Nike Trips Up .SWOOSH Launch While Bitcoin NFTs Soar

This week, Bitcoin NFTs are having their moment, placing them just behind Ethereum NFTs in terms of sales. Meanwhile, NFT lending platforms and loan services are also gaining momentum. Blur’s Blend is dominating with 82% of the NFT lending market share, while Binance has released its own NFT loan service that allows holders to use their blue-chip NFTs as collateral to secure ETH loans.

Also, Nike’s .SWOOSH platform released its first collection of digital sneakers, which netted over $1 million in sales so far, though the mint process was not a walk in the park for eager buyers that faced numerous delays and technical difficulties.

You’re reading The Airdrop, our weekly newsletter where we discuss the biggest stories across Web3. Sign up here to get it in your inbox every Friday.

This Week’s Alpha

Go off, Bitcoin NFTs: NFTs on Bitcoin have continued to grow in popularity, jumping to the number two spot in terms of sales per blockchain, coming just behind Ethereum, according to data from CryptoSlam. Bitcoin NFTs are a relatively new phenomenon, as they didn’t effectively exist before the enabling of inscriptions on the Bitcoin mainnet in January 2023.

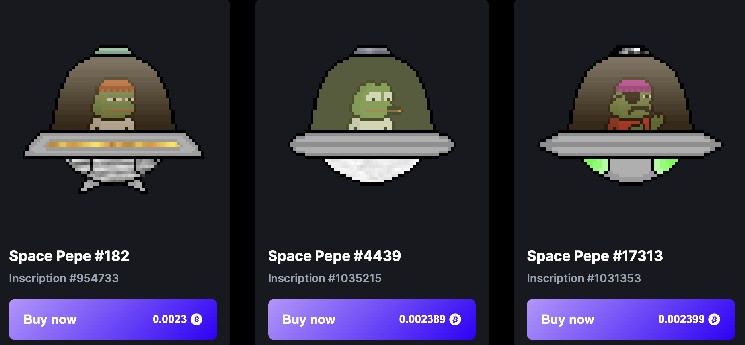

Space Pepes to the moon: The Bitcoin-based “Space Pepes” NFTs jumped to the top of the NFT leaderboard on Thursday, becoming the most traded NFTs over a seven-day period, data from Cryptoslam shows, with over $7.3 million worth of the collection traded.

Inscriptions boom: The number of Ordinals inscriptions spiked above 3 million earlier this month following the introduction of the BRC-20 token standard… but the vast majority are just text.

Nike’s jagged path to $1M: .SWOOSH, Nike’s Web3 collectibles platform, released its first NFT sneaker collection called Our Force 1 and has surpassed $1 million in sales despite a bumpy mint. The sale, which began with “First Access” on May 15 after numerous delays, faced multiple technical issues that hindered the user experience. The “General Access” sale began on May 24 – two weeks after its initially-proposed date – and also experienced issues with traffic and tech preventing many from minting. The sale is ongoing, but Nike has already deemed it a success on Twitter, despite the fact that many NFTs haven’t sold.

Drop master or drop-saster?: Some users were frustrated that Nike, who are experts in releasing exclusive sneaker drops that sell out in seconds, had so many technical issues with the .SWOOSH drop.

NFT lending is trending: NFT lending platforms and loan services are having a moment, as buyers seek new ways to enter the NFT market without shelling out thousands of dollars:

Blend: Earlier this month, NFT marketplace Blur launched its lending platform Blend, which has already seized 82% of the NFT lending market share, according to a report by DappRadar.

Binance NFT Loan: Top crypto exchange Binance has launched a new feature integrated into its NFT marketplace that allows digital asset holders to secure ETH loans by using their NFTs as collateral.

Astaria: Co-founded by the former CTO of DeFi protocol SushiSwap, Astaria allows NFT holders to lease their assets to traders who may not want to shell out for a blue-chip NFT in a single transaction.

Projects on the Rise

RSTLSS x Claire Silver: PixelgeistWho: AI artist Claire Silver and digital fashion platform RSTLSSWhat: Pixelgeist, a 2,136-edition NFT collection, blends fashion, art and technology through vivid and colorful pieces of art created using artificial intelligence. The collection is made up of new artwork from Silver that range in edition sizes, with each piece portraying a “Pixelgeist,” described as “a digital entity that embodies the essence of an AI soul trapped within a portrait.” Each purchase came with an NFT, a digital and physical wearable featuring the artwork and a digital avatar wearing the specialized garment.How: During the minting process, collectors were asked two questions that dictated what combination of artwork and clothing they received together. The collection sold out, though many are available for purchase the secondary marketplace OpenSea.

Want to learn more about Claire Silver’s art? I spoke to her last week about her upcoming sola exhibition at 0x.17 gallery.

In Other News

Doge-umentary: Columnist Jeff Wilser checks in with TriDog, a member of the Own the Doge DAO, who is working on a wild documentary to tell the memecoin’s story.The divine path: Gods Unchained, Ethereum’s highest-grossing trading card game, revamped its project roadmap, laying out plans to launch a mobile version for both Android and Apple devices by the end of 2023.Metaverse master: China’s Web3-friendly city of Nanjing, which previously launched a $1 billion blockchain fund, has launched a state-backed organization aimed at promoting metaverse studies across the country.Virtually slaying: Decentraland is hosting a three-day Pride event featuring virtual art installations and live musical performances.

Non-Fungible Toolkit

What Is NFT Lending, Anyway?

The NFT lending market has seen a huge resurgence in interest following NFT marketplace Blur’s launch of Blend, which is already doing hundreds of millions in trading volume. Two more companies entered the market this week, Binance and Astaria, with unique offerings of their own and they won’t be the last.

But before you put your NFT in one of these lending protocols, you should know how they work and the full suite of options available for making money off your NFT without selling it. We’ve got you covered in this guide.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur