Huobi Token shoots 10% in 24 hours; Here’s why

Although most of the cryptocurrency industry is still feeling pain from the crisis induced by the liquidity crunch and scandals surrounding the crypto trading platform FTX, some digital assets are recording gains, including Huobi Token (HT).

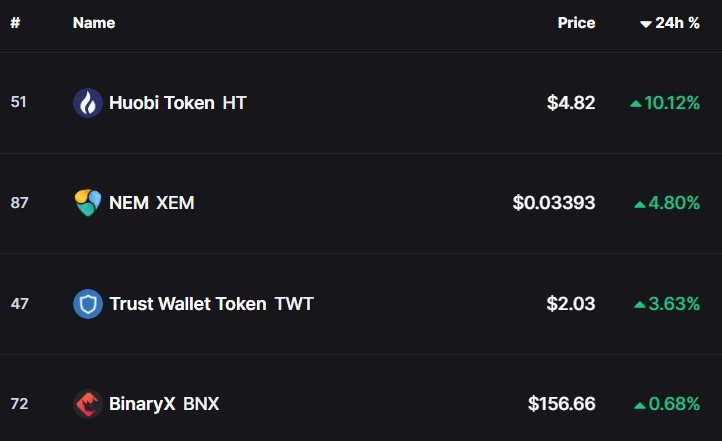

Indeed, the price of Huobi Token has soared over 10% in the previous 24 hours, placing it at the leadership position among the top 100 cryptocurrencies by daily gains, as per CoinMarketCap data retrieved by Finbold on November 21.

Changing hands at the price of $4.82 at press time, the decentralized finance (DeFi) has recorded a remarkable recovery of 10.12% on the day, despite the weekly loss of 0.51% and the monthly loss of 42.07%, as the charts demonstrate.

Delisting tokens spikes price climb?

It is also worth noting that the HT price recovery has followed an announcement by Huobi Global on delisting multiple tokens from its platform as part of its “continuous efforts to promote the healthy development of the blockchain ecosystem.”

As per the announcement, Huobi will end its support for trading Covalent (COVA), CVCOIN (CVNX), Crypto.com (CRO), DigixDAO (DGD), EchoLink (EKO), EdgeSwap (EGS), Themis (GET), Global Social Chain (GSC), NeuroChain Clausius (NCC), Origo.Network (OGO), Odyssey (OCN), Sirin Labs (SRN), Smartshare (SSP), VVS Finance (VVS), WonderHero (WND), and Zenith (ZNT), as of November 25.

On November 20, Huobi also delisted the DFI.Money/Tether (YFII/USDT) pair for isolated margin tradings as part of its Huobi Global Token Management Rules, the crypto exchange said.

A week before, Huobi performed a Merkle Tree Proof of Reserves audit, in which it publicly listed its holdings in order to reassure its users of the safety of their funds, after investors started losing their trust in crypto exchanges over the FTX saga.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond