Probability That US Banks Will Restrict Cash Withdrawals Is ‘Rising Like Mercury’, Says Macro Guru Hugh Hendry

Macro guru Hugh Hendry is expanding his views on the US banking system amid lingering turmoil in the financial sector.

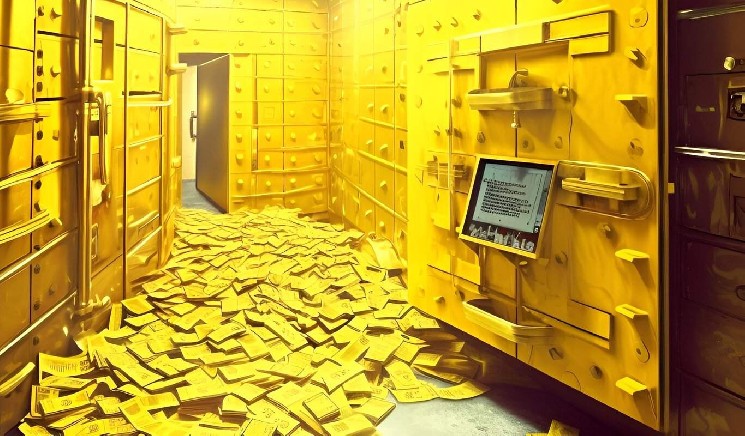

In a new interview on Stansberry Research with Daniela Cambone, the hedge fund manager says the Fed’s tight monetary policy has increased the probability that banking customers could one day face restrictions on the amount of cash they can pull out.

“If we went back a year ago, the probability you would assign to that would be almost zero. And all I’m saying is that probability, like mercury, is rising.

Why is it rising? It’s rising because we have experienced, I call it the Fed folly. One can say factually that this Fed hiking is the fastest and of the greatest magnitude. They’ve never done this before…

We no longer live in an environment where it seems prudent to have all of your money in the banking system, and certainly not congregated around one lender.”

Although blanket limits on bank withdrawals are unknown in the US, such restrictions were implemented in Greece and Cyprus during the debt crisis of the mid-2010s.

Cash withdrawal limits are currently in place in Nigeria, where individuals are allowed to withdraw 20,000 naira, worth about $43 dollars, per week. Leaders in the economically-troubled nation say the move is designed to pull cash out of the system ahead of a planned move to a fully digital economy.

Hendry says America’s banking industry will likely witness further deposit flight as we now live in a world where a customer can pull out their funds with a press of a button.

He also points out that the Fed’s rate hikes over the past year have created an environment that makes it attractive for depositors to take their money out of banks and invest it in money market funds.

A combination of being stuck with these very uncompetitive rates and now the tyranny that money can just fly so quickly… The thing that’s pulling money out is the Fed’s offering too much via money markets. I mean you could go to the Fed directly.

So what’s the Fed doing? It’s encouraging more and more and more money to leave [banks].”

At time of writing, the average annual percentage yield (APY) for savings accounts stands at 0.25%. Meanwhile, money market funds offer as high as 4.75% APY, closer to the Federal Reserve’s 5% to 5.25% benchmark rate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren