‘Inflation Expected to Remain Elevated’: Singapore Monetary Authority

Experts predict that even though Singapore’s core inflation eased a little around October, the nation will continue to feel consistent pressure from global financial concerns in the upcoming months.

In a recent report, the Monetary Authority of Singapore (MAS) warned the citizens about weakening demand and ongoing inflationary pressures. It stated that the country’s business, housing, and banking sectors are financially vulnerable.

In addition, the central bank added that “inflation is expected to remain elevated, underpinned by a strong labor market and continued pass-through from high imported inflation.”

This news comes as a blow to the Singaporean economy, which is already struggling with sluggish growth and high inflation.

The Monetary Authority of Singapore has been urging businesses and citizens to save more money to weather these difficult times. However, it seems that the pain will continue for a while.

Moreover, the Central Bank stated:

The most immediate risk is a potential dysfunction in core international funding markets and cascading liquidity strains on non-bank financial institutions that could quickly spill over to banks and corporates.

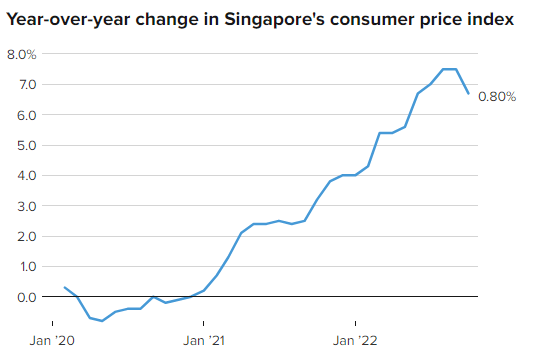

Singapore’s core consumer price index increased 5.1% in October compared to somewhat less than 5.3% in September, although it is still at 14-year highs.

MAS believes that “overall price stability” is often reflected by a core inflation rate of 2%, despite Singapore not having a specific inflation objective.

While core inflation levels are expected to remain high during the first quarter of 2023, according to JP Morgan analysts, the subsequent readings will show a further fall. This would allow the central bank to change its hawkish stance.

It is predicted that inflation will continue to be a major concern for Singapore, despite minor interest rate increases from global central banks like the Reserve Bank of Australia and the Bank of Korea.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren