3 reasons why Bitcoin is likely heading below $16,000

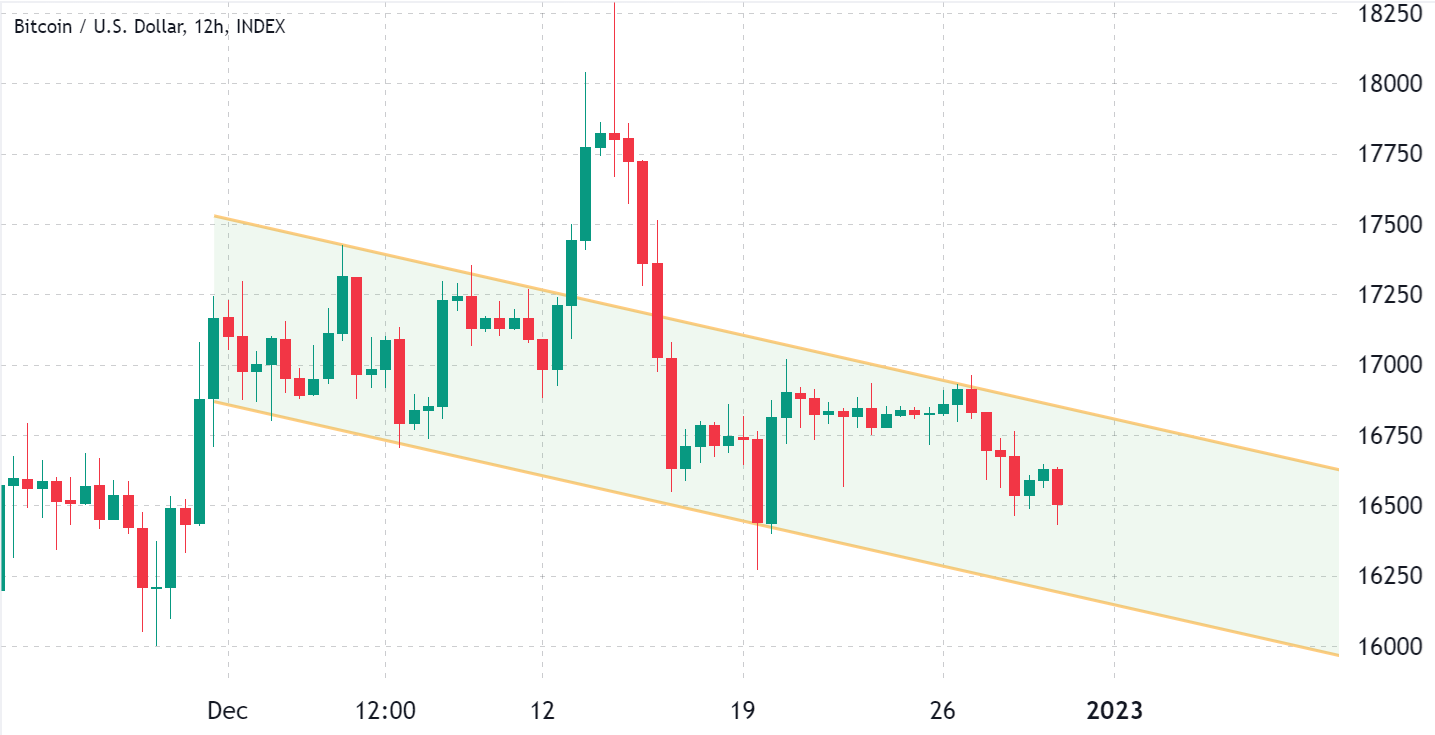

December will likely be remembered by Bitcoin’s (BTC) fake breakout above $18,000, but apart from that brief overshoot, its trajectory was entirely bearish. In fact, the downward trend that currently offers an $18,850 resistance could bring the BTC price below $16,000 by mid-January.

Bitcoin/USD price index, 12-hour. Source: TradingView

A handful of reasons can explain the negative movement, including the reported withdrawal of Mazars Group auditing firm from the cryptocurrency sector on Dec. 16. The company previously handled proof-of-reserve audit services for Binance, KuCoin and Crypto.com.

Additionally, one can point to the bankruptcy of one of the largest cryptocurrency miners in the United States, Core Scientific. The publicly listed company filed for Chapter 11 bankruptcy on Dec. 21 due to rising energy costs, increasing competition, and the Bitcoin price crash in 2022.

The liquidity crisis at the crypto lender and trading desk Genesis Global and its parent company, Digital Currency Group (DCG), sparked fear among investors. More importantly, DCG manages the $10.5 billion Grayscale Bitcoin Investment Trust (GBTC). The fund is currently trading at a 47% discount to its net asset value in part due to investor speculation on its exposure to Genesis Global.

Negative pressure from the U.S. Federal Reserve tightening movement

Apart from the bearish newsflow, the macroeconomic scenario deteriorated after the U.S. Federal Reserve hiked interest rates by 50 bps on Dec. 14. Analysts, including Jim Bianco, head of institutional research firm Bianco Research, said that the monetary authority would maintain its tighter monetary policy in 2023.

Investors fear that Bitcoin could break below the current descending trend support at $16,100, triggering a sharp correction. TH3 Cryptologist, a veteran crypto trader, points out a descending wedge potentially causing a $14,000 low by February 2023.

On daily TF I can see this shaping out to be a descending wedge with a potential bottom forming at 14k area. $btc #bitcoin pic.twitter.com/dpPVZZy5Vk

— TH3 Cryptologist (@TH3Cryptologist) December 29, 2022

But let’s also look at Bitcoin derivatives data to understand if the price action and recent news have impacted crypto investors’ sentiment.

Bitcoin buyers’ demand using leverage are yet to be seen

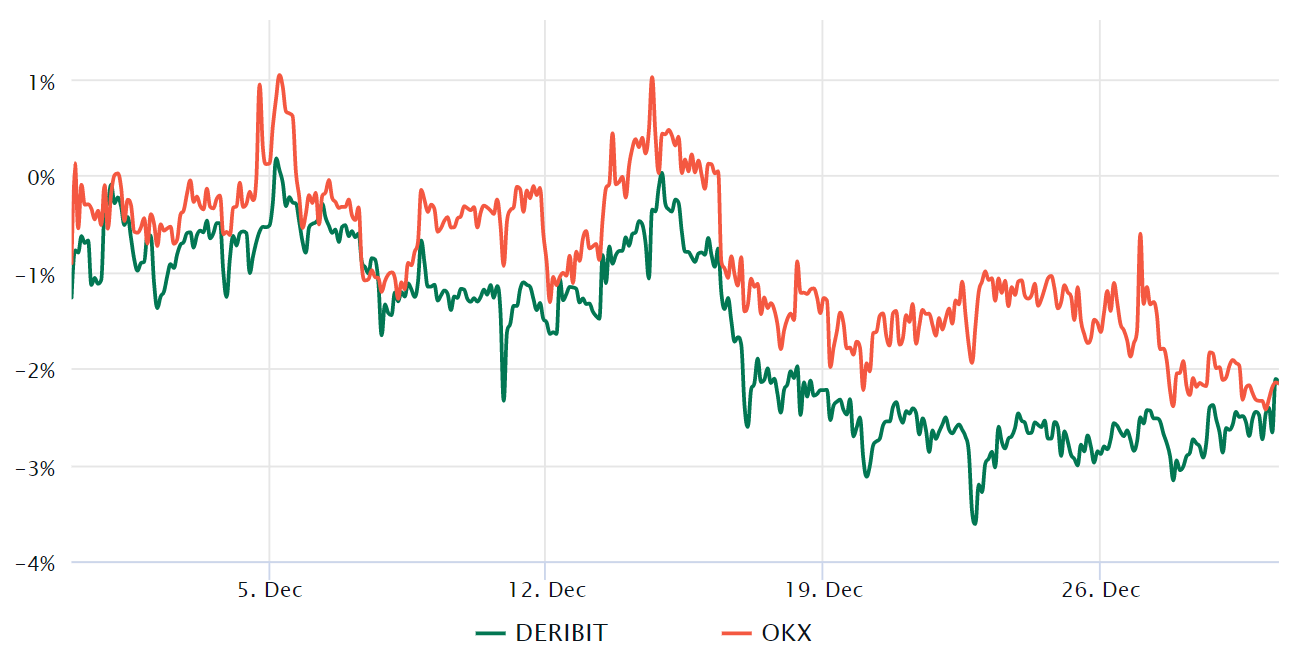

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Meanwhile, professional traders prefer these instruments because they prevent the fluctuation of funding rates in a perpetual futures contract.

The three-month futures annualized premium should trade between 4% to 8% in healthy markets to cover costs and associated risks. Thus, when the futures trade at a discount versus regular spot markets, it shows a lack of confidence from leverage buyers — a bearish indicator.

Bitcoin 3-month futures annualized premium. Source: Laevitas.ch

The above chart shows that derivatives traders remain bearish as the Bitcoin futures premium stands negative. Even more concerning, not even the $18,000 pump on Dec. 14 was able to shift those whales and market makers to a balanced leverage demand between longs and shorts.

Still, the lack of demand for leverage buyers does not necessarily indicate traders expect an immediate adverse price action. For this reason, one should analyze Bitcoin’s options markets to exclude externalities specific to the futures instrument.

Related: $8K dive or $22K rebound? Bitcoin traders anticipate Q1 BTC price action

Options traders getting comfortable with downside risks

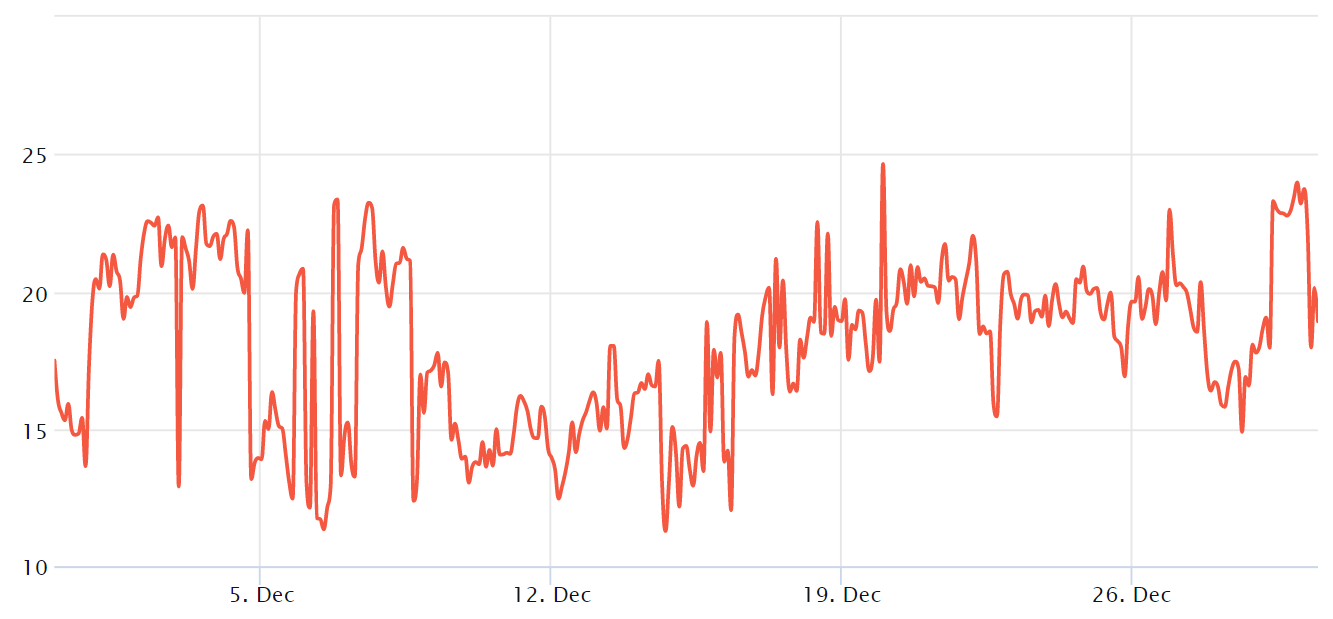

The 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 10%. On the other hand, bullish markets tend to drive the skew indicator below -10%, meaning the bearish put options are discounted.

Bitcoin 30-day options 25% delta skew: Source: Laevitas.ch

The delta skew peaked at 23% on Dec. 29, signaling that options traders are uncomfortable with downside risks.

As the 30-day delta skew stands at 18%, both options and futures markets point to pro traders fearing that the $16,100 support will likely be tested.

Therefore, the reasons for investors’ bearishness are the continuation of higher interest rates, absence of leverage buyers’ demand, and BTC option traders positioning for more downside.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur