NFT and Metaverse-Related Cryptocurrencies Underperform as Floor Prices Sink

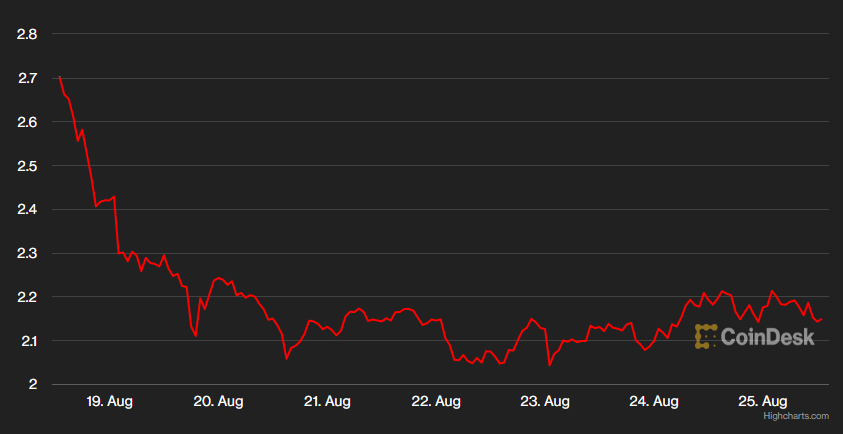

FLOW slumped some 20% over the past seven days. (CoinDesk)

Cryptocurrencies related to non-fungible tokens (NFTs) and the metaverse underperformed over the past week as sentiment about the NFT market remained sour.

The Flow network’s FLOW token, which can be used to build NFTs and decentralized applications (Dapps) such as games on the Web3 platform, slumped 20% during the past seven days. FLOW’s decline was the second largest during that period among 52 cryptocurrencies with a market cap over $1 billion, according to crypto data and analysis firm Messari.

While the general crypto market has stalled amid recent investor concerns about inflation, the economy and the pace of U.S. Federal Reserve interest rate hikes, NFT and metaverse-related token declines reflect price and profit declines for NFTs that have occurred in recent months.

According to a report from NFT data aggregator NonFungible.com, the amount of USD traded in the NFT market dropped 25% in the second quarter from the first three months. NFT resell profit also fell 46% for a total loss of $1.4 billion.

The floor price –the minimum purchase price – of an NFT from Bored Ape Yacht Club (BAYC), the largest NFT collection by market cap, is down over 50% from its high of 153.7 ETH in April 2022 to around 73 ETH. Over the past seven days, the collection’s floor price slumped 5.6%.

ApeCoin (APE), the native token of BAYC used to vote on governance decisions, slumped around 18% over the past week as investors worried increasingly that some NFTs used as collateral for loans through peer-to-peer lending service BendDAO might be liquidated due to the sinking floor price.

The price floors for CryptoPunks and Mutant Ape Yacht Club, the second and third largest NFT collections by market cap, declined 10% and 1.3%, respectively, over the past seven days.

Other NFT and metaverse-related tokens that have sunk include AXS, GALA, MANA and GMT, which all fell between 14% and 20%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur