3 striking similarities with past Bitcoin price bottoms — But there’s a catch

Bitcoin (BTC) has been consolidating inside the $18,000-$20,000 price range since mid-June, pausing a strong bear market that began after the price peaked at $69,000 in November 2021.

Many analysts have looked at Bitcoin’s sideways trend as a sign of a potential market bottom, drawing comparisons from the cryptocurrency’s previous bear markets that show similar price behaviors preceding sharp, bullish reversals.

Here’re three strikingly similar trends that preceded past market bottoms.

2018 BTC price sideways trend

The 2018’s Bitcoin bear market serves as a major cue for a potential market bottom in 2022 if one looks at its eerily similar price trends and indicators.

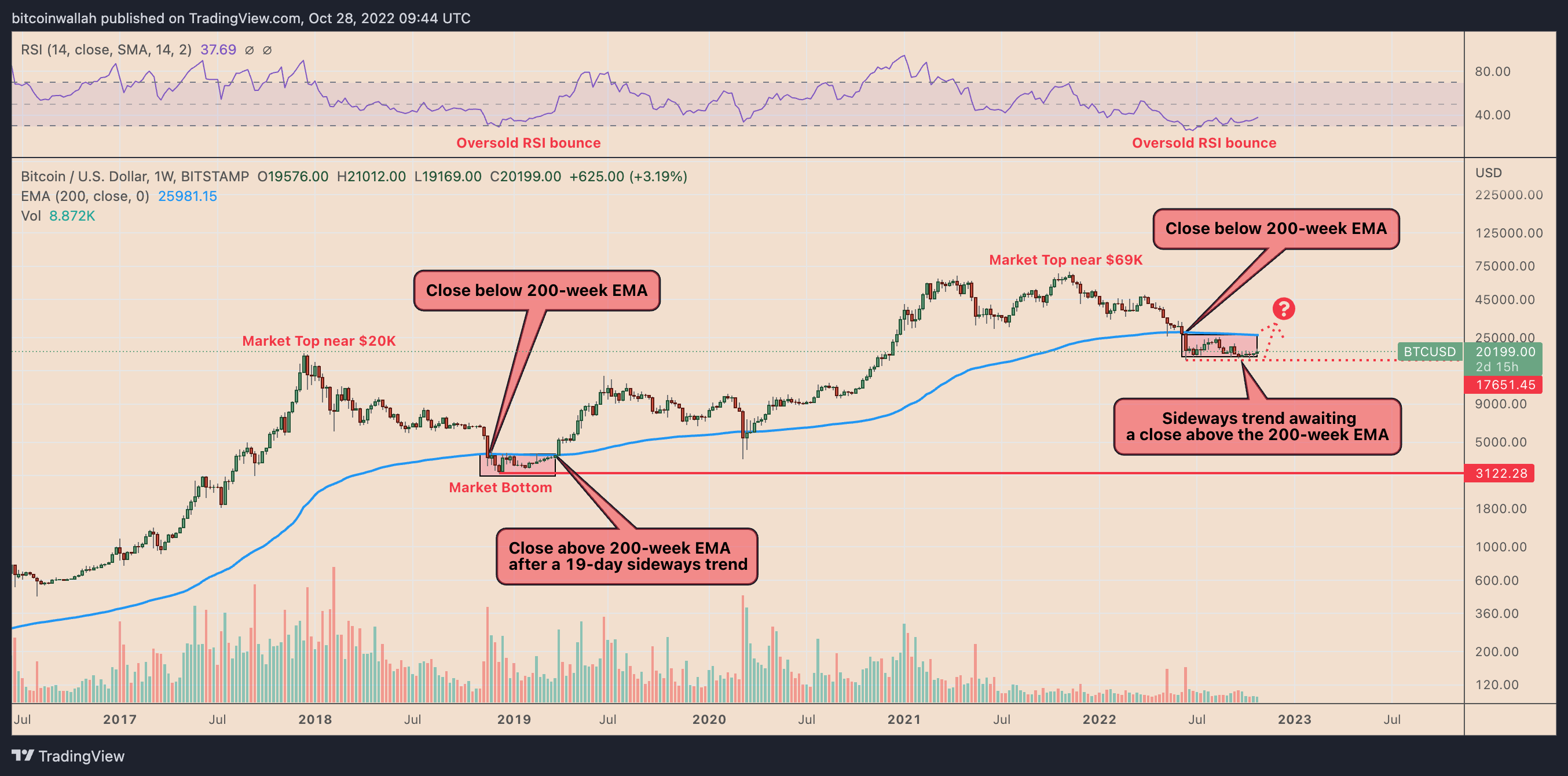

One of the key indicators is Bitcoin’s 200-week exponential moving average (200-week EMA; the blue wave in the chart below). In 2018 and 2022, Bitcoin entered a long period of sideways consolidation after closing below its 200-week EMA.

BTC/USD weekly price chart featuring 2018 bear market fractal. Source: TradingView

Except in 2018, Bitcoin’s sideways trend lasted for nineteen days, with the price reclaiming its 200-week EMA as support, followed by moves toward approximately $14,000 in June 2019. In 2022, the sideways trend entered its 19th day on Oct. 28 but awaits a clear breakout above the 200-week EMA near $26,000.

Additionally, Bitcoin’s weekly relative strength index (RSI) hints at a potential bottom formation. In 2018, the RSI’s drop into its oversold territory (below 30) was followed by the BTC’s price sideways trend and eventually by a fully-fledged bullish reversal.

That is halfway similar to Bitcoin’s RSI trend in 2022, given it slipped below 30 in June and followed up with Bitcoin’s sideways price action between $18,000 and $20,000 levels. That could follow up with a bullish reversal phase if the 2018 fractal is repeated.

2013-15 bull trap support

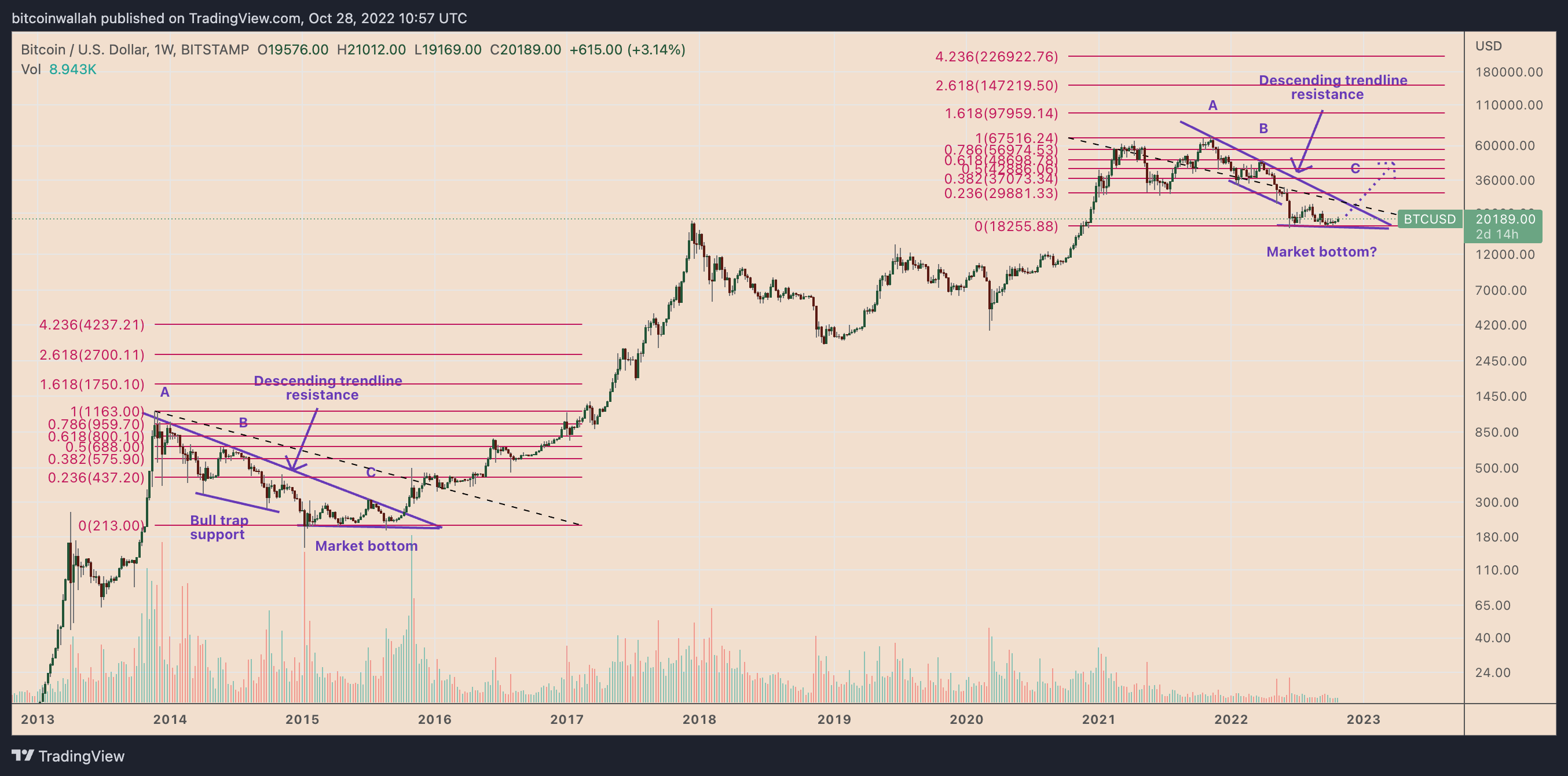

Bitcoin’s 2022 bear market also shares similarities to the price trends witnessed in 2013-2015, comprising a descending trendline resistance, a weak bull trap support trendline, and a horizontal support level.

BTC/USD weekly price chart featuring 2014-2015 bear market fractal. Source: TradingView

BTC price dropped 82% from its December 2013 top of around $1,200.

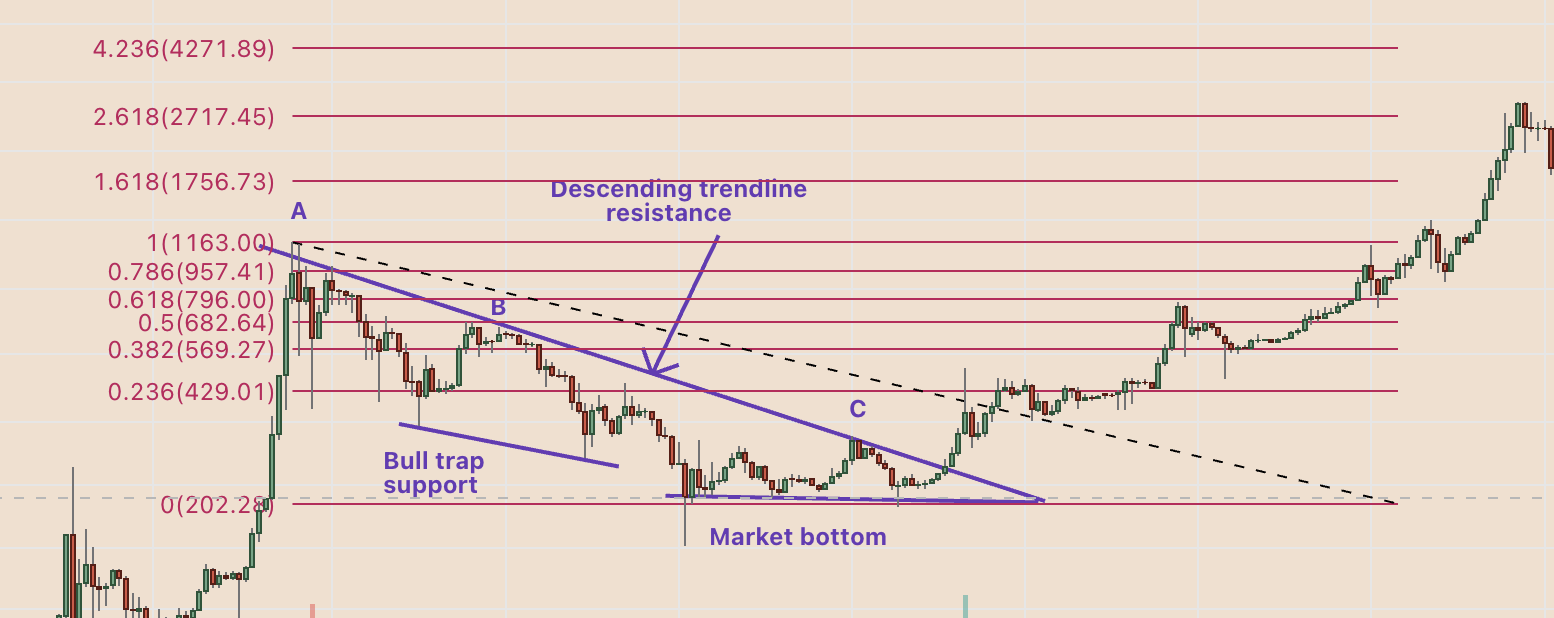

In doing so, Bitcoin attempted to close thrice above its descending trendline resistance (marked with A, B, and C in the chart above). Simultaneously, the price drew limited support from another descending trendline, resulting in bull trap rallies.

Bitcoin eventually bottomed at a horizontal trendline support near $200, following it up with a strong breakout above the descending trendline resistance, reaching the 0.236 Fib line of $429. By December 2017, its price had reached nearly $20,000.

Bitcoin 2013-15 bear market on weekly chart (zoomed version). Source: TradingView

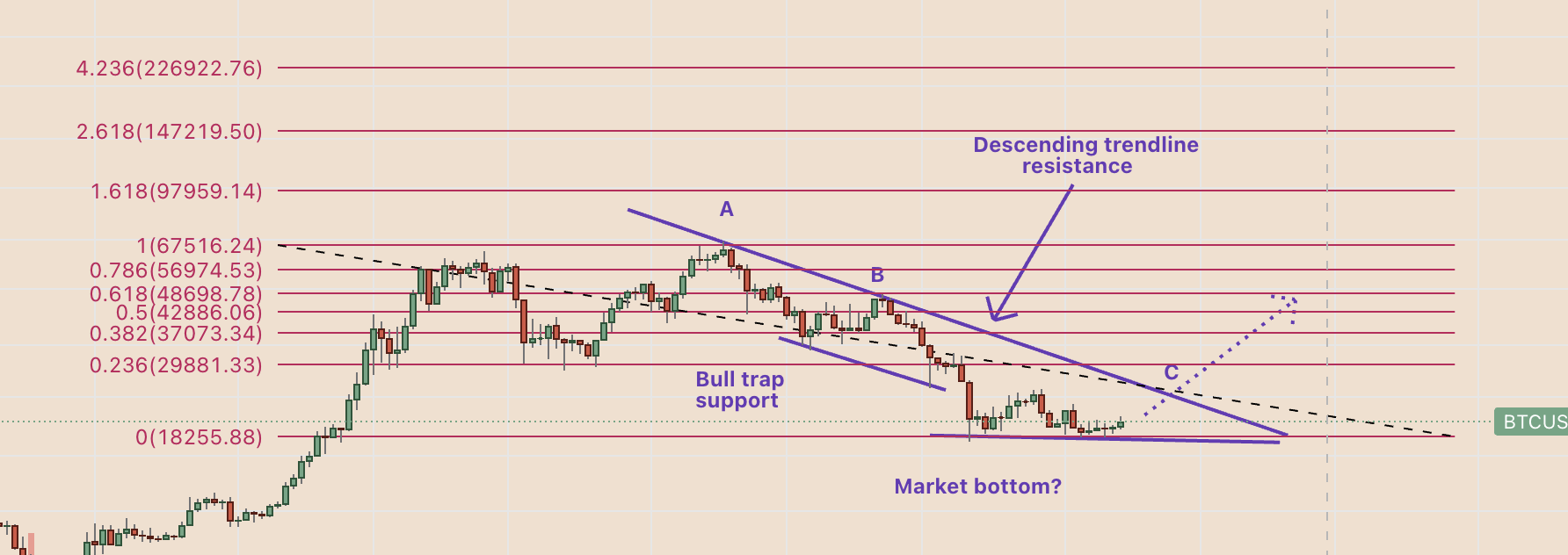

In 2022, Bitcoin’s price has ticked all the boxes regarding mirroring its 2013-15 bear market, except for the breakout above the descending trendline resistance.

Bitcoin 2022 bear market on weekly chart (zoomed version). Source: TradingView

Thus, BTC/USD could see a rally toward $30,000, the 0.236 Fib line, in early 2023 if the breakout occurs.

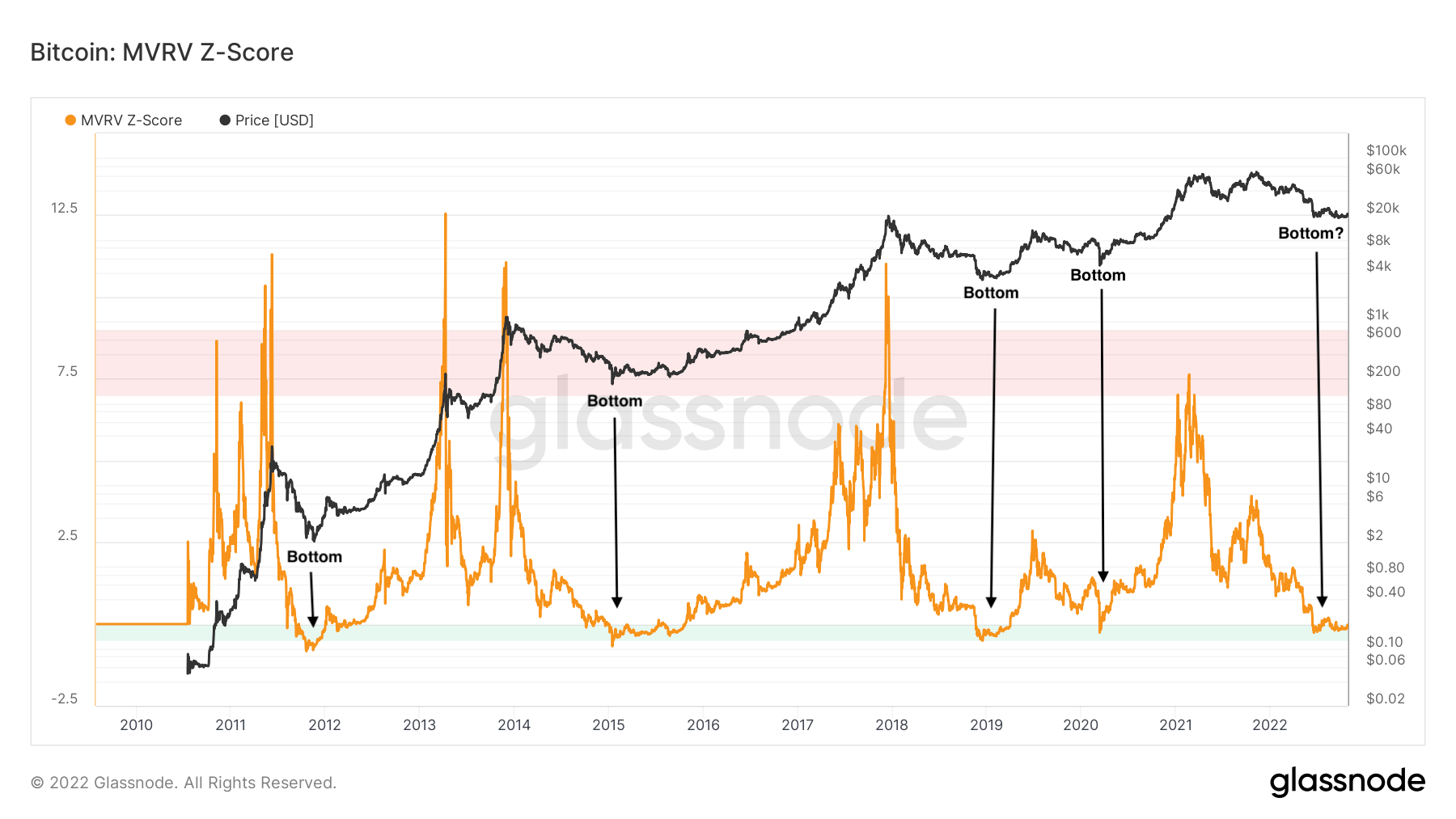

Bitcoin MVRV-Z score

From an on-chain analysis perspective, Bitcoin’s 2022 downtrend has made it as undervalued as it was at the end of previous bear markets.

For instance, Bitcoin’s Market Value-to-Realized Value (MVRV) Z-score, which measures the coin’s over/undervalued relative to its fair value, has dropped into the region that has coincided with previous bear market bottoms, as shown below.

Bitcoin MVRV-Z Score versus market bottoms. Source: Glassnode

The on-chain indicator increases Bitcoin’s possibility to bottom inside the $18,000-$20,000 region—in line with the two fractals discussed above.

Different this time?

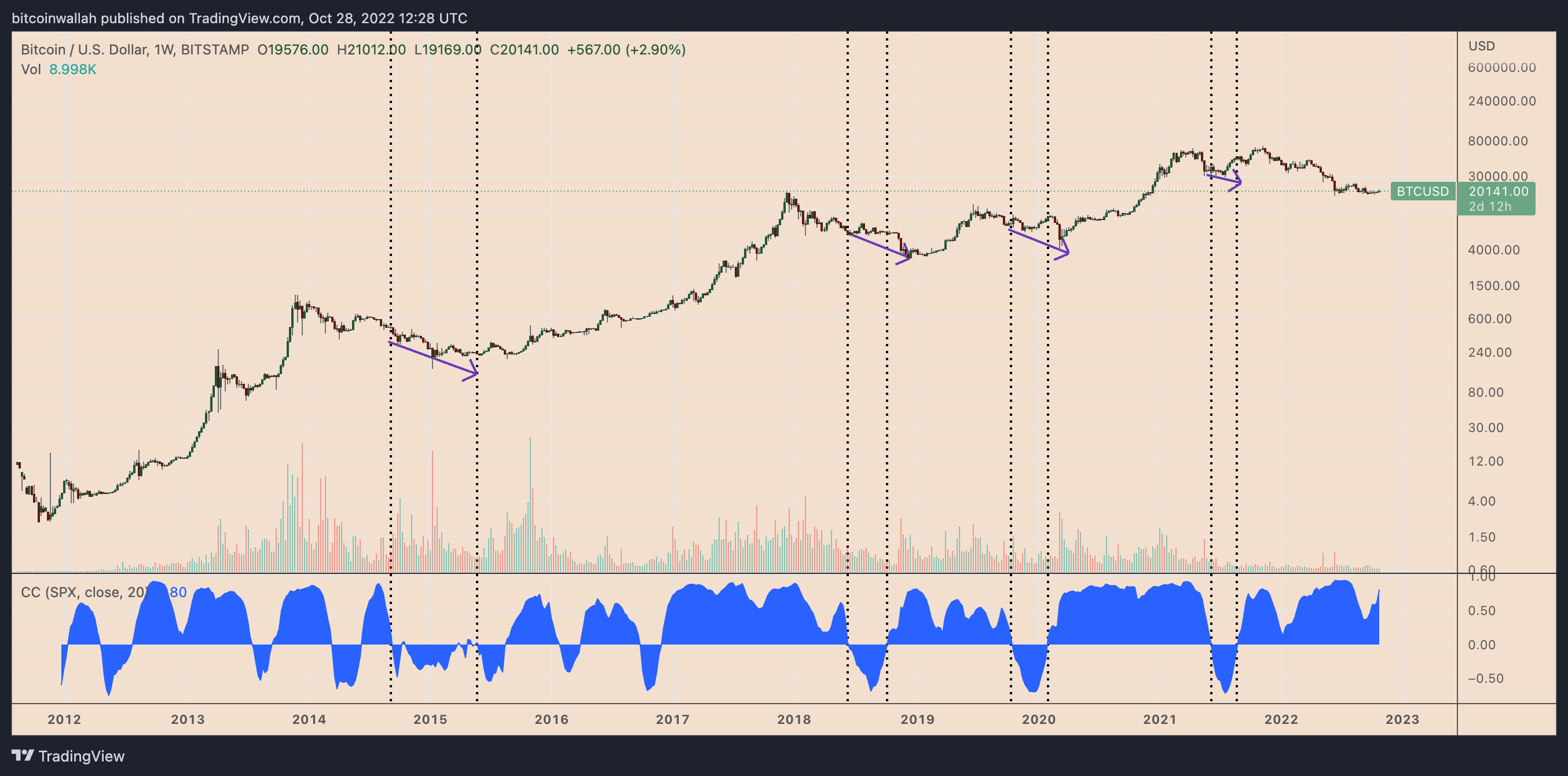

Unlike previous years, Bitcoin’s 2022 bear market occurred primarily due to the Federal Reserve’s interest rate hikes in response to persistently higher inflation.

The U.S. central bank’s tightening measures removed excess cash from the economy, thus leaving investors with little capital to speculate on risk-on assets. As a result, Bitcoin fell alongside U.S. stocks with a strong correlation coefficient of 0.80 as of Oct. 28.

Related: Bitcoin mirrors 2020 pre-breakout, but analysts at odds whether this time is different

Previously, the Bitcoin market recovered weeks or months after its correlation with U.S. stocks dropped below zero. The chart below shows four instances from the 2014-2016, 2017-2018, 2019-2020, and 2021.

BTC/USD weekly price chart. Source: TradingView

Hence, Bitcoin carries risks of bearish continuation if its correlation with U.S. stocks remains positive.

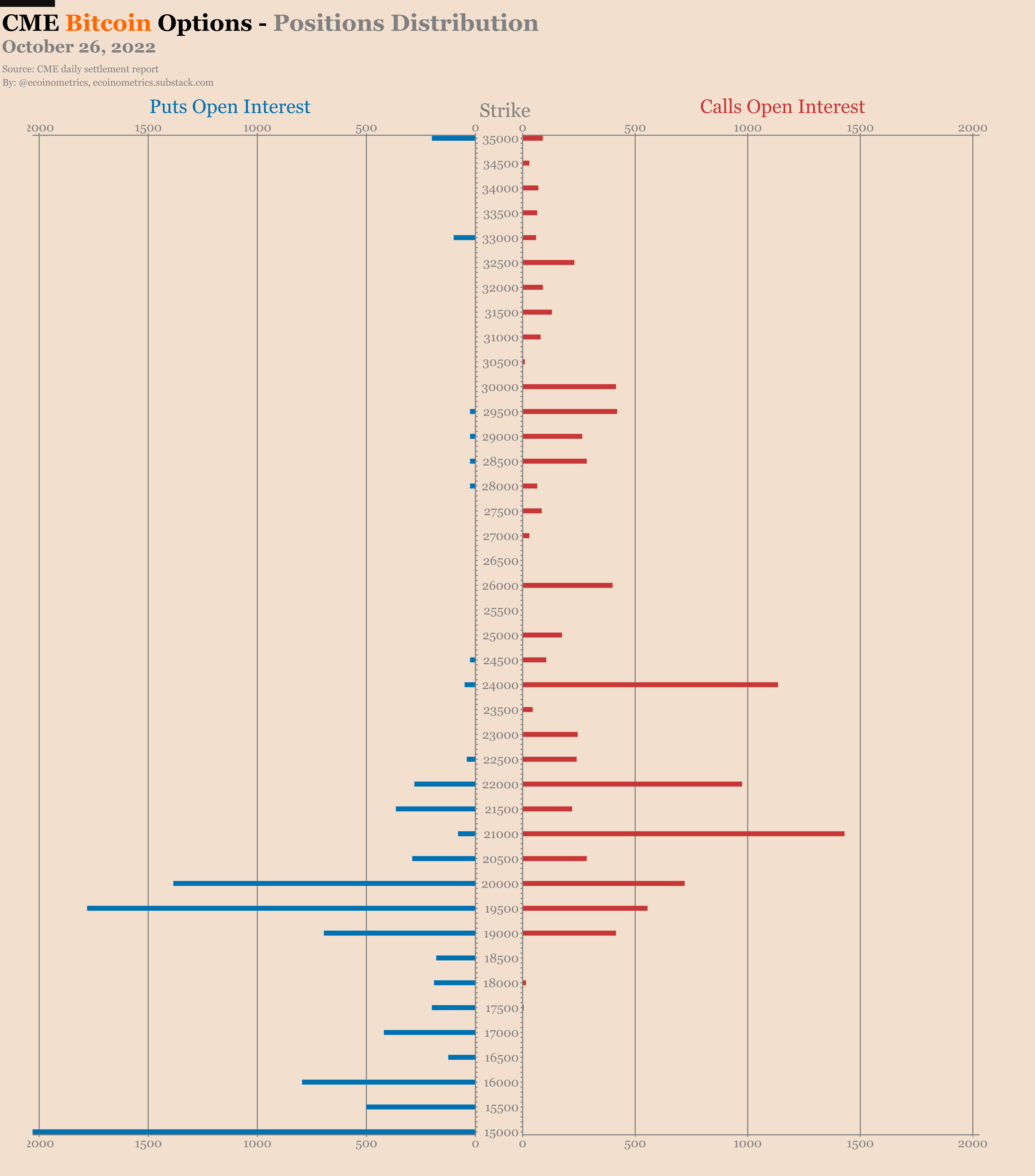

Meanwhile, over 2,000 CME Bitcoin options contracts expiring by the end of this year show a net bias toward put positions. In other words, traders have been anticipating more downside for BTC price.

CME Bitcoin options position distribution. Source: Ecoinometrics

Traders see the possibility of Bitcoin sliding towards $10,000 to $15,000 but anything lower than that is given a low probability, said Nick, analysts at data resource Ecoinometircs.

As Cointelegraph reported, the $10,000-$14,000 area remains an area of interest for a possible price bottom if a breakdown occurs from the current levels.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond