Arbitrum: What is the fair value for ARB as tokens bloom in pre-launch trading?

Share:

- Crypto exchanges looking to leverage the hype have launched IOUs and derivatives of ARB.

- Speculators have flocked to Arbitrum IOU tokens ahead of the token airdrop on March 23.

- ARB token price could fluctuate between $1 to $2 shortly after launch.

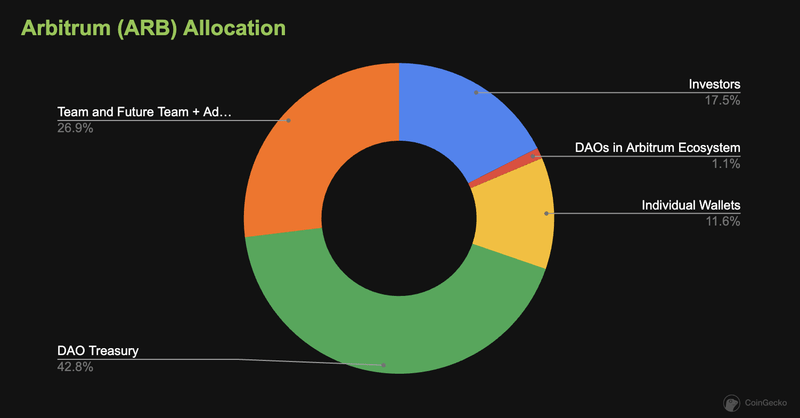

On March 16, the Arbitrum Foundation developers announced the launch of the Arbitrum Decentralized Autonomous Organization (DAO) and its native governance token ARB. From the report, qualified users and developers would receive 12.75% of the token’s total supply of 10 billion on the token’s deployment date, March 23.

However, the ARB tokens are already blooming even before the launch, with speculators flocking to the network’s IOU (I Owe You) tokens ahead of the ARB airdrop on Thursday.

Speculators flock to Arbitrum IOU tokens before the ARB airdrop event

Discord and Telegram Over The Counter (OTC) desks have started recording active trading of ARB tokens with prices ranging from $1 to $1.50. The trades are performed through a transfer of ownership of Ethereum wallets eligible for the ARB airdrop.

$ARB already selling for over $1.10 on OTC groups.

Love to see it. pic.twitter.com/Od8eGSTB8m

— Viperr.eth (@CryptoSources) March 18, 2023

Based on a comparison with Optimism’s OP token valuation, another Ethereum Layer 2 network whose token debuted in May 2022, the trading prices on futures contracts and OTC groups are in tandem with the estimated value of ARB tokens.

Notwithstanding, analysts on Crypto Twitter believe that ARB token price could see-saw between $1 and $2 post-launch, hence the question, what is the fair value for ARB tokens?

What is a fair price for $ARB?

How to play the launch to benefit the most?

I’m tackling with the most popular takes on CT to separate moon math from>pic.twitter.com/cOxeoJyzE6

— korpi (@korpi87) March 20, 2023

Notably, the team behind Arbitrum has not released the entire supply at once, cognizant that token supply is superior to market capitalization. Accordingly, only 11.6% of ARB tokens will be tradeable on the first day of the airdrop, indicating scarcity.

ARB airdrop could be the most lucrative in crypto history

There are already rumors of the ARB airdrop going down as the most lucrative airdrop in crypto history. Based on DefiLama data, Arbitrum total value locked (TVL) currently sits at 1.84 billion, with GMX, UniV3, Radiant, Sushi, and Camelot making up the top 5 Dapps by TVL, respectively. Using TVL to approximate earnings, Arbitrum will presumably earn $1.84 billion annually.

Exchanges queue up to list ARB

Other than futures contracts, exchanges such as Hotbit and XT already deal in Arbitrum’s IOU tokens and have done $2.7 million in volume since the Monday announcement. The token holders are entitled to an equal amount of ARB tokens upon launch. The IOUs are trading over six times higher than BitMEX derivatives, which are auctioning for approximately $8.31.

BitMEX debuted the derivatives contract for ARB June futures on March 20 around 11 PM EST, with the futures contracts exchanging hands for $1.30 at press time. This implied that traders were actively betting on ARB price nearing this amount by the end of June.

Notably, almost all leading crypto exchanges announced plans to list ARB come the March 23 launch day, with Binance, Bitfinex, Huobi, and Bybit at the forefront. With such an explosive pre-launch mood, and the immediate listing on tier-one exchanges, the token’s price will likely display massive volatility shortly after the initial exchange offering (IEO).

Speculators can bet on the token’s market value with these futures contracts, while Arbitrum airdrop receivers can hedge their holdings. Moreover, ARB token holders can buy short futures contracts to sell ARB tokens at a set amount. This protects them from losses supposing the token’s market value plummets after the Thursday debut.

Share: Cryptos feed

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  Cronos

Cronos  OKB

OKB  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Gate

Gate  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  IOTA

IOTA  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Qtum

Qtum  Zilliqa

Zilliqa  Basic Attention

Basic Attention  Synthetix Network

Synthetix Network  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy