Senate’s Toomey Says He’s Seeking Bipartisan Support for Stablecoin Effort

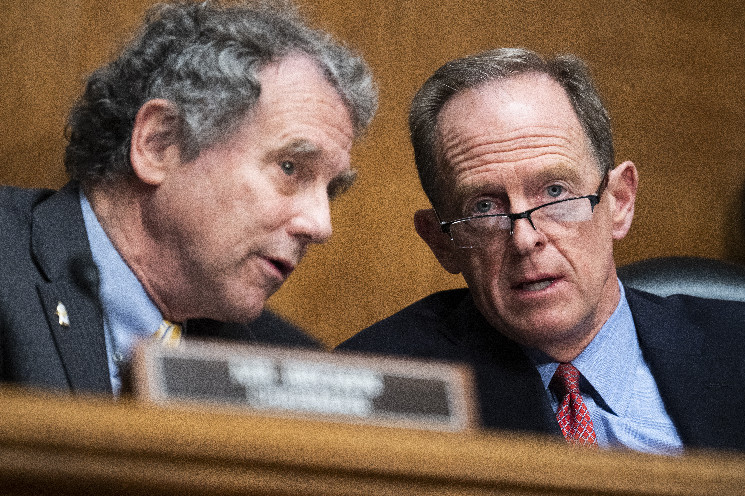

The top Republican on the U.S. Senate Banking Committee, Sen. Pat Toomey (R-Pa.), said he’s seeking common ground with Democrats to make his earlier proposal on stablecoin oversight a bipartisan effort, and Chairman Sherrod Brown (D-Ohio) confirmed he’s been involved in the discussion.

«The first place where we should be able to find common ground, and I actually think in many cases are close, is to chart a path forward for clear and sensible regulations on stablecoins,» Toomey said at a Wednesday committee hearing, mentioning his own push for oversight of the tokens.

«I’m in discussion with several members to make this proposal a bipartisan one,» said Toomey, who called his proposal a “starting point.”

Still the key voice that’s been missing was the panel’s chairman, Brown, who made a brief remark Thursday after Toomey’s mention of the stablecoin proposal.

“Senator Toomey and I have talked about this,” Brown said, noting that the two have “a different view generally” over the intensity of regulation needed. However, he added that “we want to get to that; we want the regulators to go as far as they can go.”

Stablecoins are designed to maintain steady value by tying them to assets such as the dollar, and leading tokens – such as Tether’s USDT and Circle Internet Financial’s USDC – are a key component of the crypto market, because they allow investors to reliably trade in and out of more volatile digital assets.

Toomey’s proposal pushes for full disclosure of reserves that back stablecoins, and it would set up the Office of the Comptroller of the Currency as a key regulator of the issuers. But a bipartisan negotiation in the House of Representatives has so far been considered the leading effort toward setting up guardrails for U.S. stablecoins, though the talks in the House Financial Services Committee have been delayed past the upcoming August recess.

Also at the Thursday hearing, Sen. Elizabeth Warren (D-Mass.) said she’s poised to release a bill «to regulate the crypto market and stamp out the worst scams.» In March, she’d introduced a bill addressing sanctions compliance in crypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur