, Senior Token Analyst at Celsius, put it as “prices drive prices.”

As Crews puts it, Celsius changed the public perception of CEL, contributed to fraudulent purchases, and tricked customers into OTC purchases.

Finally, employees were intentionally purchasing CEL to drive its price higher by their own admission.

As Johannes Truetler put it, “prices drive prices.” Celsius changed public perception of $CEL with its fraudulent purchases, helping trick customers into making OTC purchases. pic.twitter.com/4M8Fc14Vfi

— Cam Crews (@camcrews) March 7, 2023

In a later tweet, Crews added that Celsius made their “largely inadequate” account reconciliations for institutional loans and collateral payable or receivable using Instilend, a software owned by Anthony Napolitano’s parent company, Investview Inc.

Celsius allows customers to withdraw funds

After suspending the withdrawals for 265 days since June last year, the platform has now allowed its customers to withdraw assets.

The company sent an email to customers with details on eligibility to withdraw last month, stating that customers holding their funds in Custody Accounts would be eligible.

The eligible customers can withdraw up to 94% of their funds, with the 6% contingent on the outcome of future hearings.

As for customers that had transferred funds to Earn accounts, they have a withdrawal limit of 72.5%. In addition, there is a maximum of $7,575 for each withdrawal.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur