Crypto’s correlation with macro events, US equity markets is weakening, Bernstein says

Crypto prices are continuing to trade in a broadly similar range as the correlation with U.S. equities and macro events weakens, Bernstein analysts said. Crypto-related stocks opened higher on Monday, with Silvergate leading the gains.

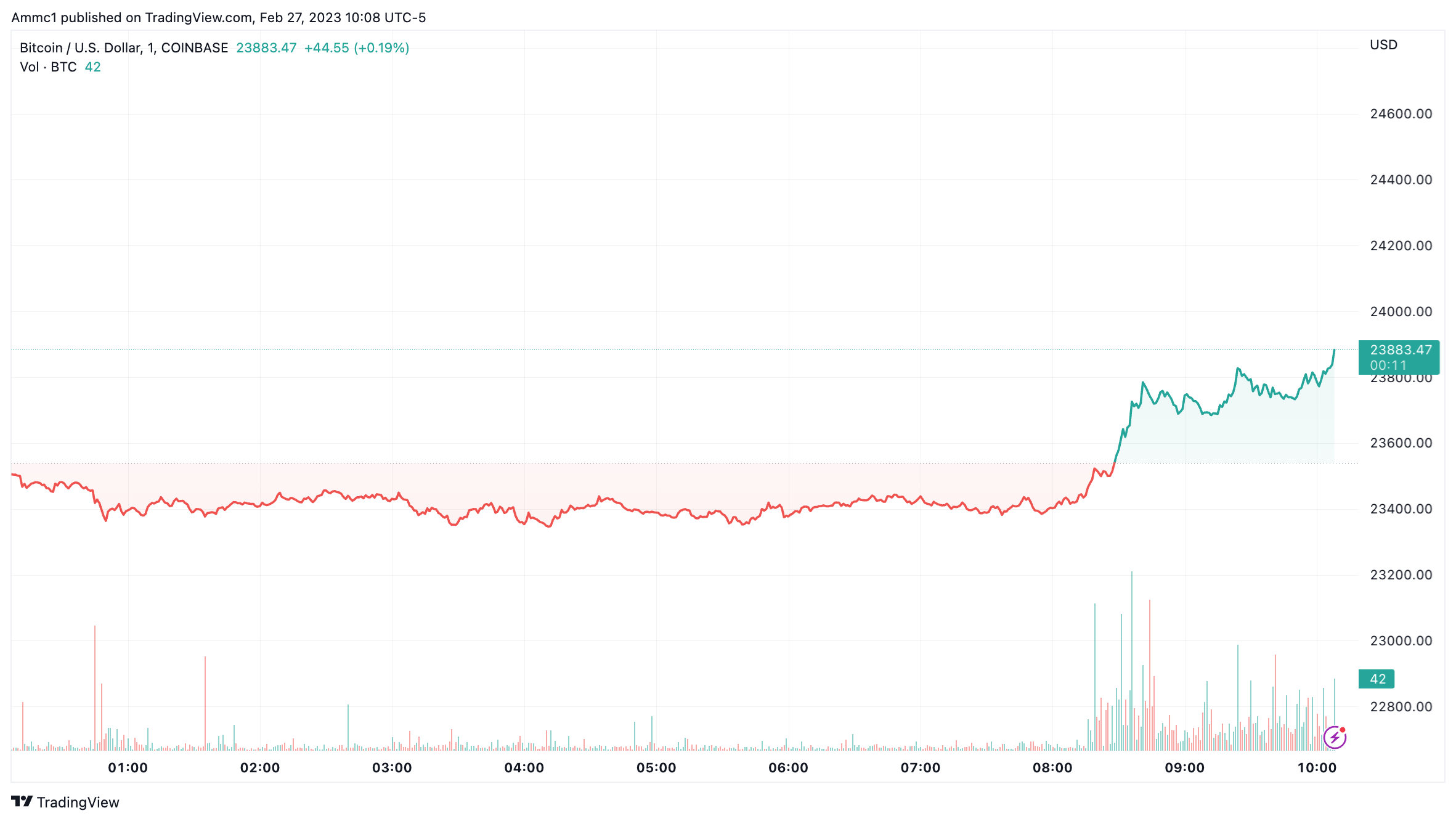

Bitcoin was trading at $23,800, by 10 a.m. EST, according to TradingView data.

«The crypto market remained range bound, with bitcoin correcting early in the week and then recovering over the weekend, to end marginally lower by 3% to $23,600,» the Bernstein analysts wrote in a note, adding that «ether was also lower by 2.3%, still trading in the $1,600 range.»

BTCUSD chart by TradingView

The crypto market appears to be poised between bulls and bears, the note read, «awaiting any further catalysts.» The market’s sensitivity to traditional markets isn’t what it used to be, with every dip being bought after down days in U.S. equity markets, the analysts said.

Bitcoin’s correlation with equities has fallen steadily throughout the year. The correlation between the leading cryptocurrency by market cap and the Nasdaq Composite has fallen t0 0.58 now from 0.94 at the beginning of February, according to The Block data.

On the down side, Bernstein said regulatory headwinds present a bear case for markets, as do a lack of institutional adoption and significant use cases. Its correlation to tech equities means bitcoin’s value as an inflation hedge has failed, the note added.

Weakening correlation to the U.S. poses a bull case for crypto, according to Bernstein. «A large part of stablecoin issuance (>50%) and global crypto trading (95%) remains outside the U.S market. Thus, the crypto market is driven by more global flows vs U.S. flows.»

Crypto stocks

Coinbase was trading at $60.57, up 3.5% by 10:10 a.m. EST, according to Nasdaq data. Shares in the exchange were lifted in line with equity indexes. The S&P 500 and the Nasdaq 100 added 0.8% and 1.1%, respectively.

Silvergate jumped 5.8% to $15.15, and MicroStrategy gained 4.7% to trade just below $265.

Jack Dorsey’s Block failed to benefit from the buoyant mood in markets and slipped 0.4%. Profit from the company’s Cash App product dropped by 25% in the fourth quarter to $35 million, its earnings revealed on Thursday.

Grayscale’s bitcoin trust slipped below $12 last week, continuing a disappointing month for the fund. GTC’s discount to net asset value showed signs of arresting its decline throughout the week. Shares in the fund were trading at a discount of 45.8% to the value of the bitcoin in the fund, according to The Block data.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond