Top Bullish BNB Smart Chain Tokens To Buy In Feb 2023

From popular cryptocurrencies like Binance coin (BNB) and Dogecoin (DOGE) to stablecoins like Tether and USD Coin, there is a large number of crypto tokens that run on the Binance Smart Chain. In this article, we discuss the best BNB Smart Chain tokens to buy and why they are going to rule the cryptocurrency market in February 2023.

BNB Smart Chain Tokens Ruling the Crypto Market

As it is growing to become one of the most widely used smart contract networks on the crypto market, finding the best BNB Smart Chain tokens to buy can be a rather profitable endeavor.

Baby Doge Coin

Introduced in 2021, The Baby Doge coin is in the headlines for its new improved transaction speeds & adorableness. Just like any other meme cryptocurrency, it was also created as a joke with a mission to help spread awareness of animal adoption.

Source – CoinMarketCap

The token started 2023 with a blast, currently hovering around $0.000000004082 and a 24-hour trading volume up by 165.86%. Now it stands at $75,997,740. In the past thirty days, BABYDOGE has soared nearly 270.35%

BinaryX

BinaryX began as a decentralized derivative trading system and now, it provides services like infrastructural support, a DAO governance system, and more. Its price at the time of writing is $168.04, with a 24-hour trading volume up by 68.63%.

Source – CoinMarketCap

Now it stands at $82,300,094. At the same time, the circulating supply is approximately 21,000,000 BNX as per the crypto market tracker CoinMarketCap.

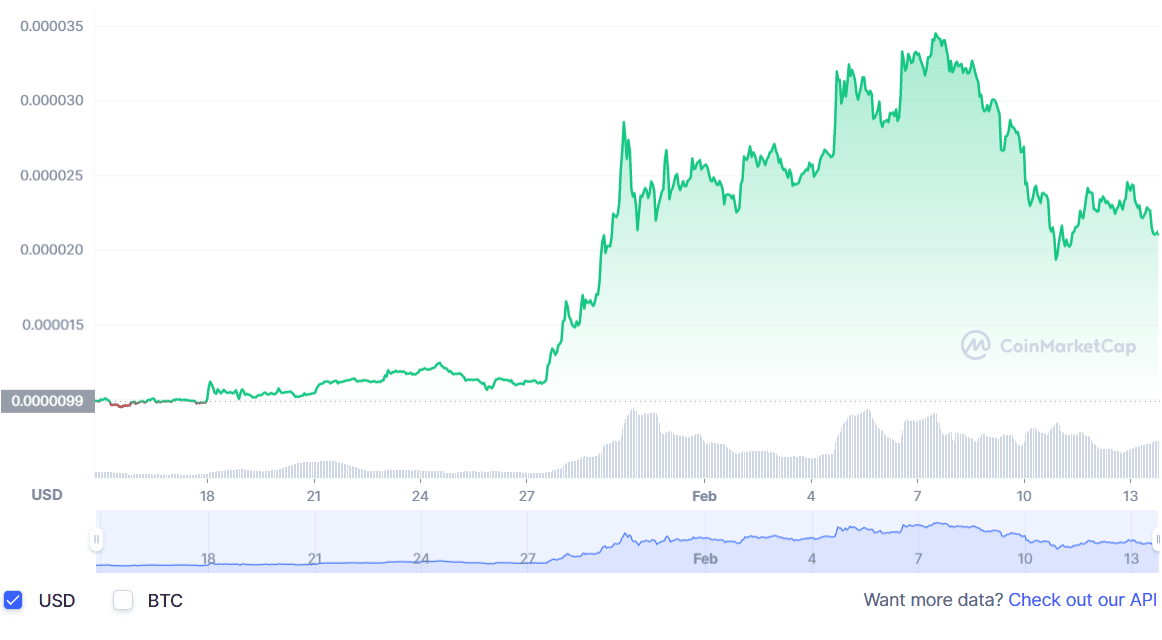

FLOKI

Floki is the utility token of the Floki Ecosystem birthed by fans and members of the Shiba Inu (SHIB) community. Overall, the token has witnessed tremendous growth since its inception.

Source – CoinMarketCap

At present, Floki is trading around $0.000021 and has a 24-hour trading volume up by 58.13%. Now it stands at $23,504,980. In the past four weeks, FLOKI has soared nearly 112.89%.

Also Read: XRP News: Over 592 Million XRP Moved: What Are Whales Up To?

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice. The whole purpose of “Best BNB Smart Chain Tokens Ruling the Crypto Market in Feb 2023” is to educate and provide information about what is trending in the crypto space. Anyone planning to invest in crypto assets should seek his or her own independent financial or professional advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD