Ordinal Punks NFTs called out as ‘sketchy’

Anonymous Twitter account TheNorwegian expressed concerns about Ordinal Punks NFTs, asking, “[is this] the biggest NFT scam of all time?”

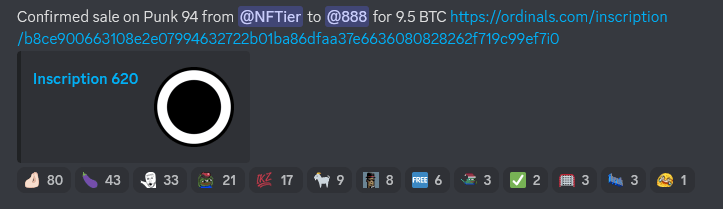

On Feb. 9, CryptoSlate reported on the rising popularity of Ordinal Punks, covering the sale of three NFTs according to social media posts, including #94, which reportedly sold for 9.5 Bitcoins ($215,800).

The novelty of NFTs on the Bitcoin chain and the chain’s provenance seems to be driving demand for these NFTs. However, some are questioning the collection’s legitimacy.

What are the concerns with Ordinal Punks?

Given that the Bitcoin chain was not originally designed to accommodate NFT functionality, there is no infrastructure to verify information such as sales or even to accommodate sales in a click-and-buy process.

Details about Ordinal Punks are restricted to people’s accounts of what happened rather than openly accessible data derived from on-chain information.

Citing the Director of Research at PROOF Collective, who got this information from a “Google doc,” TheNorweigan said Ordinal Punks have a current price floor of 55.4 ETH ($85,500). He added that this is the ballpark figure for a blue chip NFT collection but then questioned whether Ordinal Punks are worthy of being classed as blue chip.

Supporting this point, TheNorweigan pointed out the following, which leads him to think they are “sketchy”:

- Everything is happening OTC

- There are a lot of scams

- There’s low to none transparency

- You need to run a Bitcoin node to mint

- Extreme information asymmetry

Demand for Bitcoin NFTs is going crazy

@seanbonner tweeted that Bitcoin Punks, a clone of Ethereum’s CryptoPunks, is taking off right now.

Bitcoin Punks suffer the same drawbacks as Ordinal Punks due to using the same inappropriate, undeveloped NFT infrastructure on Bitcoin.

Nonetheless, according to @seanbonner, despite the lack of smart contracts and the “square peg, round hole” approach, people are going crazy in Discord, trying to snap one up a Bitcoin Punk. He advised against falling for the FOMO due to the following:

“A. There’s no market so you have to rely on trust and scammers are everywhere B. Fomo is insane and people are asking stupid prices C. Receiving is hard, transferring is harder. Again this isn’t like eth in the way that we’re all used to.”

Bonner also pointed out that Bitcoin Punks are not “official,” adding they are just a copy of cryptopunks on any chain. The same could be said for Ordinal Punks, which TheNorwegian pointed out are nearly identical to Ethereum’s MutantPunks.

“I think Bitcoin NFTs could be great for the space and bring new people into it. What I am bearish on, however, is orchestrated hypes, and influencers selling you gold-disguised rocks.“

What is happening on the Ordinal Punks Discord?

Accessing the Ordinal Punks Discord, the buy and sell activity is not as “crazy” as that described by Bonner in the Bitcoin Punks Discord, perhaps because there are just 100 of the former versus 10,000 of the latter.

However, the general channel is highly active and appears to be a place to discuss Bitcoin NFTs, not just Ordinal Punks. Upon browsing, a Google Doc on Bitcoin NFTs was discovered. It showed 43 NFT projects with Discord links and information such as supply and notes for potential buyers.

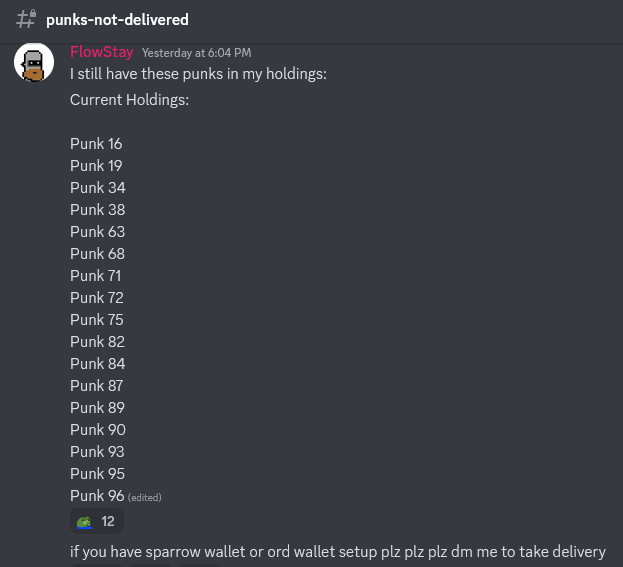

According to admin FlowStay, as of the evening of Feb. 9, 17 Ordinal Punks were still available to buy.

Also, a review of the sales shows Ordinal Punks were changing hands for a lot less in the early days. The first sale occurred on Feb. 2, when #69 was sold for 0.07 BTC. Scrolling down into the present shows a steady price increase over time.

The sale of #94 was confirmed at 9.5 BTC and was the most expensive noted in the channel.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Status

Status  Ontology

Ontology  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond