This Chinese MLM Ponzi Is Now the Fifth-Biggest Polygon (MATIC) Holder

A Chinese MLM Ponzi scheme has become the fifth largest MATIC holder. The project’s transactions have led to increased gas fees on the network.

A multilevel marketing (MLM) ponzi project is the fifth-biggest holder of the MATIC token, according to on-chain data. Both crypto security service PeckShield and individuals in the crypto community have been talking about the development.

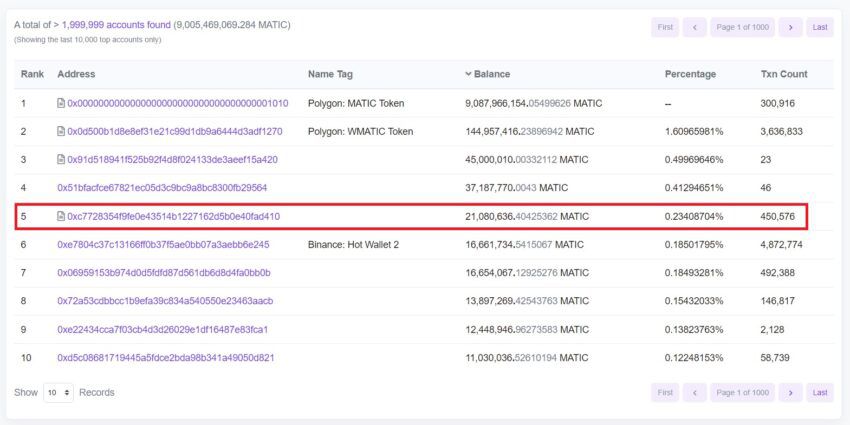

Top Accounts by MATIC Balance: PolygonScan

PeckShield said that the address associated with the Ponzi scheme had gathered about 22 million in MATIC, which surpassed the Binance hot wallet and would make it the fifth-largest holder. Wu Blockchain also spoke about the project, which launched in China.

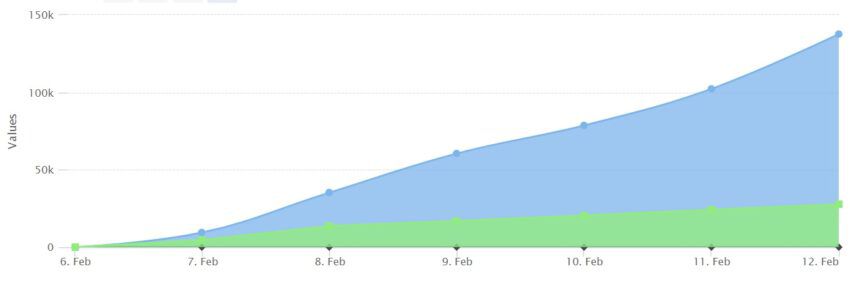

One of the reasons why the project has come to the crypto community’s attention is that it has been responsible for a great deal of gas consumption. Over the past week, the address has consumed over 100,000 MATIC in gas fees. Wu Blockchain also pointed out that the number of transactions on the address went as high as 117,000, which resulted in the gas fees crossing 700 gwei.

MATIC Transactions for Avatar: PolygonScan

There is little information about what the project does on Twitter, as it primarily operates on Chinese social media. The project, named ‘Avatar,’ apparently offers a referral staking protocol with very high rewards. Some in the crypto community have warned about the project, explaining how it offers suspicious returns.

Polygon’s Strong Start to 2023

The Polygon network and MATIC token have seen demand increase substantially in recent times. Several factors have pushed up the price of the MATIC token, now priced at around $1.21.

MATIC Price Chart by BeInCrypto

Among those developments is a zero knowledge-powered scaling solution. This will make Polygon much faster and more efficient, processing up to 10,000 transactions for less than $1. Such efforts have attracted the attention of investors and increased adoption levels.

Ponzi Schemes Continue to Affect Crypto Markets

Ponzi schemes appear to be heavily popular in the market at the moment, with many reported over the past few weeks. One project, called Dingo, was highlighted as a potential scam by a cybersecurity software firm. These types of projects have been around for years, and it doesn’t look like they will fade out of existence anytime soon.

Recently, authorities tracked down the creator of the infamous Squid Game scam token. Meanwhile, one of the co-founders of the OneCoin scam remains missing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Monero

Monero  Dai

Dai  OKB

OKB  Ethereum Classic

Ethereum Classic  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  KuCoin

KuCoin  Tether Gold

Tether Gold  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  Qtum

Qtum  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Waves

Waves  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Lisk

Lisk  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Ren

Ren  Bitcoin Gold

Bitcoin Gold  Augur

Augur