Bitcoin repeats pattern from 2016, suggesting ‘mega bull run’ on the horizon

As Bitcoin (BTC) is starting to witness modest gains in recent days, during which the cryptocurrency industry is struggling under the pressure of lawsuits that the United States Securities and Exchange Commission (SEC) has filed against two crypto exchanges, a bullish run could be ahead judging by a repeating trend.

Specifically, Bitcoin is currently moving above its exponential moving average (EMA) on 20 observed time periods and is demonstrating two bars in its Bollinger Band width percentile (BBWP), as observed by the pseudonymous crypto analyst el_crypto_prof a.k.a. Moustache, in a tweet shared on June 13.

By comparison, the same chart pattern had emerged seven years before, in 2016, right before a “mega bull run” began for the flagship decentralized finance (DeFi) asset, during which its price had soared as much as 3,200%, ultimately reaching the top at $19,033, from the mere $580.

According to the cryptocurrency expert’s Bitcoin chart analysis, a similar pattern occurred following the Covid-19 crash in 2020, after which the maiden crypto asset saw a bull run of more than 600% to its price, culminating at $56,031, up from around $7,800.

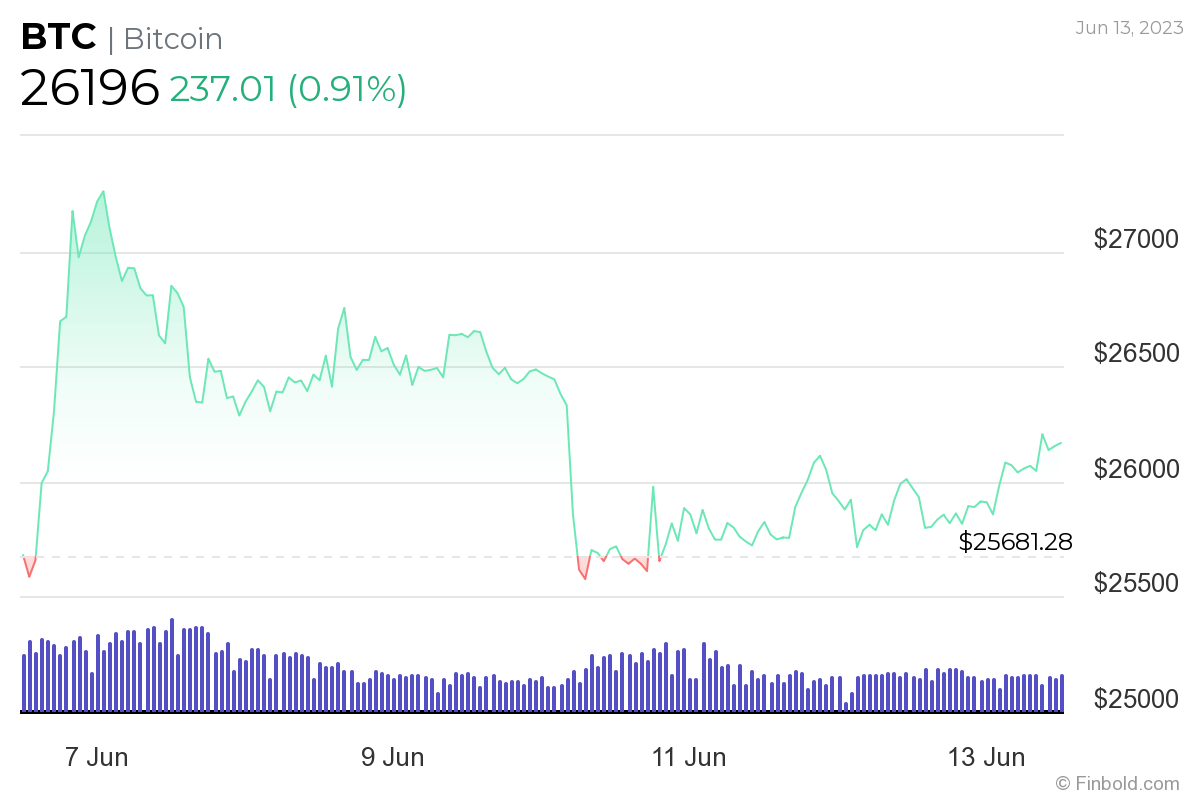

Bitcoin price analysis

As things stand, Bitcoin is currently trading at the price of $26,196, demonstrating an increase of 0.91% on the day and 1.59% over the past week, whereas, on its monthly chart, it is writing down a loss of 2.44%, as per the latest data retrieved on June 13.

Despite occasional struggles, Bitcoin has still managed to increase its price by nearly 60% since the year’s turn, turning almost 48,000 crypto investors into millionaires, and recently, the accumulating behavior of its largest holders has indicated a possibility of a strong rebound.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Ontology

Ontology  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur