Inverse Cramer ETF Outperforms S&P 500 a Week After Market Debut

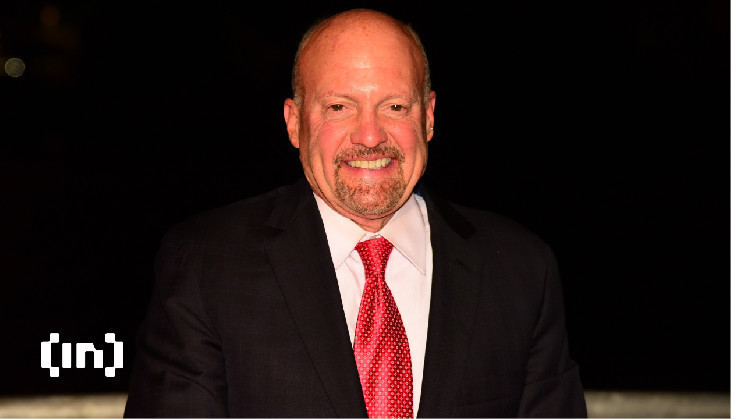

The Inverse Cramer Tracker ETF, which is ‘not’ based on Jim Cramer’s financial advice, is outperforming the market two weeks after it went live.

On March 2, Inverse Cramer Tracker ETF began trading on the Chicago Board Options Exchange. It went live along with the Long Cramer Tracker ETF.

Inverse ETF Based on Jim Cramer’s Advice Outperforms

Investor and the founder of Uinvst, Gurgavin Chandhoke, took to Twitter to state that the fund is outperforming the market by 5%. He compared the performance of Inverse Cramer Tracker ETF with SPDR S&P 500 ETF Trust.

After the failure of Silicon Valley Bank, both the Dow Jones Industrial Average and the S&P 500 have experienced losses. On the other hand, the Nasdaq Composite ended higher on Monday, giving Jim Cramer the impression that the Fed may be nearly finished tightening.

Cramer’s Recent Stock and Crypto Advice

Jim Cramer, the host of CNBC’s ‘Mad Money,’ said on Monday’s episode that the tech buying is “thoughtless” at the moment. He said it is accelerated by algorithms based on bond yield.

This could be something that the Inverse Cramer Tracker ETF could tap into. He also recommended to ‘stop fighting the Fed,’ adding that smaller techs like Gitlab Inc are loss-making software enterprises. He said, “It [Gitlab Inc] is getting crushed. Those kinds of companies, I’m begging you to continue to avoid.”

Meanwhile, the internet is remarking on Cramer’s pick for FRC First Republic Bank on March 10. The bank has recorded a fall in value ever since. FRC’s stock price has lost more than 75% since last week.

Netizens also criticized the ‘Mad Money’ host for reportedly advising viewers to purchase shares of Silicon Valley Bank’s parent in February. In April 2022, Jim Cramer included the now-defunct Signature bank in his list of four investable financial companies that he thought would be good buys based on earnings growth.

According to the prospectus, the inverse ETF keeps tabs on Cramer’s stock picks and general market recommendations throughout the trading day. This includes public recommendations via Twitter or his CNBC television shows and takes its opposite position.

Jim Cramer also vowed to ‘sell his Bitcoin’ in the rally.

That said, Bitcoin has resurged from the banking crisis, surpassing $24,000 on Tuesday and gaining over 10% in the past day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond