Pancakeswap Proposes New Tokenomics: 3-5% Inflation And 5% Trading Fee Sharing

PancakeSwap is proposing changes to the CAKE tokenomics in order to transition towards a deflationary model based on real yield and CAKE burn. They aim to target a 3-5% annual inflation rate for CAKE and propose a model with low staking inflation and real yield drawn from PancakeSwap’s protocol revenues.

They also plan to allocate 5% of trading fees from PancakeSwap v3 0.01% and 0.05% fee tiers monthly to CAKE stakers and increase CAKE emission weighting towards longer-term stakers. Longer CAKE stakers will be allocated more benefits across products, with longer stakers receiving higher benefits.

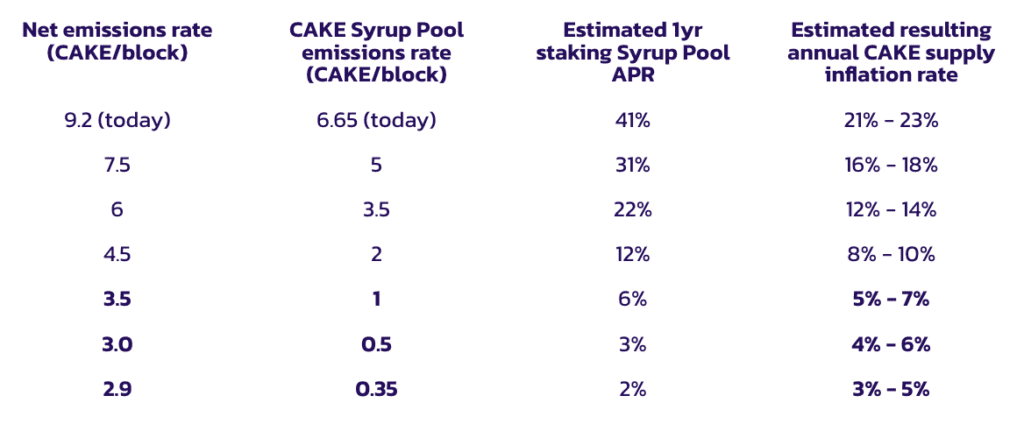

PancakeSwap has mapped out the impact of their proposed changes on their journey to ultrasound CAKE, on Syrup Pool APRs, and CAKE Inflation % based on the voting options. They recommend 0.35-1 CAKE/block for the Syrup Pool because it will immediately benefit existing CAKE holders and stakers, and loyal CAKE stakers will receive the largest share of protocol revenue.

They believe their proposal will align with PancakeSwap’s growth as a Top 3 DEX and that CAKE has strong utilities other than staking rewards. They do not recommend 2 CAKE/block or higher for the Syrup Pool because it remains highly inflationary to existing CAKE holders and stakers.

The most significant driver of CAKE burn comes from trading fees, and the subsequent CAKE buyback-and-burn incentivizes users to hold onto CAKE. PancakeSwap aims to create more value for users and drive the long-term success of the CAKE token. They plan to introduce three new products and expand to other chains to increase CAKE burn further.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur