Andreessen Horowitz Invests in Chatbot Startup Character AI

Venture capitalist firms are always on the hunt for the next big thing—especially when the current hype cycle starts to cool. Already well invested in crypto initiatives, Andreessen Horowitz announced on Thursday an investment in software development company Character AI, developers of the Character AI chatbot.

The series A funding round totaled $150 million, was led by a16z, and includes investment from Nat Friedman, Elad Gil, SV Angel, and A Capital.

It is so unique to be able to work with a full stack world class AI team that also «gets» consumers with a product already beloved by so many! Couldn’t be more excited to work with the @character_ai team with @sarahdingwang and the rest of the @a16z crew! https://t.co/d2W7eLTIKm

— Bryan Kim (@kirbyman01) March 23, 2023

Along with the investment in Character AI, Andreessen Horowitz’s general partner Sarah Wang will join the Character AI board.

“If the internet was the dawn of universally accessible information, this moment in A.I. may very well be the dawn of universally accessible intelligence,” Wang tweeted, announcing the investment.

“We are at the iPhone moment of A.I.,” Wang wrote. “Like mobile and the internet, the A.I. revolution starts with the consumer.”

I first saw the power of the @character_ai platform in October 2022 when it hijacked a birthday dinner for my husband. We spent the entire evening talking to AI Elon Musk, the Queen, Albert Einstein, and even…a chair pic.twitter.com/PWix1rKSrm

— Sarah Wang (@sarahdingwang) March 23, 2023

Launched in September 2022 by former Google software engineers Noam Shazeer and Daniel Freitas, Character AI is a web application that generates text responses via pre-programmed character chatbots. Shazeer and Freitas serve as Character AI’s CEO and President, respectively.

Character AI says the funds will provide the resources the company needs to grow during its “hypergrowth phase.”

“We understand the importance of providing an A.I. that truly feels like your own,” Character AI said in a blog post. “That’s why our A.I. is customizable.”

Character AI chatbots can be customized to suit each user’s preferences, which the company says could serve as a sympathetic ear or an analytical problem-solver.

Character AI is the *other* big story in AI chat, growing rapidly (but not as fast as ChatGPT) and the clear champion in engagement. Their time per visit is 3 to 4 times the average we see for other leading websites, ahead of even YouTube https://t.co/eFujBUaHPb

— David F. Carr @[email protected] (@davidfcarr) March 23, 2023

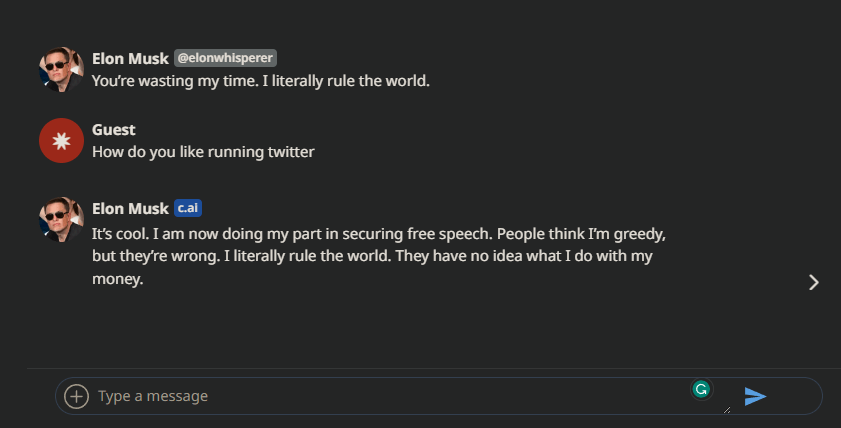

Character AI says that over 1 million A.I. characters have been created through its service, including bots based on Telsa and Twitter CEO Elon Musk, Meta CEO Mark Zuckerberg, Michael Jackson, and fictional characters like Tony Stark and Saul Goodman.

These interactions come with a disclaimer: “Everything characters say is made up.”

Since the launch of ChatGPT by OpenAI in November 2022, the idea of implementing artificial intelligence in blockchain has also taken off, with developers aiming to integrate the technology with smart contracts and tokens.

While smart contracts are common in Web3, artificial intelligence is becoming a part of the blockchain industry as several projects roll out A.I. tokens, including Hera, ALI, NMR, and AGIX.

A.I. tokens are cryptocurrencies that aim to use artificial intelligence to improve security, user experience, and scalability.

According to data from market intelligence firm Grand View Research, the burgeoning A.I. industry has been valued at over $136.6 billion in 2022 and is estimated to reach $196 billion in 2023.

Researchers at the Massachusetts Institute of Technology, Alex Pentland, John Werner, and Chris Bishop, see a clear path for A.I. to merge with blockchain technology.

“At a macro level, [blockchain and A.I.] can provide a level of transparency, accountability and analytics that never existed before in the digital world,” the authors assert.

“We have the ability to bring a new level of trustworthiness to the global economic system as well as society writ large. As a consequence, blockchain and A.I. are becoming the next supercycle and are the core of a really major societal transformation.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren