USDP Stablecoin Makes It to Top 50, Who’s Next?

Amid an accelerating market collapse triggered by the FTX/Alameda drama, stablecoins have solidified their stance on the cryptocurrency market. This process should be attributed to two interconnected catalysts.

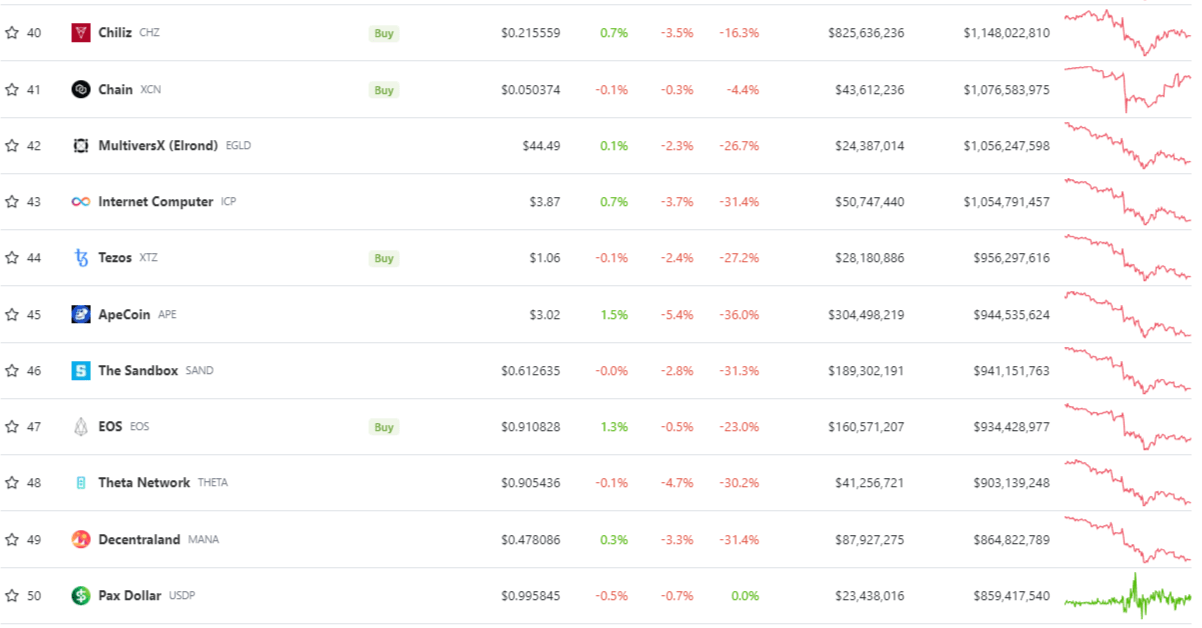

Paxos’ USDP becomes top 50 asset by market cap

Pax Dollar (USDP) by Paxos, a USD-pegged stablecoin that promotes itself as the «world’s leading regulated stablecoin,» has entered the top 50 cryptocurrency assets by market capitalization.

With its $859.4 million in market cap, it eclipsed Lido DAO (LDO) and Compound USD (CUSDC) and is now the 50th largest cryptocurrency asset.

Also, two top-league stablecoins are now getting closer to the top 50. Gemini Dollar (GUSD) with a $816 million capitalization and TrueUSD (TUSD) with $769 million in circulation might be the next assets in the elite club.

Amid the ongoing crypto bloodbath, people are increasing the share of stablecoins in their portfolios. This motivates the issuers of centralized stablecoins to mint new assets. Also, the net capitalization of stablecoins is more or less stable compared to the plummeting values of Bitcoin (BTC) and altcoins.

Large-cap decentralized stablecoins gain traction in 2022

Alongside the Big Three of stablecoins — U.S. Dollar Tether (USDT), USD Coin (USDC) and Binance USD (BUSD) — algorithmically-backed (decentralized) stablecoins are reaching new highs in Q4, 2022.

Currently, there are two decentralized stablecoins with a $1 billion+ capitalization: Dai (DAI) by the Ethereum veteran MakerDAO and Frax (FRAX) by the Frax Finance protocol.

USDD decentralized stablecoin by the TRON (TRX) ecosystem is now sitting at the 60th position of CoinGecko’s top assets by market capitalization.

It is also worth noting that the gold-pegged stablecoin Tether Gold (XAUT) is the only non-USD stablecoin in the top 100 with its $422 million capitalization.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM