NFT Marketplace Magic Eden Reports $801M Trades in Q1 and Q2

Leading Solana-based NFT market Magic Eden has recorded a total of over 5.5 million trades worth over $801 million on its platform from January to June 2022.

Magic Eden Records $801M in Trade Volume

The total volume trades generated by Magic Eden in the first half of the year (H1) amounted to 18.24 million SOL, which is equivalent to over $801 million, according to current market prices.

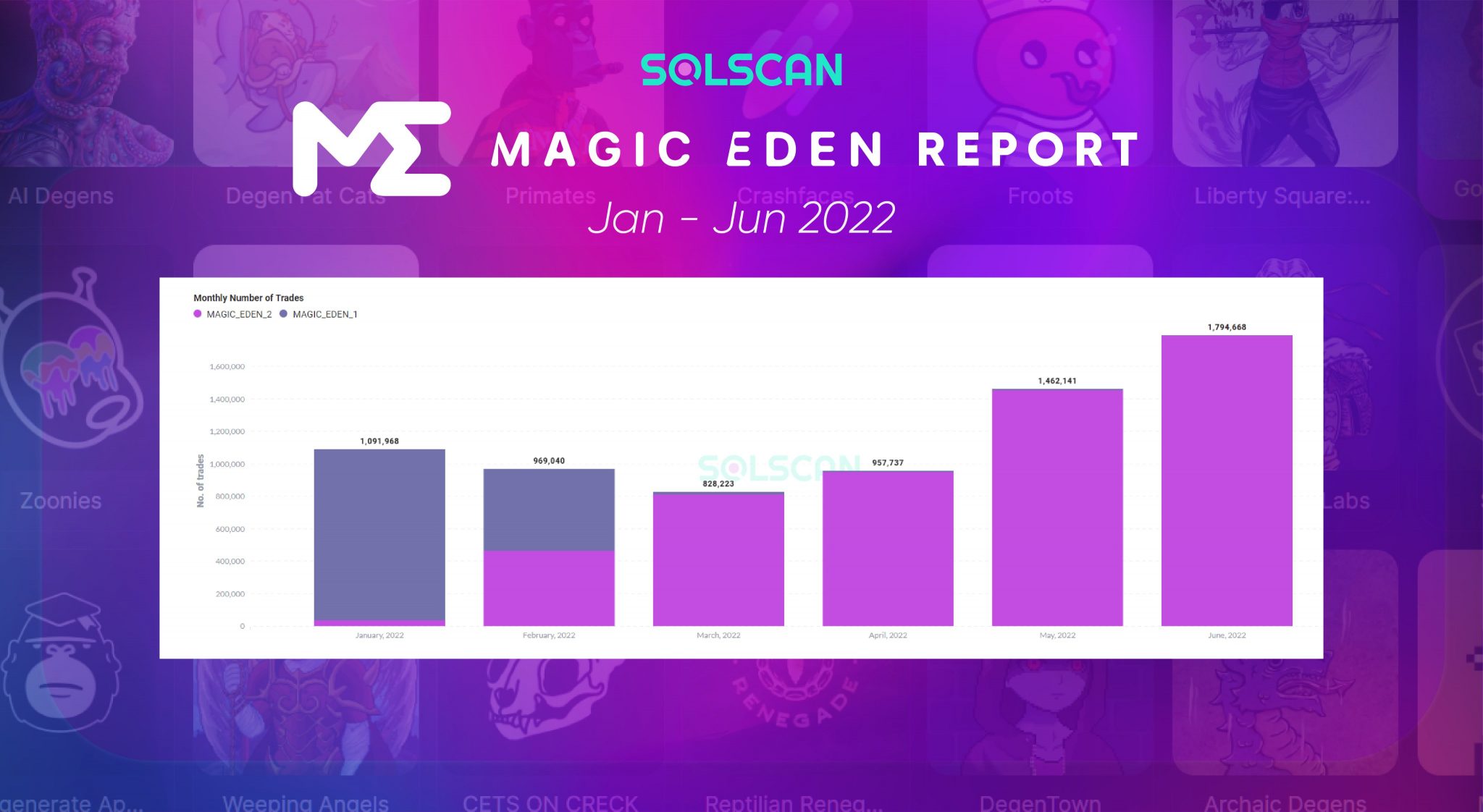

Source: Solscan

From the chart above, it is noteworthy that the company saw a significant 53% increase from its value in April, garnering a total of 1.4 million SOL in May.

The new record is a milestone for the platform as it represents an impressive 81% increase from the total volume trades since the launch of the firm in September 2021. Currently, the total volume traded on the platform is around 22 million SOL.

It is noteworthy, however, that the value of SOL for the volume trades was much higher earlier this year when SOL was trading above $100. At the time of writing, SOL was trading at $44.

The Solana-based NFT marketplace further recorded a total of 20,933 non-fungible tokens (NFTs) collections listed on its platform with more than four million NFTs in H1.

Magic Eden kept seeing increases in market capitalization as the marketplace moved from a capitalization of 1.7 million SOL in January to a peak capitalization in May where it garnered a total of 4 million SOL. Recall that the infamous Terra crash also occurred in May, causing a downtrend in the global crypto market.

However, June’s severe bearish market trends pulled down the market capitalization by 35%, bringing it to 2.6 million SOL.

While the company recorded a peak number of active wallets in February, amounting to 1.1 million wallets, subsequent months in H1 recorded lesser active wallets. It reported over one million active wallets in May while June saw around 970 million active wallets.

Magic Eden Raises $130M in Series B Funding

Earlier last month, Magic Eden was able to raise $130 million in Series B funding, which was led by Electric Capital, Lightspeed, Greylock Partners, and others.

The fund was targeted at investing in other blockchains aside from Solana’s network, as well as integrations of NFTs into blockchain games.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  LEO Token

LEO Token  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Ontology

Ontology  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD