Q1 Report Suggests Favorable Conditions for Indian Crypto Market

The recent revelations demonstrated that 2023 is a favorable year for crypto investors in India considering the substantial growth in the value of the leading cryptocurrencies including Bitcoin (BTC) and Ether (ETH).

As per the data, though the previous year hadn’t been a very successful year for the Indian crypto market, with investors witnessing grave losses, the first quarter of 2023 presumably shows that this year would be appreciatory. It is indicated that the collective market of all the cryptocurrencies has exhibited a considerable surge of almost 49% reaching $1.18 trillion.

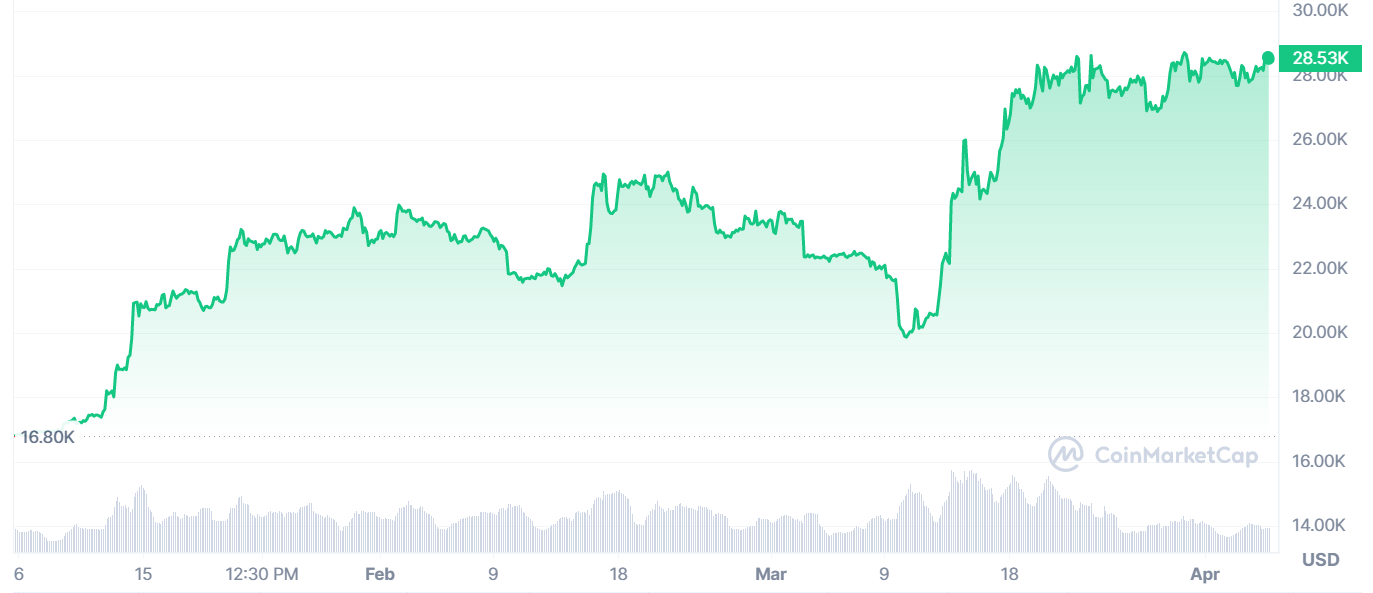

Notably, Bitcoin has presented a remarkable gain of almost 68.56% in the first quarter of 2023. Currently, the coin is trading at a price of $28,527 showing a massive growth from $16,000, its price at the onset of the year.

Three Months’ BTC Price

Similarly, the second largest cryptocurrency Ether’s current price of $1,910 represents an increase of almost 49%. At the beginning of the year, the coin price stood at $1,200 while at the end of the first quarter, it jumped to a high with a drastic increase.

Three Months’ ETH Price

Significantly, Rajagopal Menon, Vice President of the Indian crypto exchange WazirX stated that the total transaction volume of Q1 is around $0.5 billion, with trading volume for the top 10 tokens reaching approximately $300 million.

Though the first quarter bestows hope on the Indian crypto market, the investors and enthusiasts seem vigilant. The crypto investor Chahul Varma posited that 2023 is both a “hopeful” and “confusing” year for investors.

Interestingly, a software engineer in Mumbai commented that she has utilized crypto’s better performance of Q1 as “an opportunity to cash out 85% of my [her] crypto portfolio”, adding: “Bitcoin showed some signs of being an anti-fragile asset during this banking crisis, however, its high correlation with the NASDAQ is still bothersome, making it a risky asset.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur