FTX Contagion Reaches Grayscale? Are GBTC, ETHE Next FTT?

Crypto brokerage firm Genesis Trading facing potential solvency issues. A call with creditors is scheduled for tomorrow at 8 AM EST in which Genesis may explain the current situation, FTX exposure, and relations with Alameda Research. If the rumors are true, the firm may dissolve the GBTC and ETHE trusts to pay back their lenders. Digital Currency Group (DCG) is the parent of Genesis and Grayscale.

Is Genesis, Grayscale Next Amid FTX Contagion?

The collapse of FTX and Alameda Research fueled the contagion effect causing several crypto companies to face financial and withdrawal issues, with some planning bankruptcy protection.

Genesis Trading is also rumored to be facing solvency issues. Genesis interim CEO Derar Islim will host a client call on November 17 at 8 AM EST to discuss the state of crypto markets and Genesis’ lending business. Some believe the company may dissolve GBTC and ETHE to pay back their lenders. The situation will be more clear tomorrow.

Autism Capital in a tweet asserts that Grayscale controls GBTC and ETHE trusts, not Genesis. However, Digital Currency Group, the parent company of Genesis and Grayscale, is supporting Genesis. Moreover, a solvency issue may force DCG to dissolve the trusts due to financial issues.

As part of transparency, Genesis Trading reported that it has $175 million in locked funds in FTX trading account, but no material exposure to FTX. As a result, DCG provided $140 million in equity infusion to Genesis.

Grayscale’s GBTC and ETHE Status

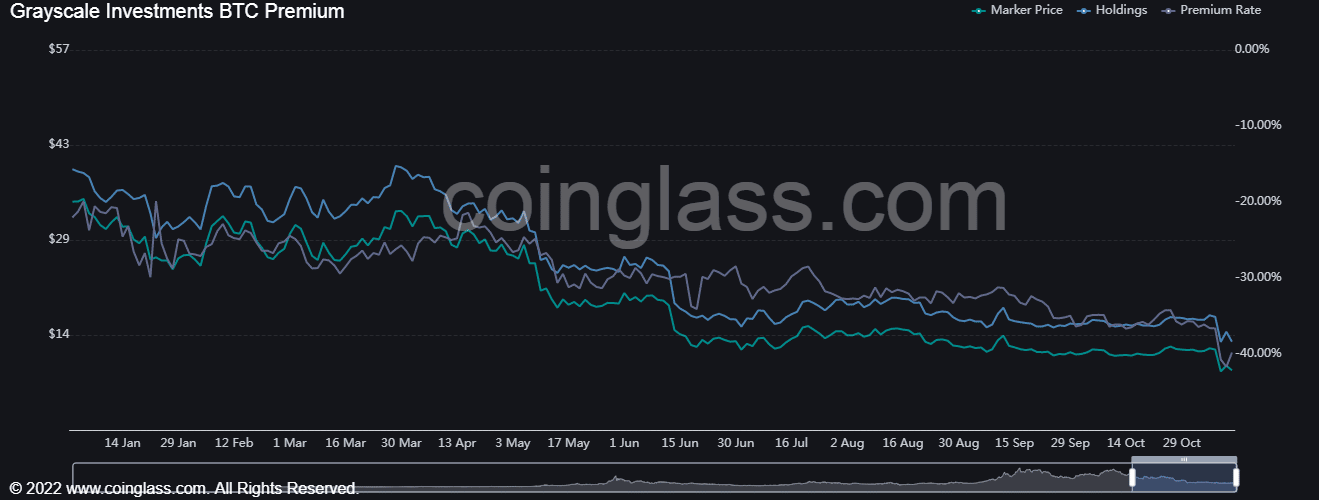

Grayscale’s GBTC hit a 41% discount amid the FTX crisis. Cathie Wood’s Ark Invest recently purchased Grayscale Bitcoin Trust shares worth $2.8 million. According to Coinglass data, GBTC’s total holdings stand at 633.64 BTC worth over $10 billion. At the time of writing, GBTC premium is at -37.08%.

GBTC Holdings and Premium Rate. Coinglass

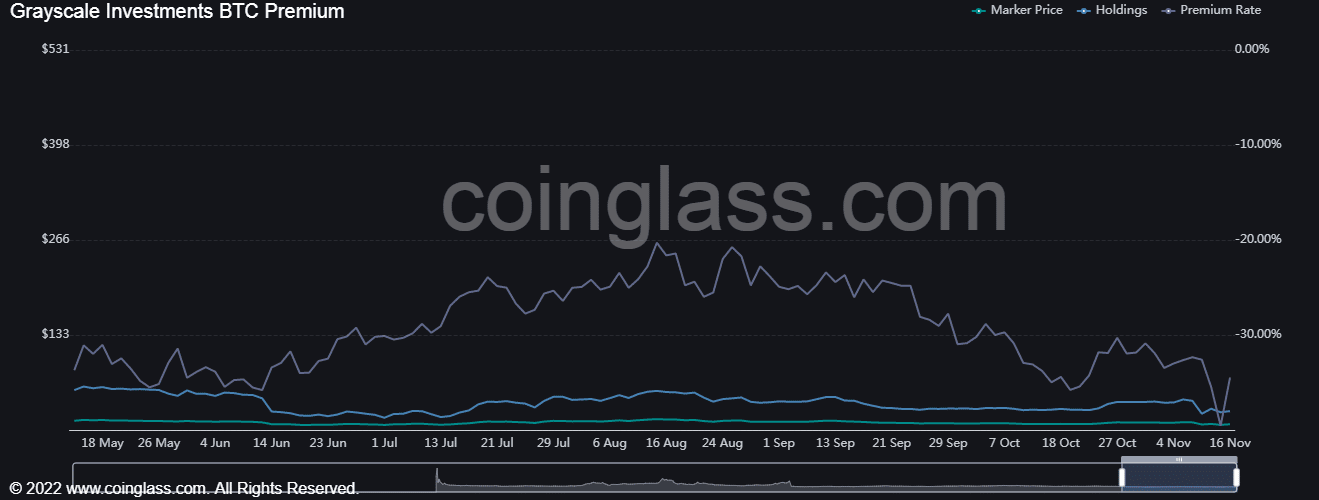

Meanwhile, ETHE has also hit a record low amid the FTX collapse. Currently, it is trading at a -34.47% premium rate, as per Coinglass data.

ETHE Holdings and Premium Rate. Source: Coinglass

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur