Magic Eden COO calls 0% royalties a ‘prisoner’s dilemma’

Solana’s largest NFT marketplace Magic Eden announced last week a switch to an optional royalty model, a move that means those buying or selling NFTs may choose what percentage cut of the sale is returned to the original artist.

The reaction was swift and predictable. One NFT artist called it a “sad day for Solana.” Broccoli DAO, a community built around the CyberVillainz and CyberHeroez NFT collections, said that the decision could kill its project. It estimates it has lost $27,000 to 0% royalty marketplaces and is now taking measures to block anyone avoiding royalties from its Discord channels.

Magic Eden’s defection was a blow to royalty supporters in the Solana network. The company accounts for 86% of the sales volume on Solana NFT marketplaces over the past month, according to data from Hello Moon. The second, third and fourth most popular marketplaces on Solana by sales volume (Solanart, YAWWW and Hadeswap) are also 0% royalty. Together they account for 99% of NFT sales on Solana.

Despite its decision, Magic Eden still supports creator royalties and it is committed to finding ways to make royalties enforceable, co-founder and COO Zhuoxun “Zedd” Yin told The Block in an interview.

Prisoner’s dilemma

Creator royalties have long been touted as one of the top use cases for NFTs, allowing creators to make money on secondary sales. But there’s no way to make people cough up on the protocol level. Instead, collecting royalties has traditionally been left to NFT marketplaces themselves. If markets don’t collect, creators don’t get paid.

Several royalty-free marketplaces have emerged over the last few months on both Ethereum and Solana. The most prominent is X2Y2 on Ethereum. In the last few months, it has taken around half of the share of marketplace volume on the chain, although it’s not clear how much of this is wash trading, which is the practice of buying and selling the same NFT over and over to create a false impression of greater marketplace activity. By some calculations X2Y2 and another marketplace, Sudoswap, have less than 20% of the market share when adjusted for wash trading.

Nevertheless, they proved popular, taking market share from giants like Magic Eden and OpenSea. “In my view, this is sort of a classic prisoner’s dilemma situation… We felt that in the absence of technically enforceable solution at the protocol level things would continue to trend basically toward optional royalties anyway,” Yin said.

Not everyone agrees. Some believe that the move toward 0% royalties could even be a chain-specific issue. Despite X2Y2’s gains on Ethereum, Fidenza artist Tyler Hobbs recently told Decrypt that “the Ethereum space is really much more serious” and that “creators will put up much more of a fight.”

“We did not want to go down this path. We tried to avoid this as long as possible because we knew that this decision is something that would be fairly controversial,» Yin added.

Blurred NFTs

Part of the fight is finding a way to enforce royalties or penalize those that don’t pay them through technology that can track whether royalties have been paid on NFT trades. One such tool was created by Magic Eden itself. It launched Metashield last month as a tool for creators to track traders circumventing royalties and blur the NFT images of holders who didn’t pay their dues.

Now it could be used to blur NFTs sold on Magic Eden’s own platform. Unsurprisingly, Yin seems to regret the blurring feature and says Metashield in its current form isn’t going to be developed any further by Magic Eden. But he’s encouraging developers to tinker with it — and some have already reached out to take him up on the offer.

“One of the lessons that we took away from the whole Metashield experience was that, as a marketplace, we should not be in the business of anything that really touches someone’s NFT,” said Yin.

But that doesn’t mean it isn’t open to funding projects that do. Magic Eden is planning to offer $1 million as prize money for a hackathon focused on the development of royalty protection tools and exploration of different ways for creators to monetize. Solana’s co-founder Anatoly Yakovenko is among the judges.

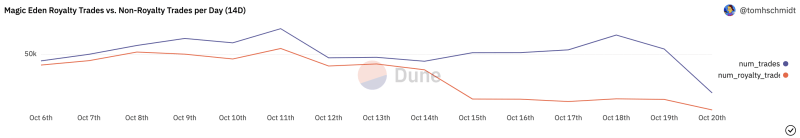

Yet the fact remains that 0% marketplaces dominate the Solana ecosystem and have captured a large share of the market on Ethereum. In a bear market, not having to pay a premium on NFTs is simply too appealing to customers. Non-royalty trades are already surpassing royalty trades on Magic Eden. In addition, it has managed to claw back some market share from 0% competitors.

«It seems that ME has effectively absorbed almost all of Solanart’s liquidity (also introduced a zero-royalty policy a couple of weeks ago) since this feature has been enforced. Prior to this turning point, Solanart’s market share by trading volume has fluctuated between about 3% and 8% throughout October. As of now, it sits at less than 0.5%,» The Block Research’s Thomas Bialek said.

It’s difficult to pinpoint whether this is a temporary shift or if Magic Eden’s announcement was the only driver of this trend, Bialek cautioned. But directionally speaking, it seems to have had the desired effect thus far.

The data for Oct. 20 represents the number of sales as of 12pm UTC, not for the full 24-hour period. Source: Dune Analytics

Magic Eden transaction data over the past week certainly don’t suggest a mass exodus from disgusted buyers. The last few holdouts among NFT marketplaces are likely watching what happens next closely.

“Something’s gotta give. Either the whole ecosystem has to come to the table to effectively figure out what is the right solution… Or this just regresses into a slow, slow burn toward basically 0% royalties,” Yin said.

When asked whether it was thinking about following suit, a Rarible representative said that it was still discussing internally.

Solana NFT creation platform Metaplex was not immediately available for comment but directed The Block to documents stating that it believes 0% royalty trades create “a structural risk to the NFT economy at-large because it breaks the incentive alignment between creators and buyers.”

OpenSea did not respond to multiple requests for comment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur