Circle Yield Reduced to Zero, Gemini Earn Paused as Genesis Contagion Spreads

Circle, Gemini, Luno and Hut 8 Mining are among major crypto companies with exposure to digital currency prime broker Genesis, which has halted customer redemptions and new loan originations within its lending division as the fallout of FTX’s collapse continues.

Genesis partnered with Luno in August 2020, saying at the time it would enable interest-bearing products customized for the Luno community.

Hut 8 Mining said in January 2021 that it opened a Bitcoin Yield Account in partnership with Genesis’s lending business, called Genesis Global Capital.

Bitcoin IRA — a company allowing clients to purchase crypto for their retirement accounts — unveiled an interest-earning program offered through Genesis in February 2021. The company said the program would provide interest rates as high as 6% annually on cash and crypto holdings using the company’s self-directed retirement platform.

“We have zero exposure to Genesis Lending or any crypto lending program,” Bitcoin IRA co-founder Chris Kline told Blockworks in an email.

Genesis tweeted its decision to temporarily suspend withdrawals and new loan originations Wednesday.

“This decision was made in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion,” the company said.

Genesis executives explained the situation to institutional clients on a call Wednesday morning, according to a source familiar with the matter. Another source last week told Blockworks that Genesis was “functionally insolvent.” Sources were granted anonymity to discuss sensitive business dealings.

Circle Yield powered by Genesis’ credit operations

Circle and Genesis parent Digital Currency Group signed a $25 million deal in 2020, aimed at accelerating global adoption of USDC in mainstream finance.

As part of the strategic partnership, Genesis would help Circle add new USDC yield and lending services. The idea was to allow companies to generate “strong positive yield” on their own USDC holdings, as well as those of their customers.

Circle wrote in a blog that Genesis would help provide access to USDC-based credit for businesses and merchants relying on USDC for treasury operations and business payments. The services were pegged to go online in late 2020, and Circle’s terms and conditions states that Circle’s Bermuda-based subsidiary had entered lending agreements with “one or more” institutional borrowers, including Genesis.

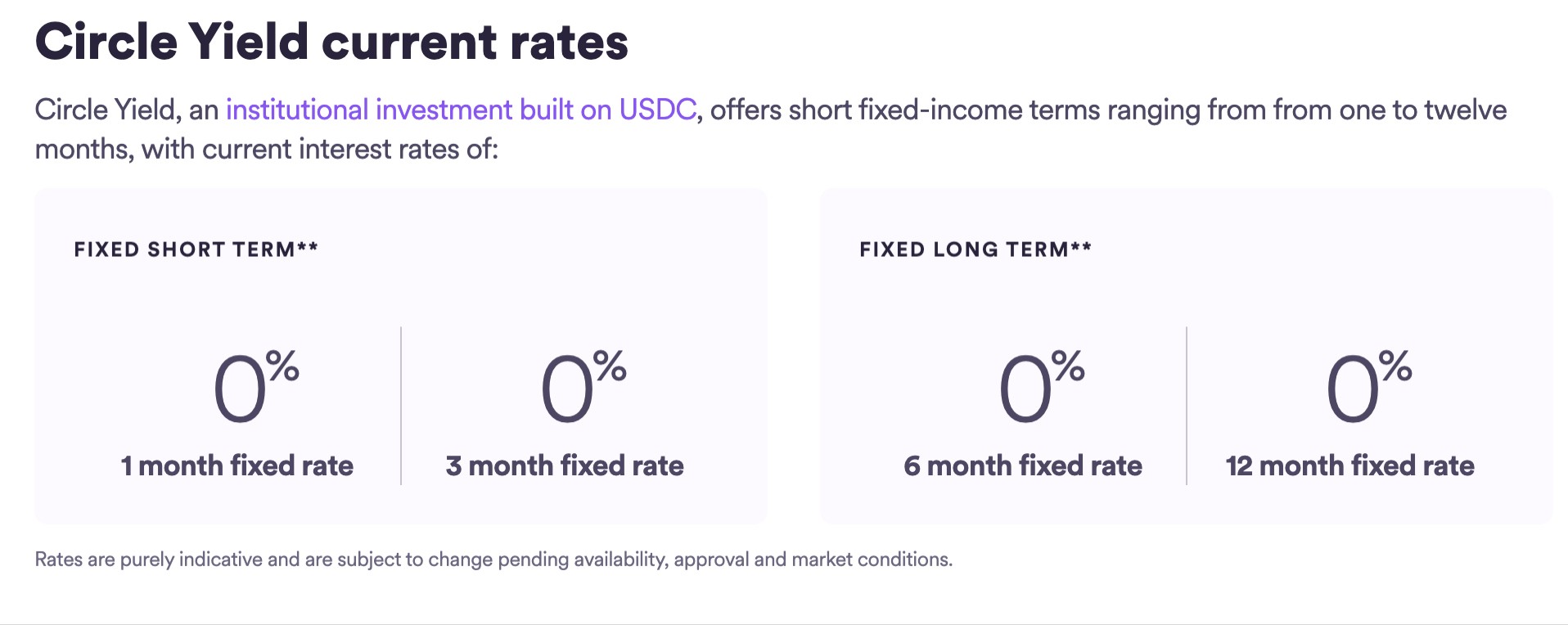

Circle listed 0.25% annual percentage yield (APY) on its yield product on Tuesday, per an internet archive. Today, that figure has been reduced to 0%. Blockworks has reached out for comment.

Source: Circle

Gemini Earn withdrawals paused

Cryptocurrency exchange Gemini is another major industry player to announce issues as the Genesis contagion spreads.

Its Gemini Earn product has paused withdrawals, and the exchange released a statement noting that “We are aware that Genesis Global Capital, LLC (Genesis) — the lending partner of the Earn program — has paused withdrawals and will not be able to meet customer redemptions within the service-level agreement (SLA) of 5 business days.”

However, the exchange also noted that other products and services are unaffected, stating that “Gemini is a full-reserve exchange and custodian. All customer funds held on the Gemini exchange are held 1:1 and available for withdrawal at any time.”

Crypto lended Ledn clarified in a statement issued via Twitter that it has moved assets away from Genesis: “When Ledn first began, Genesis was our primary lending partner. Over time, we have reduced concentration risk through the diversification of our list of borrowers. As of October 2022, Ledn no longer has any active lending relationship with Genesis.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM