Stepn founders’ bright idea for its new NFT marketplace: compulsory royalties

Stepn developer Find Satoshi Lab is bucking the trend set by other NFT marketplaces with its own multi-chain offering called Mooar — with a zero-fee, compulsory royalty structure.

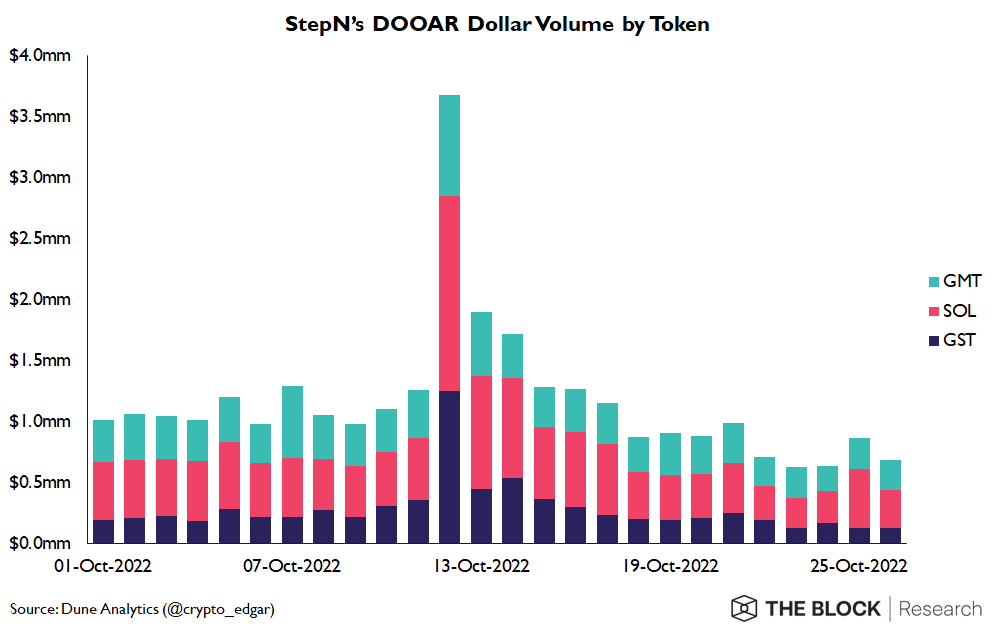

Launched today, the venture is the third project in the FSL ecosystem after the move-to-earn darling Stepn and its decentralized exchange product, Dooar.

Mooar debuts with what the business calls a «unique membership model,» as it eschews platform fees in favor of an initial entry fee of $29.90 a month for unlimited NFT trades. For context, the fee is nearly double what you might currently pay for a standard Netflix subscription.

Royalties for creators will default to 2%, or within a 0.5% to 10% range, depending on what the creator chooses to set. It will initially launch on Ethereum and Solana.

Stepn’s move into the NFT marketplace business comes at a time when many other established players and new disruptors are shaking up revenue models — as a race to adopt the most competitive fee structures has emerged.

The most prominent of these is X2Y2. In the last few months, it has taken around half of the share of marketplace volume on Ethereum — although it’s not clear how much of this is wash trading, which is the practice of buying and selling the same NFT over and over to create a false impression of greater marketplace activity. By some calculations X2Y2 and another marketplace, Sudoswap, have less than 20% of the market share when adjusted for wash trading.

Earlier in October, Solana’s largest NFT marketplace, Magic Eden, also announced a switch to an optional royalty model. Meanwhile, LooksRare moved to an optional model while allocating 0.5% of its trading fees to creators.

Value for creators

The marketplace will enable community members to create and launch their own collections on Mooar’s launchpad, which is run like a community-driven hackathon. FSL hopes it will create a «self-sustaining ecosystem.» FSL said that profile picture collections will be among the first assets sold.

“We deeply empathise with builders in the space and we want to empower those creators,” said Shiti Manghani, COO of FSL in an interview with The Block. “We are fed up of centralized institutions and want to create a new paradigm. If we make systems that are biased against artists while championing decentralization, what’s the point?”

Mangani believes that, despite the race to 0% royalty structures in recent weeks, what attracts buyers and sellers to different NFT platforms “boils down to how people see value.”

“Long-term value will be built on platforms that reward creators,” she added.

A tokenomics balancing act

As well as being a new venture for FSL, the move also looks set to attempt to revive the GMT token associated with Stepn, which will be used for governance on the marketplace, giving holders the right to vote on certain decisions, such as which projects are listed.

Stepn, which went to market in August 2021, has thus far struggled to find the right tokenomics balance for its users. Throughout the year, it has implemented ways to regulate the token supply such as through token buybacks and burns that reduced the amount of GMT, helping to make its gaming ecosystem more sustainable.

Stepn’s GMT token was 86.9% below its all-time high of $4.114427 as of 8 a.m. EST on Oct. 31, according to Coinbase data.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM