How Stacks Has Revolutionized the Prospects of Blockchain’s Leading Network

The world of blockchain started back in 2009 with the publication of the Bitcoin whitepaper. Since then, this world has skyrocketed in public understanding, community support, capital investment, and industry applications. What started as a singular cryptocurrency has evolved into several ecosystems of incredible proportion, being used in seemingly every industry, from finance and cybersecurity to gaming and telecommunications.

The cryptocurrency that started it all, Bitcoin, has continued on as a shining example of what is possible within the blockchain. At its high, Bitcoin had a total market cap of 872 billion, demonstrating the huge extent of capital that has flocked into this financial asset from all over the world.

Yet, while Bitcoin is a leading cryptocurrency, many people within the blockchain community prefer to use Ethereum, a major network competitor, when building any form of decentralized application. Typically, the main reason for this is that Bitcoin is notoriously difficult to build on as it has an incredibly simple core architecture. Ethereum, on the other hand, offers a range of developer tools which have led to developers from around the world flocking to this medium.

This has been the case for several years, with there now being over 4,000 applications on Ethereum. However, another Layer-1 blockchain ecosystem known as Stacks is set to change this, with their new consensus mechanism and connection to Bitcoin providing a new way to engage with this legacy blockchain network.

What Is Stacks?

Stacks is a blockchain in itself, acting as a Layer-1 ecosystem. While this is nothing new, the consensus mechanism that they use is completely different from all other blockchain systems. Typically, blockchain ecosystems either use Proof-of-Work (like Bitcoin) or Proof-of-Stake (like Ethereum) in order to process transactions and lock them into the system.

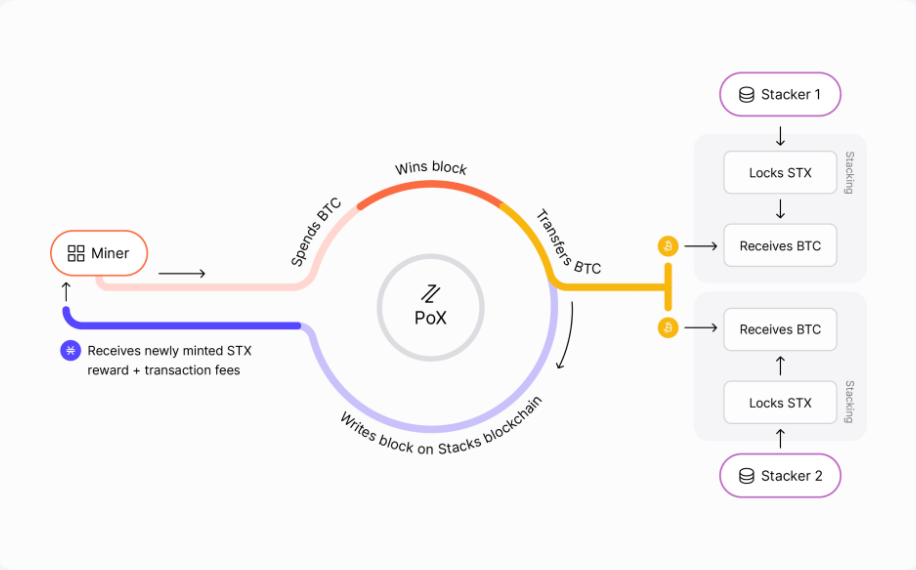

However, Stacks uses a new consensus mechanism that they invented known as Proof-of-Transfer (POX).

With POX, an active transaction happens between two distinct blockchains. In this system, block producers (those that validate transactions) are chosen when cryptocurrency on a separate blockchain is transferred to a list of predetermined addresses. Typically, with Stacks, this uses Bitcoin to Bitcoin addresses.

Using this system, every block has a singular miner, just like with Bitcoin’s established Proof-of-Work system. Using this system, those that use Bitcoin have a new opportunity to use their BTC and generate more from mining, without having to go through the incredibly energy-demanding process of Bitcoin mining.

Equally, those on the Stacks blockchain are able to lock away their STX tokens and start receiving BTC in return for the time in the system, with this movement from one blockchain to another creating a stacking cycle that validates transactions.

POX is the whole system behind Stacks, with this invention setting the foundation for all of the great progress this blockchain has made since its launch.

Where Did Stacks Come From?

Stacks has had a long journey to become the blockchain titan that it currently is. Its road started all the way back in 2013, when Muneeb Ali and Ryan Shea founded the company while both studying in the Computer Science department at Princeton University. Fast forward to 2017, and Ali was finishing his Ph.D. thesis, focusing on the structure and development of the New Internet.

Releasing a public alpha of the Blockstack browser in 2017, Stacks already received a huge influx of public and investor support, with the end of the year marketing a $47.4 million token offering launch. With the launch of Stacks 1.0, the blockchain network was created, with their early goal being to enable developers to build decentralized applications that they could then scale.

The blockchain network picked up traction instantly, with over 360 applications developed using Stacks in the next 12 months. With their increasing exposure, developer following, and passionate community, Stacks was then able to raise $23 million USD for their coin offering. Alongside a huge amount of capital, this marked the first ever SEC-qualified coin offering in US history, demonstrating the extent to which Stacks was pushing out the boat.

Throughout much of 2019, Stacks 2.0 was tested and developed, until January of 2020 when it was released. This marked another turning point for Stacks, as they introduced several new features which would later become the foundations for further success.

The main features associated with Stacks 2.0 were:

- Advanced Smart Contract Language — The team behind stacks redeveloped their main smart contract language, publishing Clarity — which is apt for both security and predictability when creating smart contracts.

- POX — Proof of transfer was released with Stacks 2.0, which was a new mining mechanism proposed and delivered by the team at Stacks. This is the foundation for stacking and provides a new way of working with blockchain mining.

- Stacking — Using POX, stacking allows users that hold bitcoin to earn coins by participating in their consensus algorithm.

The mainnet of Stacks 2.0 was developed throughout 2020 and 2021, going live early in 2021. With the community support that Stacks has, their tools unlocked over $1 trillion USD of capital on the Bitcoin network, with their new consensus mechanism providing an invaluable opportunity for the Stacks community.

In 2022, Stacks has continued to set their sights on improving development, scaling their communities, and bringing a new method of interacting with the Bitcoin network into the mainstream. If their 136,000 Twitter followers are any measure of public intrigue, it seems their mission is going swimmingly.

Beyond Bitcoin With Stacking

Typical Bitcoin mining is a proof-of-work system, in which computers need to solve incredibly complicated mathematical problems to validate transactions. To solve these problems, a huge amount of energy is required, with the average transaction taking the equivalent of 50 days of energy use in the average American home.

With the huge energy requirement, only very few people around the world actually have the means to mine bitcoin, making the availability of processing transactions incredibly slow. Typically, Bitcoin can only process around 3-7 transactions per second, which is far too low for any financial system.

Compared to Visa, a centralized financial system, which offers 1,700 TPS, Bitcoin simply cannot keep up. This has been a huge problem, limiting the potential of Bitcoin as it cannot scale quickly or effectively. Equally, those that own Bitcoin can’t do a whole lot with their currency. While other POS cryptocurrencies allow their users to stake cryptocurrency to gain annualized returns, Bitcoin just doesn’t have that option. Simply put, Bitcoin seems more like a buy-and-forget investment than anything else.

Yet, the arrival of Stacks has caused a complete revolution in how people engage with and use Bitcoin. With the Stacking system, users of Bitcoin are able to actually use their own Bitcoin to validate transactions at a much greater speed, allowing for the Bitcoin blockchain network to liberate a range of transactions due to the presence of Stacks users.

Stackers that use this system follow four steps:

- Locking in — People that own STX tokens will lock in their tokens to the network, choosing a period of time that they want to keep their funds there.

- Pool or Alone — Users choose whether they want to stack their currency alone or add to a pool with others, thus allowing even someone with a minute amount of cryptocurrency to get involved.

- BTC Address — By adding a BTC address to their STX, they then begin to receive BTC as a reward for holding their STX in place.

- Cycle Ends — After the selected period of time, the STX are unlocked, with the user getting their STX back while also having BTC rewards.

At the same time, miners will go through the opposite process in order to validate transactions:

- Transfer — Miners actively transfer BTC to the registered BTC wallet addresses of those stacking.

- Winner — Randomly selected (while taking a proportion of investments into account), one user will be chosen to validate the transaction block of Bitcoin.

- Gain — The winner will earn the transaction and can then commit a new block to the Stacks blockchain.

- Receive — The miner then will earn newly minted STX from the transaction, which was minted during and from the POX process.

With this system, both BTC miner and STX stacker are set to benefit, with the proof-of-transfer system liberating Bitcoin from the energy-intense and monotonous traditional POW mining process.

A Huge Future Impact

With the arrival and popularization of Stacks, Bitcoin suddenly has a method of increasing its scalability without having to compromise any of its security features through side chain partnerships. As Stacks is an L1 ecosystem as its own blockchain system, the ingenious use of POX radically improves the scalability of Bitcoin. Yet, Bitcoin is still able to maintain its own ecosystem structure, continuing without being compromised.

The major benefit of working through Stacks is that it uses the Bitcoin network, allowing users and developers to benefit from the fantastic security systems that Bitcoin has in place. With the vast development of Bitcoin, it is virtually impermeable to hacking attacks, making this a huge benefit of working on Bitcoin.

What’s more, the POX system that Stacks offers also makes Bitcoin mining an accessible and easy-to-do activity, dramatically increasing the real-world applications of BTC for those that currently hold this cryptocurrency. Over time, this will boost the usage of Bitcoin, making it a more attractive cryptocurrency beyond just being the first.

By combining the scaling potential of Stacks with the rigorous base infrastructure of Bitcoin, the latter suddenly becomes an ever more feasible blockchain network to use for development. With this considered, we’re likely to see a major shift in the approach and understanding of Bitcoin over the next decade.

If Stacks continues on the upward trajectory that it is currently experiencing, Bitcoin could well and truly push forward to become the perfect blockchain system.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur