«Amazon» Ethereum Name Service Sells for $1,000,000

Ethereum name services have already disrupted the digital assets industry, as more brands, companies and influencers are looking for ways to plant their flag in the blockchain space by acquiring their own name service on the blockchain.

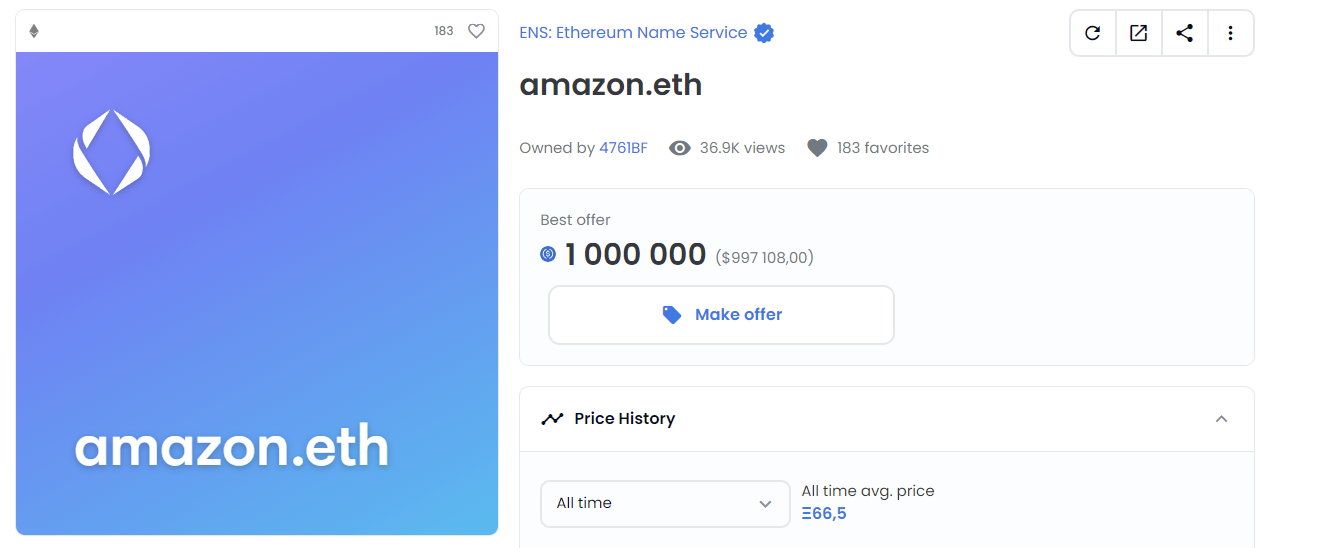

As the OpenSea page suggests, the ENS with the address of one of the world’s biggest corporations is now selling at $1 million following the most recent bid placed on the market by an anonymous NFT investor.

Back on October 18, 2019, someone purchased the «amazon.eth» ENS domain for 100 ETH worth approximately $20,000 at that time. Later in February 8, 2022, someone purchased the amazon.eth ENS domain for 33 ETH, or $102,000.

If the ENS domain finds a new owner, an investor who purchased the digital asset in February will end up with a 1,000% profit in only a few months. It is not yet clear if the deal will go through.

The anonymous investor who offered $1 million for the domain actively collects various ENS domains according to his own OpenSea page. The account also owns the domain «omozon.eth,» which is similar to the name of Jeff Bezos’ company.

The Ethereum Name Service is a naming system based on the Ethereum blockchain that transforms long and unreadable blockchain addresses into something a human eye can quickly process and type in.

ENS inherits and implements DNS technology on the blockchain while having a completely different architecture thanks to the capabilities of the Ethereum blockchain. By using ENS’s web application, users can send ETH or interact with other name services while not having to go through remembering and pasting long blockchain addresses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Stacks

Stacks  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  Qtum

Qtum  Decred

Decred  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  DigiByte

DigiByte  NEM

NEM  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  Status

Status  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond