Crypto Market Liquidations Top $220 Million as Bulls Restrategize

A glance through the crypto market today will show an all-encompassing bearish slump across the board. Besides sensational digital currencies like Threshold (T), the broader ecosystem has recorded a total liquidation worth $223.43 million over the past 24 hours, per data from Coinglass.

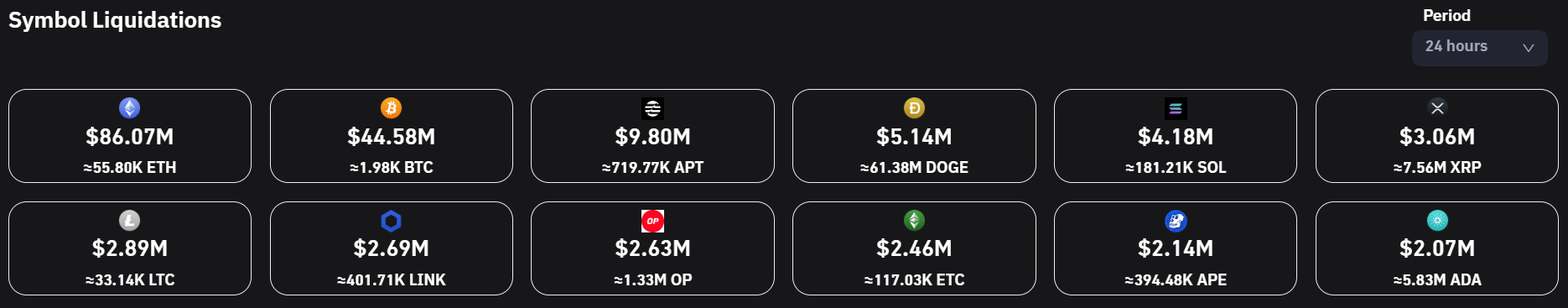

The liquidations are not unfounded, seeing as the price of Bitcoin dropped by 1.49% to peg the price of the leading cryptocurrency at $22,554.28. Nonetheless, Ethereum (ETH) recorded the biggest liquidations with approximately 55.74K ETH units worth approximately $86.12 million. Bitcoin’s liquidation was pegged at 1.98K BTC units worth approximately $44.59 million.

The liquidations are encompassing and feature some of the high-performance digital currencies that come off as high fliers this year. One of these is the Aptos (APT) coin, a Layer 1 protocol that recorded over 94% growth last week, as reported by U.Today. Per the liquidation data from CoinGlass, Aptos ranks as the third most liquidated coin with over 721.81K APT units worth $9.79 million cleared off the market.

The outlook of the industry shows that the bears are making the effort to erase the valuation boost most cryptocurrencies have recorded since the start of the year.

How are bulls responding?

Liquidations are not an unusual occurrence in the crypto ecosystem, and from observation, market bulls utilize them as springboards to stack up their bags. Riding on the principle that periods of price slumps are the best time to accumulate, we might begin to see intense accumulation at the key resistance points for some of the most liquidated digital currencies.

With BitMEX, Binance, OKX and Huobi arising as the exchanges where most liquidations took place, chances are that market investors will also choose to relaunch their comeback in trades.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Zcash

Zcash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  0x Protocol

0x Protocol  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur