NFTBank Collaborates With X2Y2 Loans To Offer NFT Pricing

NFTBank teams up with X2Y2, the third-largest Ethereum-based NFT market, and an emerging NFT loans platform. Infrastructure for NFT financialization has developed over the last two years as NFT use has increased. NFT-backed loans, NFT rentals, and NFT derivatives are current developments that branch out from NFT markets and aggregators and serve as trading platforms for NFTs as collectibles.

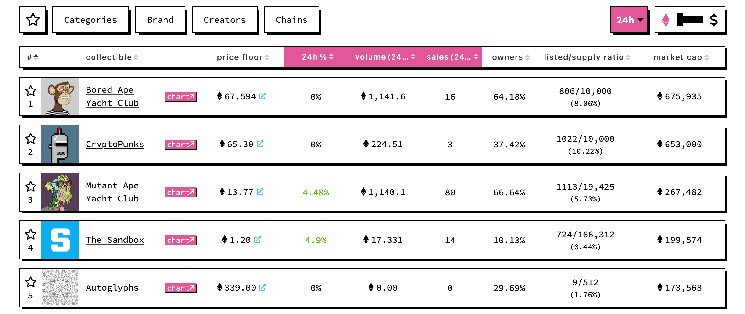

X2Y2, the third largest NFT marketplace in the world with a total trading volume of more than $950 million, introduced its own NFT loans platform in September in accordance with this trend.

Individual NFT holders negotiate a loan term with an individual liquidity provider using the peer-to-peer (P2P) lending platform X2Y2 Loans. The two parties engage in a negotiation over the parameters of the loan, including the LTVs, interest rates, and other loan terms, based on the value of the NFT. NFT-backed loans help solve this issue even if NFTs are not the most liquid assets by providing liquidity even when a holder is unable to sell their NFTs.

But in this scenario, having an accurate estimate of the value of the NFT is very necessary. Loan terms are negotiated based on the value of each non-fungible token (NFT), and having an accurate estimate of the value of the collateral makes it possible for lenders and borrowers to agree to terms that are more equal and variable. X2Y2 has collaborated with NFTBank, the foremost NFT valuation service in the business, in order to give its customers accurate information on the prices of NFTs.

NFT pricing has been a challenging problem for a while since each NFT is unique and there is a dearth of sales transaction data. And NFTBank has worked to address this problem from the beginning of NFTs.

The culmination of several years of research and development is a cutting-edge statistical system that is based on machine learning and can generate price estimates for individual NFTs with an accuracy of more than 90%. The machine learning algorithm used by NFTBank determines a single pricing value for each specific NFT included inside a collection by using a variety of data points like floor price, rarity, and bid/ask distribution. As of right now, NFTBank offers pricing information for over 5,000 different NFT collections and makes it available to users through application programming interfaces (APIs) as well as a dedicated mobile app.

Users may now select loan conditions more smartly than ever before since NFTBank’s value supports each and every NFT listed on X2Y2 loans. For instance, borrowers may more effectively choose how much of their NFT to pledge as collateral for loans, while lenders can more simply identify which NFTs need liquidity.

The fact that X2Y2 Loans was the first marketplace to make the transition to a loans platform is the primary reason for the company’s prominence. The fact that X2Y2 has more than 3,000 DAU demonstrates that a significant number of buyers and sellers have faith in it. Because the loan service is put on top of the marketplace, users now have the ability to make lending decisions in addition to purchasing decisions on the same website. After just two and a half months after its launch, X2Y2 has made its way into the top three most successful NFT lending platforms, with a total loan volume of about 8,000 ETH.

In the meanwhile, NFTBank has already established itself as the industry standard for NFT valuation solutions. In addition to supplying data for Chainlink, NFTfi, Pine, Stater, and Unlockd Finance, NFTBank—known for its NFT price information—recently merged into MetaMask’s portfolio dapp. Hashed, DCG, as well as other partners and investors, support NFTBank.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD