Justin Sun’s stablecoins are melting

Both of Justin Sun’s stablecoins, one of which Protos has previously reported on, are struggling to maintain their promised $1.00 peg.

At the time of writing, USDD is hovering around $0.97, and USDJ is trading at $1.09. Curiously, this means that one of Sun’s stablecoins is melting down while the other is melting up.

How the stablecoins work

USDD relies on a Decentralized Autonomous Organization called the TRON DAO Reserve to stabilize the price of the stablecoin. Since November 8, it’s been unable to reliably peg the price to $1 and has consistently traded at a 2% discount, suggesting the mechanism has ultimately failed.

Meanwhile, USDJ, a stablecoin that started in 2020 to support the JUST Network — a Justin Sun-crafted DeFi project, relies on “collateralized debt positions” and “autonomous feedback mechanisms.” It too has begun to fail.

Thin markets and big swings

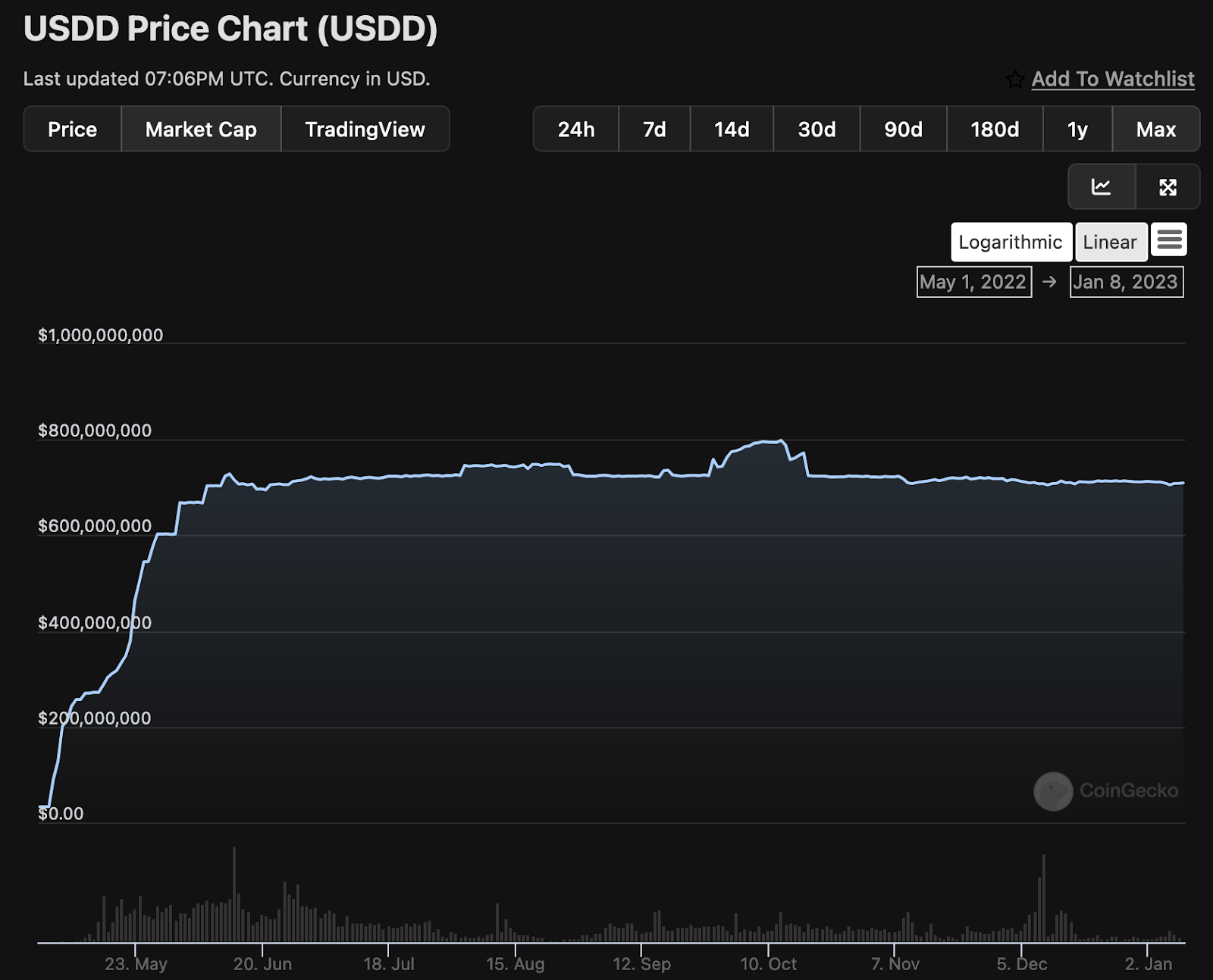

The combined daily volume for the two coins is less than $50 million a day — often far less — but both currencies have almost identical market cap structures. Within about a month, USDD reached its market cap plateau of about $700 million.

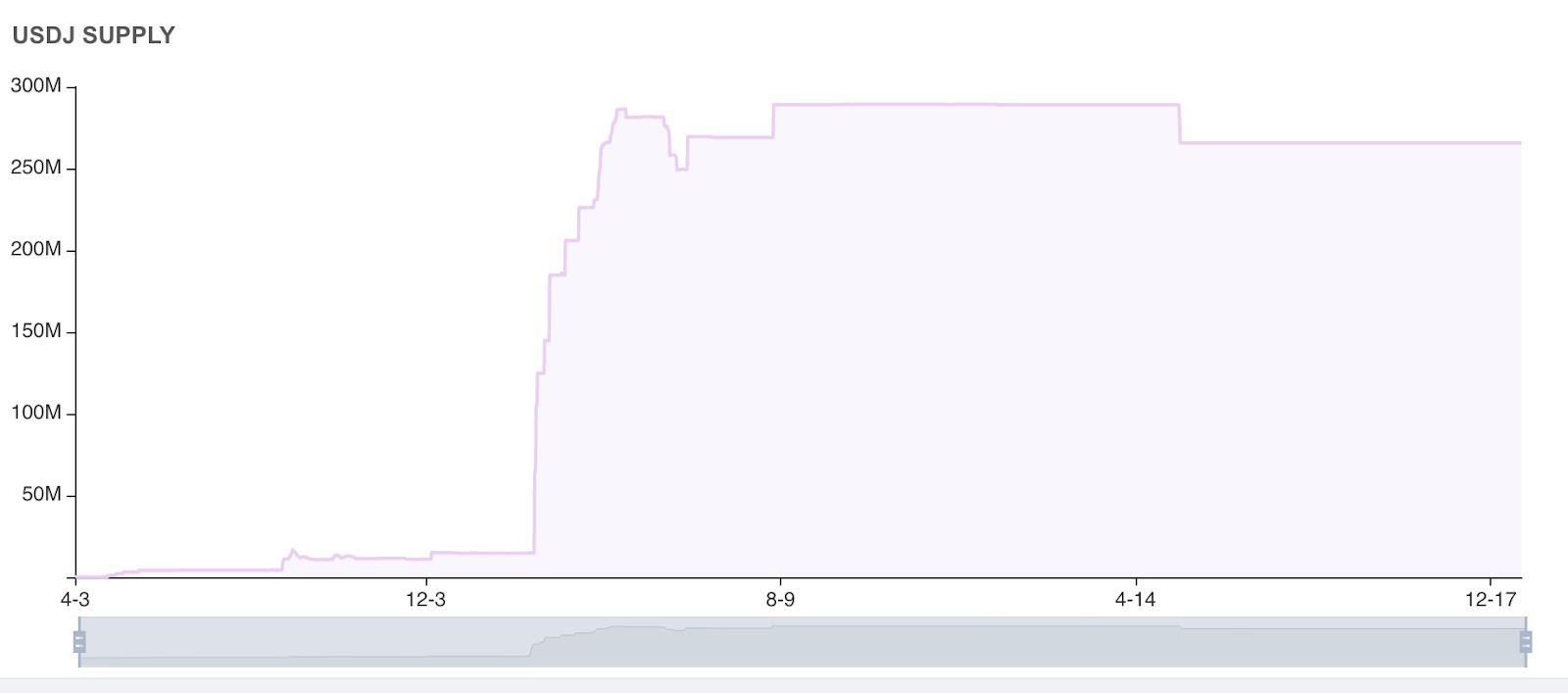

USDJ remained nearly untouched for about a year before seeing its market cap spike from a mere $15 million to almost $300 million.

These coins only trade on a few exchanges, including Poloniex (owned by Justin Sun), Huobi (owned by a Justin Sun shell company), and Sun dot io (a decentralized exchange named after Justin Sun).

This means that few people besides Sun are incentivized to utilize the dual stablecoins. In addition to this, Huobi, one of the only exchanges they’re trading on, is experiencing insolvency rumors and staff layoffs, meaning they could be experiencing a liquidity crisis, as well.

Read more: Justin Sun, crypto’s most shameless marketer, play-acts the hero

Where’s Justin’s money?

While layoffs at Huobi and suggestions of an FBI investigation into Sun point to money and legal issues for the TRON founder, many questions remain unanswerable. That is at least until the problems with his exchanges and stablecoins play out.

The coins themselves are curious insofar as they’re behaving in differing ways, with no recent capital injections to attempt to control the instability at hand and no incentive for short-sellers to try to short the broken stablecoins. Clearly, where the problems are coming from — or how they could be solved — isn’t Sun’s number one priority.

On Sunday, Sun put out a tweet thread in Chinese apologizing for Huobi’s poor communication during times of strain and welcomed further criticism of the exchange. He also expressed a desire to expand his business endeavors into China.

At the same time, it’s unclear how serious His Excellency is taking his ambassadorship to the WTO for the country of Grenada. His last tweet regarding his position was in October of 2022 and his last video was in June.

All of this is a far cry from Q3 and Q4 of last year when Sun was promising “safe and sustainable” 148% interest rates on stablecoins and saying he’d invest “at least billions” in an attempt to save FTX.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD