This Vulnerability Could Put Prime Protocol Users’ Funds at Risk

A security firm has reported a feature (or a bug) in cross-chain brokerage Prime Protocol that could jack up TVL and put users’ funds at risk.

While decentralized finance (DeFi) is often the victim of various hacks and thefts, open-source code also helps discover certain vulnerabilities.

A Vulnerability in Prime Protocol?

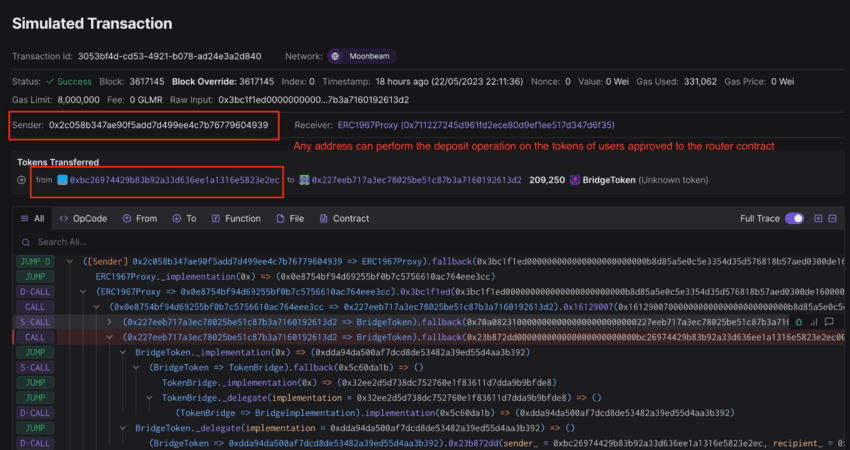

According to a security firm, Dilation Effect, a feature in Prime Protocol could put users’ funds at risk. The security firm claims that after users complete an approval operation, anyone can deposit their approved crypto into the protocol’s loan pools.

Source: Twitter

While it is not a critical bug, it might get misused to jack up the total value locked (TVL) of the DeFi protocol. According to DefiLlama, the TVL of Prime Protocol stands at $1.3 million.

If there is an attack on the platform, apart from TVL, the additional users’ funds are also at risk. This is because the hackers can deposit the approved crypto into the loan pool and steal away the additional funds.

According to the official website, security firms Veridise and Ackee Blockchain have audited Prime Protocol’s security.

Community members are looking for clarification on the matter. BeInCrypto has reached out to Prime Protocol but has yet to hear back.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD