MakerDAO co-founder recommends DAI-USD depegging to limit attack surface

In light of the recent discussions around depegging its native token from USD Coin (USDC) amid sanctioning of Tornado Cash, MakerDAO co-founder Rune Christensen reached out to the community explaining why free-floating DAI may be the only choice for the decentralized autonomous organization (DAO).

In his blog post, “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai,” Christensen disclosed miscalculating the risks related to risk-weighted assets (RWA). He stated:

“Physical crackdown against crypto can occur with no advance notice and with no possibility of recovery even for legitimate, innocent users. This violates two core assumption that we used to understand RWA risk, making the authoritarian threat a lot more serious.”

While revealing the protocol’s inability to comply with regulators, Christensen suggested that “we must choose the path of decentralization, as was always the intent and the purpose of Dai.”

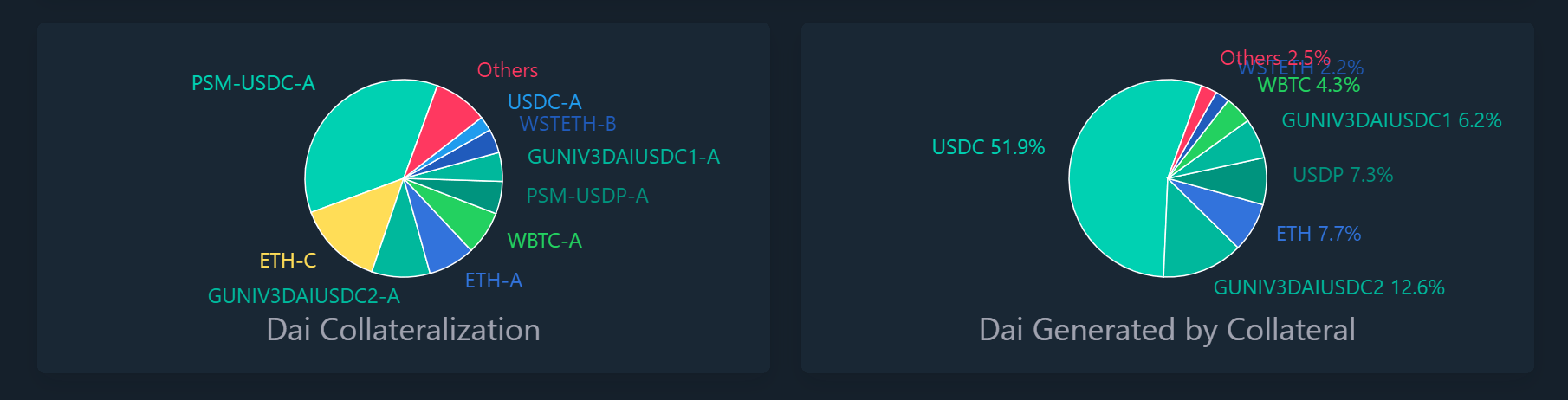

DAI collateralization data. Source: Dai Stats

He believes that decentralizing Maker would reduce the impact of crackdowns on the overall protocol, adding that «The only choice is then to limit attack surface by reducing RWA exposure to a maximum fixed percentage of the total collateral — this requires free floating away from USD.»

It is important to note that over 50% of DAI is currently collateralized by USDC, as evidenced by daistats data.

Related: MakerDAO should ‘seriously consider’ depegging DAI from USD — Founder

Joey Santoro, the founder of the decentralized finance (DeFi) platform Fei Protocol recommended revoking participation from Tribe DAO after reimbursing Fuze victims.

Previously, Rari Fuze hacker was offered a $10 million bounty for returning the $80 million worth of assets, but Fei Protocol received no response from the attacker.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond