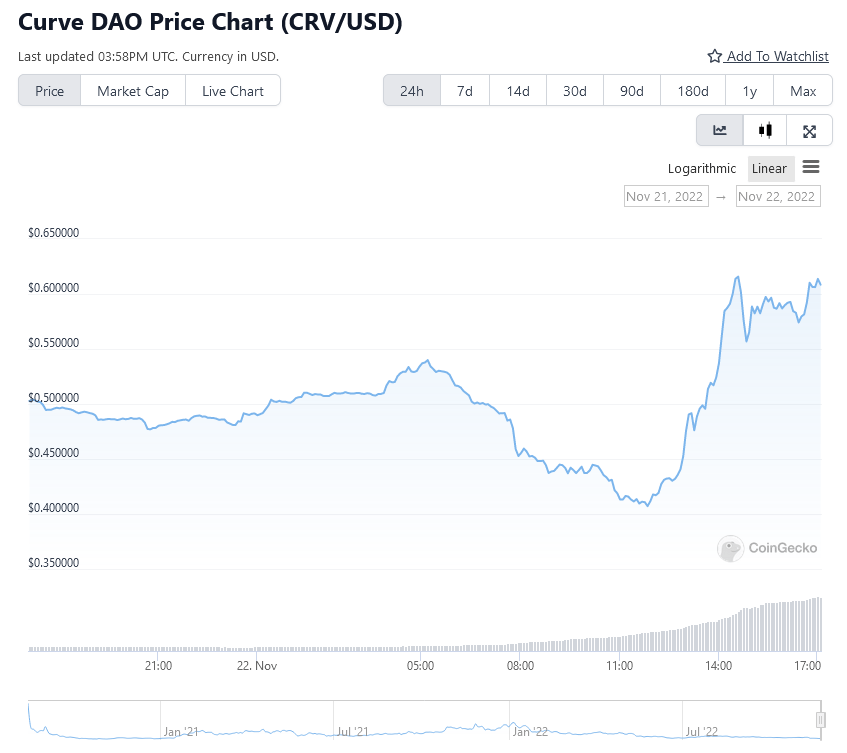

Curve token jumps 50% amid squeeze on big short position

The price of the Curve DAO token (CRV) rallied significantly today in what appears to be a squeeze on a publicized short bet.

Data from CoinGecko shows the CRV price fell sharply this morning from $0.53 to $0.40, a decline of about 25% to the token’s lowest level in two years. The sharp fall was followed immediately by a massive spike of more than 50% that saw CRV go as high as $0.61.

CRV is currently trading at $0.60 as of the time of publishing, posting a 17% price gain in the last 24 hours.

The volatile price action for CRV appears to be connected to a major short position on the token that saw a trader borrow a total of 92 million CRV from the DeFi lending platform Aave using $57 million in USDC as collateral. The trader had been selling the CRV tokens, as previously reported by The Block, which could have been responsible for the initial decline earlier in the day.

The price recovery now puts the short seller in danger of liquidation. Data from the trader’s profile on portfolio tracker DeBank shows the initial loan on Aave now has a health factor of 1.08.

Debt positions go into liquidation when the health factor, which represents the value of borrowed tokens against the worth of the collateral deposited, dips below 1.

The short seller will face liquidation if CRV rises above $0.63, but the trader can prevent this from happening by posting more collateral on Aave.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond