MEXC Faces Fresh Scandal: Partners Call Out Scams and Token Price Drops

- MEXC exchange faces partner complaints; accused of scamming users, manipulating token prices.

- Trendoshi.eth exposes MEXC’s scam history, including selling more tokens than held.

- MEXC allegedly stole millions in SORA, freezing withdrawals, and dumping tokens.

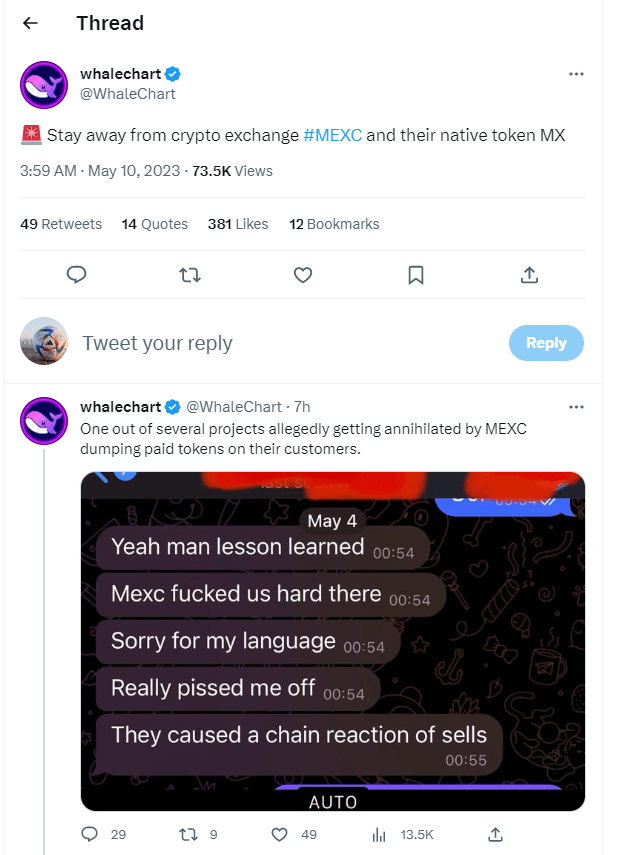

MEXC, a crypto exchange with a checkered past, has once again found itself in the crosshairs after recent allegations from partners concerning scams and token manipulation. These partners claim their collaborations with MEXC have led to project token price drops and dismal experiences.

This is not the first time MEXC has faced controversy. In the past months, the exchange was accused of scamming users. Trendoshi.eth detailed MEXC’s alleged misdeeds in a tweet, revealing that during DEFI summer 2020, Dos discovered MEXC had only half the 17M DOS tokens they claimed in their wallets. By selling more tokens than they possessed, MEXC was able to artificially deflate prices, executing an elaborate scam.

To mitigate the damage, Dos airdropped a new token, excluding MEXC from the process. Following this incident, other projects came forward, claiming to have had similar experiences with the exchange.

In a particularly egregious case, MEXC purportedly stole millions of SORA tokens in August 2020. The exchange froze SORA withdrawals, dumped the tokens on Uniswap, delisted SORA, and never allowed withdrawals, as they had no tokens left to return.

Despite rebranding from MXC to MEXC in an attempt to sanitize their image, the same perpetrators continue to operate the exchange, perpetuating its cycle of scams.

The pros and cons of using crypto exchanges like MEXC must be carefully weighed. While exchanges can provide a platform for trading and investing in various cryptocurrencies, they can also expose users to risks like scams, fraud, and market manipulation.

As the future of cryptocurrency becomes increasingly bright, it is crucial for users to conduct due diligence when selecting an exchange to minimize potential losses and ensure a secure trading experience.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Theta Network

Theta Network  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Decred

Decred  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Status

Status  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  NEM

NEM  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD