Money Printer Go Brrr – How the Fed Printed $300B to Bail out Banks

The Federal Reserve (Fed) has expanded its balance sheet by nearly $300 billion to help banks out with loans. So can we expect the return of quantitative easing (QE)?

The Fed announced that the banks hit with a liquidity crunch had borrowed almost $300 billion in the past week. With this bailout, the economist Peter Schiff believes the QE is back. He predicts that inflation is headed much higher because the Fed has wiped out almost four months of quantitative tightening (QT) in one week.

Fed Rescues Banking System With Money Printing

According to Fortune, the Fed allocated $143 billion to holding companies for failed banks such as Signature Bank and the Silicon Valley Bank. The holding companies will use the money to make the depositors whole.

Then, the Fed lent $148 billion through a program called the “discount window.” The amount is record-high than the usual borrowing through the program. According to The Guardian, only $4 to $5 billion is borrowed in a given week through the discount window.

Last Sunday, the Fed inaugurated Bank Term Funding Program (BTFP) and lent $11.9 billion. This program helps the bank raise funds to meet the needs of all depositors.

What Do the Experts Say?

In total, the U.S. central bank has assisted the banking system with nearly half the amount that it did during the 2008 crisis. Michael Feroli, a JPMorgan economist, believes it is a big number. He says, “The glass half-empty view is that banks need a lot of money. The glass half-full take is that the system is working as intended.”

Nikolaos Panigirtzoglou, a JPMorgan strategist, estimates that the Fed might inject $2 trillion into the US Banking system and reverse the impact of the QT. Gaurav Dahake, the Chief Executive Officer of Bitbns, told BeInCrypto, “Over time, it pushes Bitcoin over $50,000, and Bitcoin halving is about a year away now.”

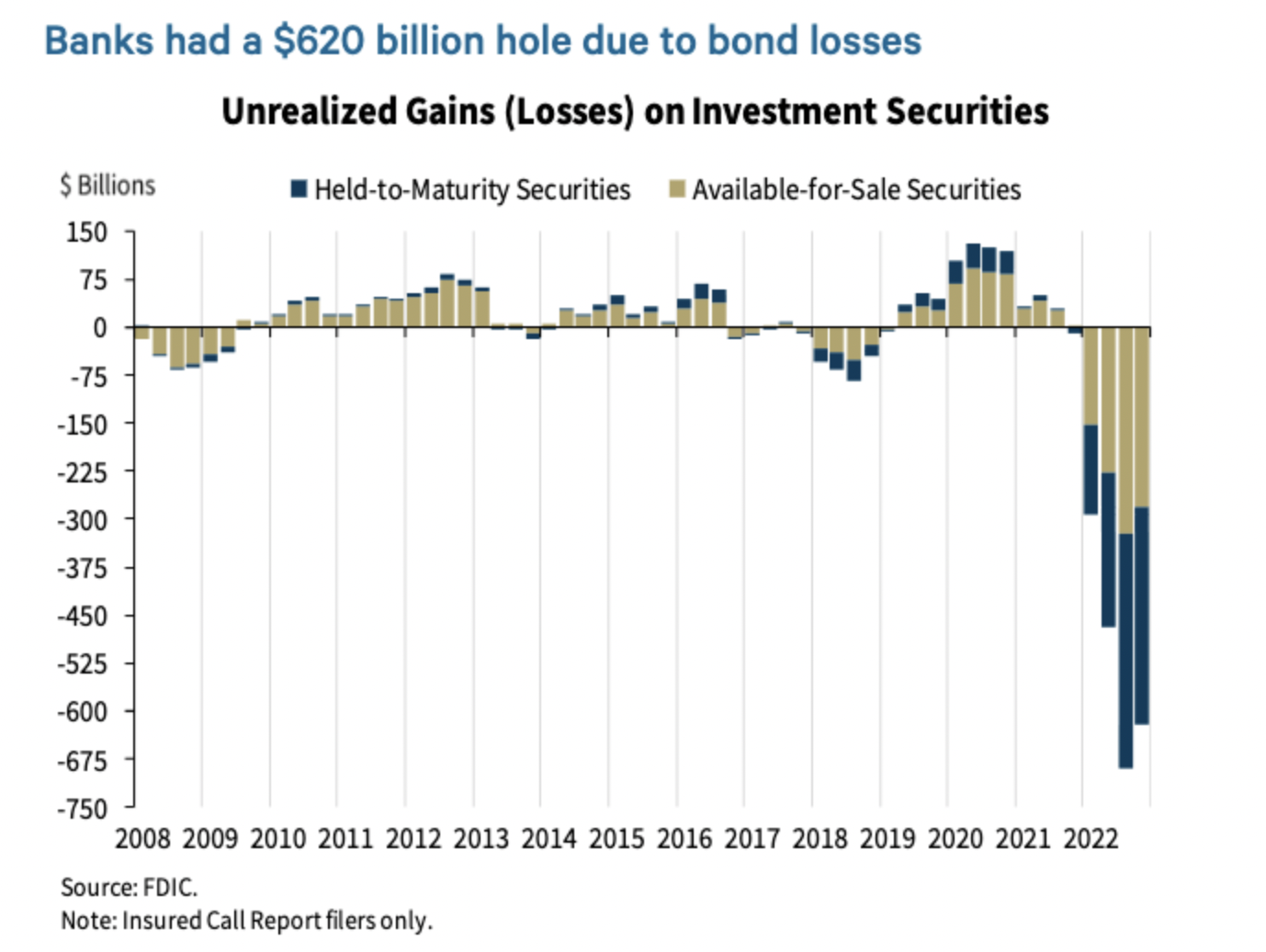

Banks Have an Unrealized Loss of $620 Billion

The banks purchased government bonds with extra deposits due to the QE during the 2020 covid crisis. But, with the increase in interest rates, the price of the bonds fell, and the banks are sitting with huge unrealized losses.

The co-founder of BitMEX exchange, Arthur Hayes, writes, “Banks are carrying an unrealized $620 billion in total losses on their balance sheets due to their government bond portfolios losing value as interest rates rose.”

Source: Medium

Last month, the People’s Bank of China also turned to Quantitative Easing mode by injecting $92 billion into the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur