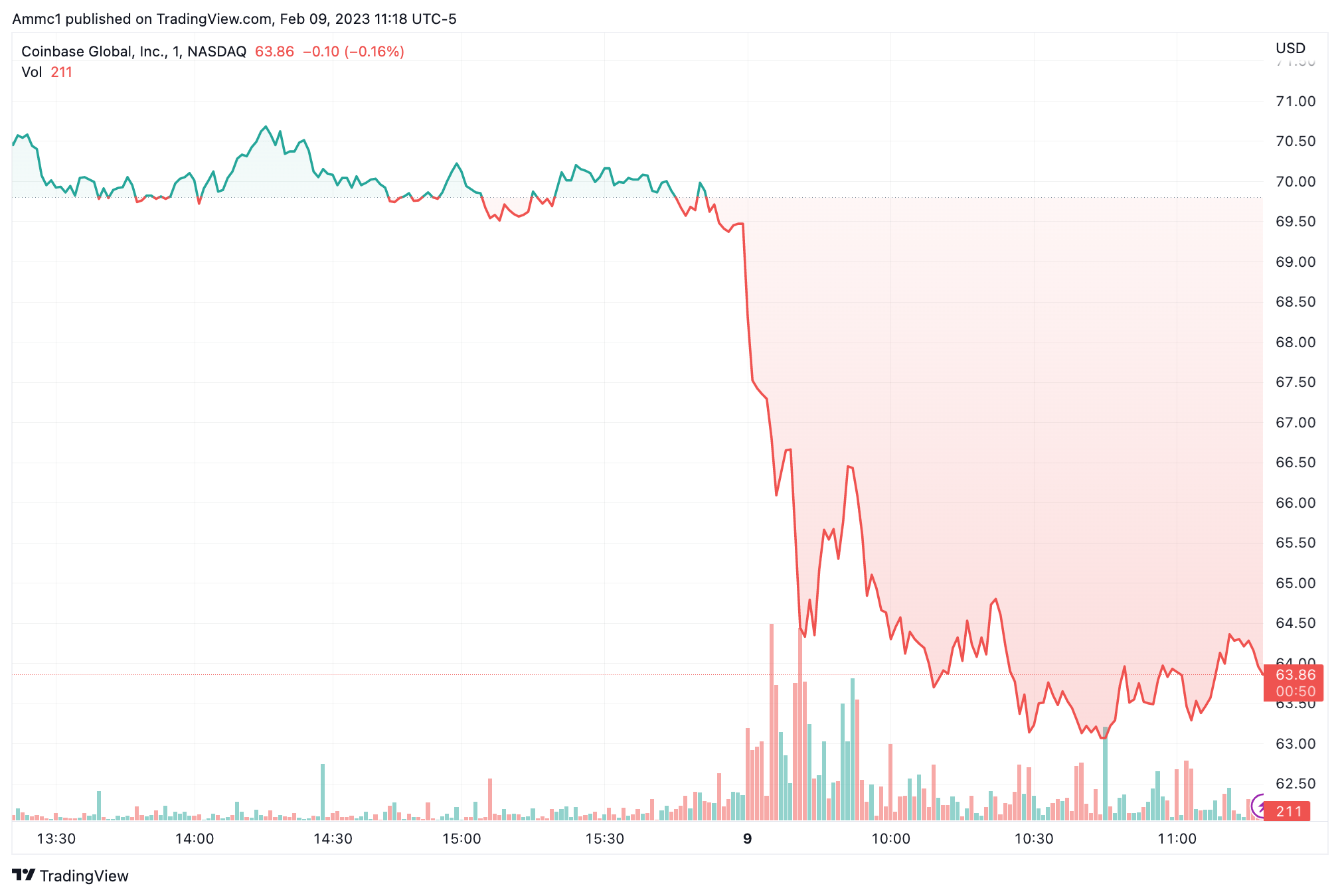

Coinbase drops 8% as CEO Armstrong calls out SEC; Silvergate sinks 5%

Crypto-related stocks sold off at the open, with Coinbase and Silvergate leading the drop.

Coinbase shares fell over 8% to $63 by 11:15 a.m. EST, according to Nasdaq data. Last night Coinbase CEO Brian Armstrong said it would be a «terrible path» for the U.S. if it were to restrict crypto staking.

COIN chart by TradingView

Shares are trading down primarily as a result of Armstrong’s comments, John Todaro of Needham told The Block. «While staking is still a small portion of COIN’s overall revenue today, it is an important piece to diversify revenue away from trading and is seen as a potentially high-growth vertical.»

Two million ETH are currently staked on Coinbase, with close to 20 million ETH under custody. «If Coinbase can convert a larger portion over to staking, it could start to become an important revenue driver,» Todaro noted, adding that «investors now have to start pricing in the possibility that this future revenue vertical gets removed if regulation comes down strict enough to shut the product down.»

Crypto-friendly bank Silvergate was down, too, dropping 5.3% to $16.50. Jack Dorsey’s Block shed just 3.7% as it traded below $79 for the first time since late January. MicroStrategy dipped about 4.2% to $264.

Argo Blockchain shed 12% today. CEO Peter Wall announced his resignation earlier in the day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond