How much does Tether (USDT) hold in reserves?

Gabor Gurbacs, a well-known figure in the cryptocurrency sphere and the founder of PointsVille, has voiced his insights on the role of precious metals within Tether’s financial strategy. As he stated on May 12, 2023, Gurbacs, who also held the position of Director of Digital Assets Strategy at VanEck, referred to the stablecoin as a “precious metals powerhouse”.

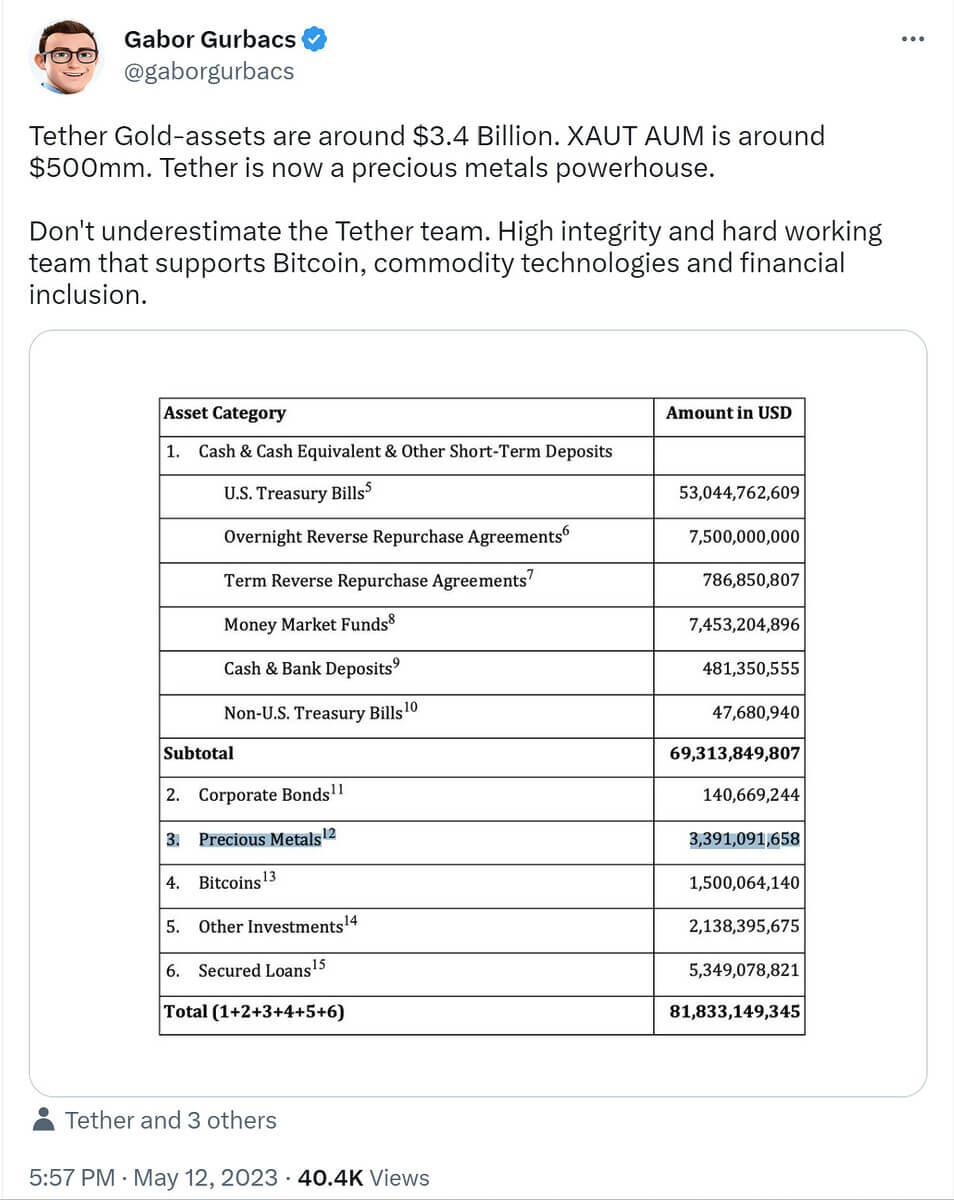

According to Gurbacs, gold has gained significant importance for Tether Limited, the entity responsible for issuing USDT. With a hefty sum of $3.4 billion in reserves held in gold, the stablecoin has secured its status as a formidable force in the precious metals market.

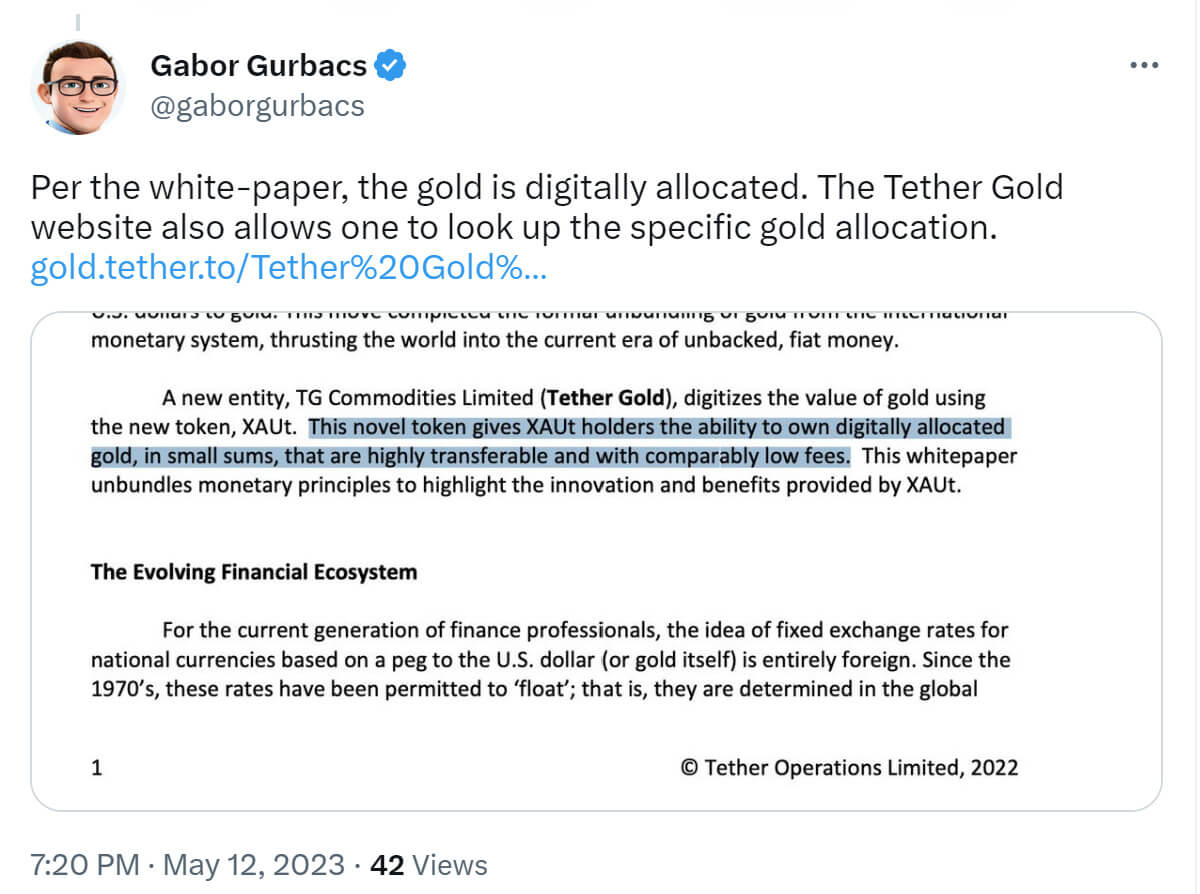

Gurbacs pointed out that roughly $500 million backs the circulating supply of Tether Gold (XAUT), Tether’s flagship gold-pegged stablecoin. Consequently, the proportion of gold in USDT reserves surpasses that of Bitcoin (BTC) by a staggering 127%. Tether’s holdings of Bitcoin only amount to an equivalent of $1.5 billion. In Gurbacs’ view, this blend of gold and Bitcoin serves as a robust buffer against potential market disasters and unpredictable “Black Swan” events.

It’s worth noting that Gurbacs’ analysis of USDT’s strategy comes from an insider’s perspective, as he holds an advisory role within the company, as stated in his Twitter profile.

The Rise of Tether amid stablecoin crisis

Additionally, Gurbacs suggested that diversified portfolios could benefit from holding a 5-10% stake in gold, Bitcoin, and commodities. Historically, precious metals have exhibited the least volatility among investment assets available to retail and corporate investors.

USDT’s market capitalization appears to have made a strong recovery from the substantial losses triggered by the collapse of Terra (LUNA) a year ago. at the time of writing, The stablecoin’s market capitalization has climbed above $82 billion. This figure is inching closer to its all-time high, which stood at $83 billion.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur