IRS expands crypto question on tax forms 1040

The US Internal Revenue Service has continued looking for extended crypto investors’ details. The ongoing global changes and increased regulations demand detailed answers from taxpayers regarding crypto. IRS has expanded the area in form 1040, which included a query about crypto investments. The updated form has been expanded and includes some new questions.

It had already changed the taxpayer form back in March when all taxpayers, instead of just crypto investors, had to answer questions about crypto. The increased regulation will help the government know about the investors and possible gains from their investments. The new draft for form 1040 has evident changes compared to the form 1040 draft for 2021. The complete details are given in the following sections.

Here is a brief overview of the changes made by the IRS in the form 1040 and how it will impact the market.

Expanding crypto investments and taxes

The global crypto market has seen fluctuations in the recent few months. These changes have forced governments to go for enhanced measures for regulation. The new legislation aims to provide a safe environment to the investors as well as to ensure the prevention of crimes.

The US government has been proactive in this regard, and President Biden had issued an executive order regarding crypto. He had asked the US Treasury for a draft regarding crypto regulations. While the Securities and Exchange Commission had braced itself for the upcoming responsibilities. Lately, the US Treasury has submitted its draft, which is expected to be approved soon.

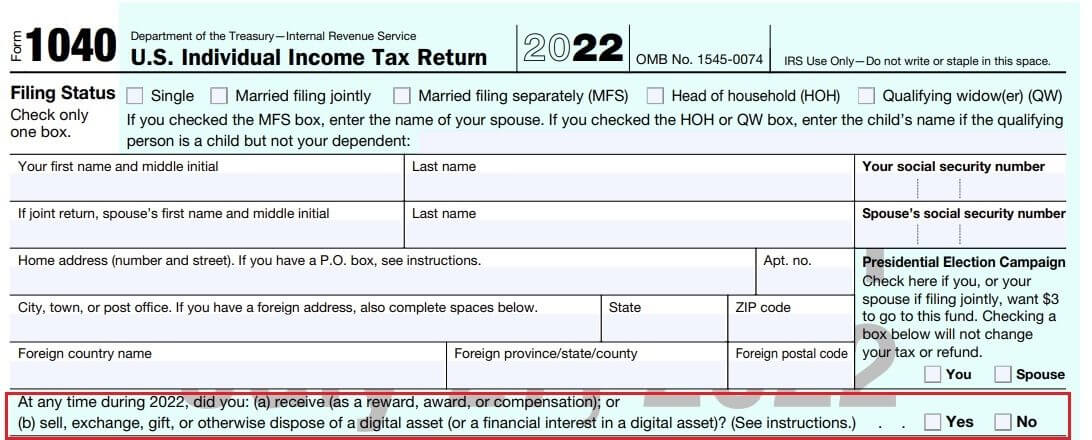

Draft for 2022 (Source: IRS)

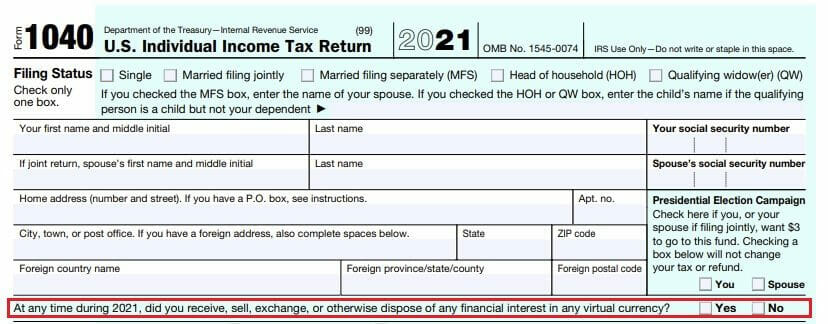

The chain of changes has continued, and one of the repercussions is the new changes into taxpayer form 1040. IRS has revised form 1040 for 2022 and issued a new draft. These changes are the continuation of the previous modifications to this form. The question regarding crypto was first included in 2021. The question in that form asked the taxpayer about their activity in the crypto market.

Draft for 2021 (Source: IRS)

Crypto-related questions expanded further, meaning that IRS is taking more interest in taxpayers’ crypto investments. It has chances to expand further in the upcoming IRS taxpayer forms.

IRS expansion of tax questions

As IRS has shared the new draft for taxpayer form 1040, it has a detailed question regarding crypto investments. The question that has been included is as follows:

At any time during 2022, did you: (a) receive (as a reward, award, or compensation); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?

The previous year’s form included the following question:

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?

As it had become mandatory for all taxpayers to answer ‘yes’ or ‘no’ to crypto-related questions, the taxpayers felt confused. IRS explained later that if the users own crypto but haven’t engaged in transactions, they can select ‘no’ as an answer to the question. While if the activity included the transfer of funds between one’s own wallets or accounts, they could also select ‘no.’

Along with IRS, other names like SEC, US Treasury, etc., will also move towards enhanced regulations to oversee the crypto business. The increased regulations will help increase the investor’s security in the market.

Conclusion

IRS has shared the latest draft for taxpayer form 1040. The new draft has made some revisions to the questions related to crypto. In contrast to the previous year’s form, it has detailed questions regarding crypto transactions and whether the investor has made any gains. The new changes show that IRS is more interested in crypto and might ask more about it.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond