Tether transparency: A lesson in lying

Tether, the first — and probably most controversial — stablecoin, has spent seven years promising transparency and audits. But a promise of transparency isn’t transparency. What Tether has proven, if anything at all, is that, sometimes, a promise may be enough.

The first promise

The first time Tether told a live, public audience it was going to get an audit was on March 9, 2015. You can still find the tweet, in which Tether claims to have partnered with blockchain company Factom.

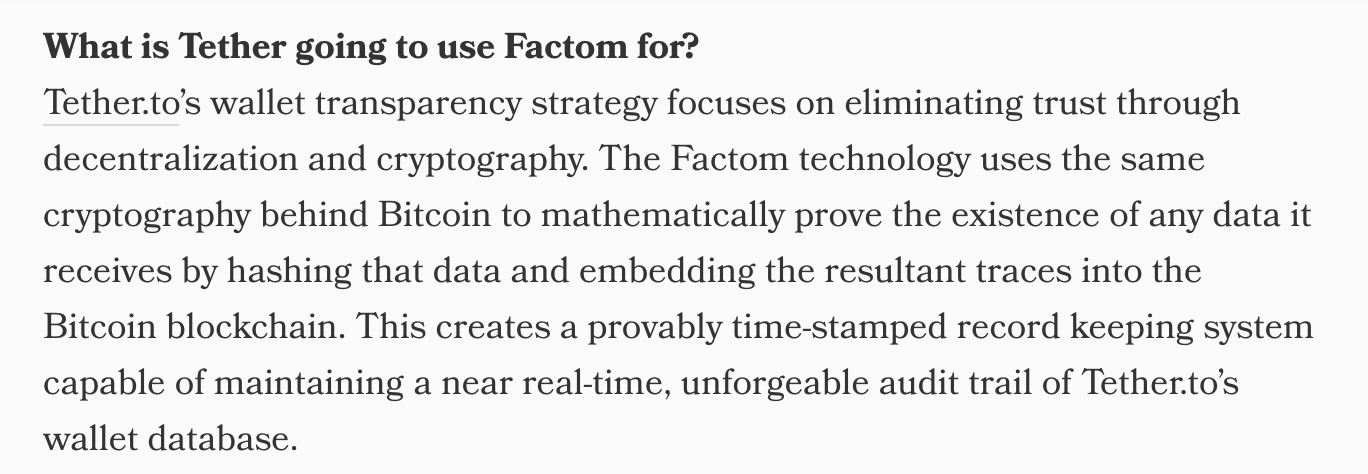

An excerpt from the official announcement of Tether and Factom’s collaboration.

While the link is dead, the internet archive shows us the Factom blockchain was being prepped to be used for an “unforgeable audit trail.”

Indeed, the audit trail was unforgeable — because it never existed. In fact, Factom and Tether didn’t work together on anything at all.

The second promise

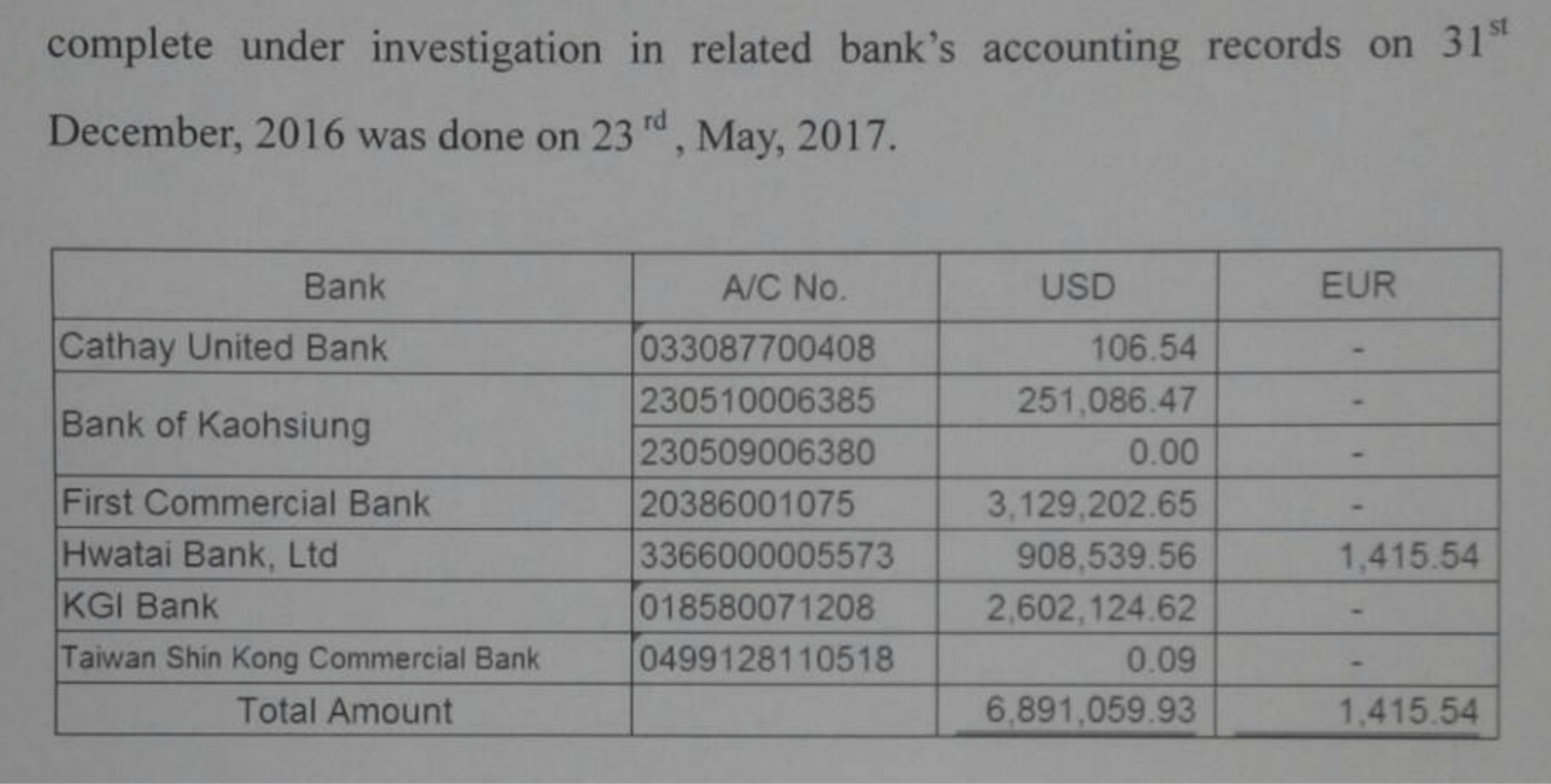

In late 2016 and early 2017, after Tether’s sister company Bitfinex was hacked and subsequently lost 119,756 bitcoin, Tether engaged with Taiwanese auditor Topsun. The audit doesn’t really resemble an audit, more an attestation of bank account statements that Tether management shared with Topsun — something Tether will get used to pretending is an audit.

Bank account records shared with Topsun.

Read more: Was Tether at the center of Sam Bankman-Fried’s empire?

In late 2017, roughly two months before Tether itself was hacked for 30 million tethers (which were subsequently frozen via a hard fork of the Omni Network), the firm engaged with Friedman LLP to audit its financials.

But instead of getting an audit, Tether chose to release a memo for management in which it explicitly stated it’s “not intended to be, and should not be used, or relied upon, by any other party.” Tether offered the statement from Friedman to the public as proof that it was about to get audited.

Shortly after that, Friedman either quit or was fired because, according to a Tether spokesperson, it was utilizing “excruciatingly detailed procedures.” This is quite literally what an audit entails, so it’s disconcerting to think that asking for detailed financials was reason enough for Tether to stop the audit from occurring.

The third promise

The third attempt to ease the fears, uncertainty, and doubts of the public at large saw Tether seek out a law firm called Freeh, Sporkin, and Sullivan (FSS). The firm issued an engagement document proclaiming all of Tether’s funds were stated publicly. However, this wouldn’t constitute an attestation or assurance from an auditing firm. It was simply a letter from three lawyers in mid-2018.

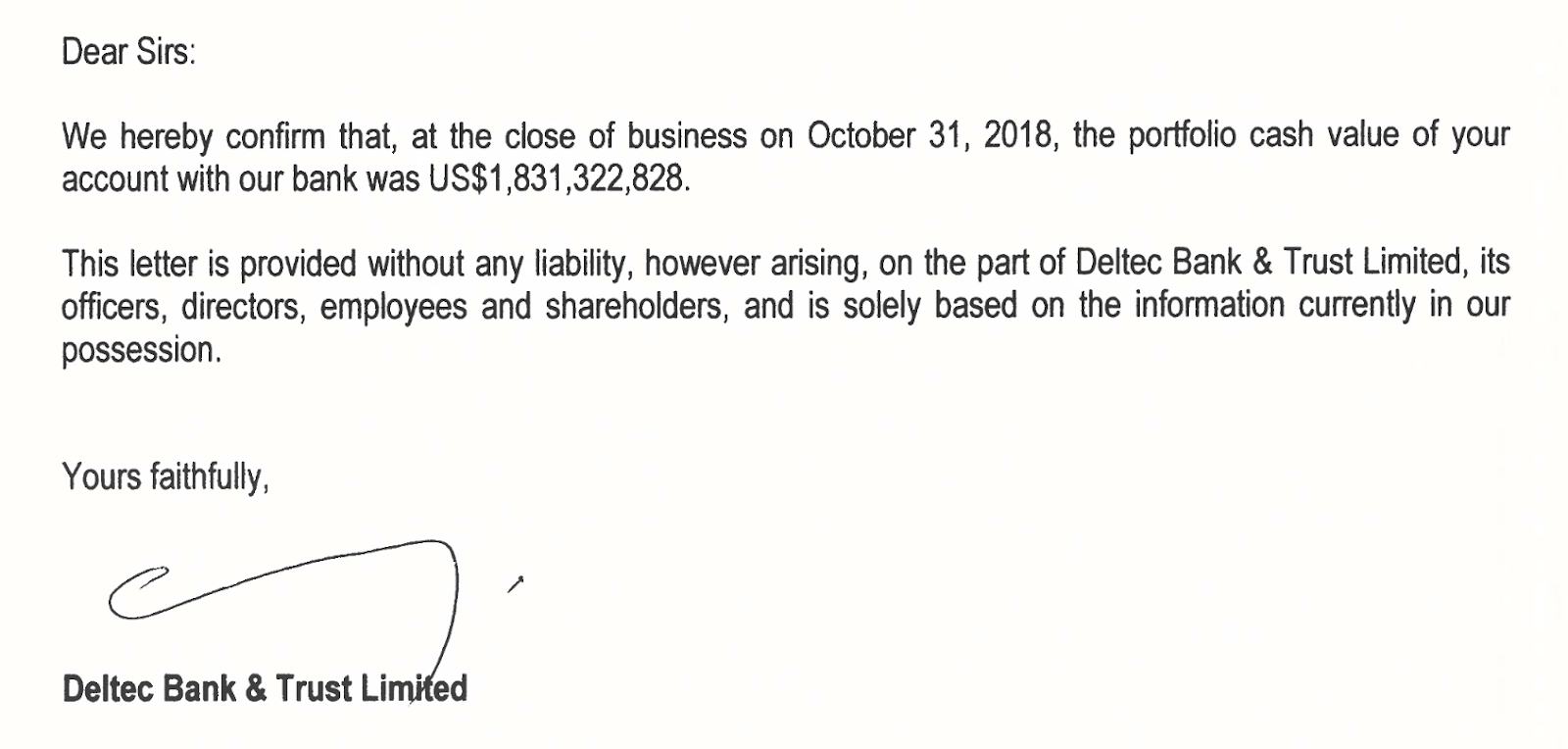

By late 2018, Tether had stopped working with FSS and moved on to its current banking partner, Deltec Bank & Trust, which issued it a “portfolio confirmation.” This isn’t even really a thing and asking your banking partner to sign a letter that confirms your portfolio (which Tether claimed not to have at the time, instead still pretending it was 1-1 backed with US dollars) isn’t exactly an objective third party. It’s signed with a quick, illegible signature by Jean Chalopin.

The letter signed by Deltec chairman Chalopin.

No more promises, forced adherence to the law

After settling with the New York Attorney General, Tether was forced to start issuing quarterly attestations proving that its reserves were fully backed and that it wasn’t dipping into funds via Bitfinex, as it had done previously.

In 2021, Tether settled with the New York Attorney General’s office, agreeing to pay an $18.5 million fine to end an investigation into whether it covered up the loss of $850 million in commingled client and corporate funds.

It began this process in 2021 with Moore Cayman — the Cayman Islands subsidiary of Moore Accountancy Corporation — and the first results were quite concerning. It appeared that Tether was laden with commercial paper — commercial paper of unknown national origin, unknown quality, and unknown liquidity. It refused to share any further information.

However, Paolo Ardoino, the CTO of Tether, and Stuart Hoegner, General Counsel at Bitfinex, did decide to join Deirdre Bosa of CNBC to discuss the attestations. The interview went horrendously for the duo, with non-denial denials overwhelming the majority of the discourse and Hoegner promising a full audit of the Tether reserves in a matter of “months, not years.”

It’s been over a year and a half since Hoegner made that promise.

Read more: Tether abandons commercial paper in favor of US Treasuries

New auditors, no new transparency

In late 2021, Moore Cayman was purchased by MHA and the new auditor agreed to take on the role of providing assurances for Tether. This lasted for precisely two quarters before, in a desperate bid to utilize an auditor of some repute, Tether switched to BDO Italia — which it claimed was a top-five auditor. (BDO is a “top five” auditor, whatever that’s supposed to suggest, but its subsidiary BDO Italia definitely isn’t.)

Shortly after this, Paolo Ardoino joined Deirdre Bosa for yet another interview on CNBC. Again, it went poorly.

The secret ingredient is lying

So, the lesson here is that Tether has been given over seven years to get an audit and it has chosen not to. But, perhaps more importantly, it’s also clear that it doesn’t really matter. While Tether has repeatedly lied about its backing, its ability to get GAAP audited financials, and even its ownership structure, it’s still somehow maintained its position as the largest market cap and most liquid stablecoin in the cryptocurrency industry.

Perhaps lying and deception is all that’s required to make it as a stablecoin operator in the industry. Or, maybe, people just don’t care about the details of these companies’ financials until it’s too late.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond