$4.6 Billion in Ethereum Up in Flames Since EIP-1559

Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster)

Over the past week, Ethereum is burning hotter than ever.

As part of EIP (Ethereum Improvement Proposal) 1559, launched all the way back in August 2021, the protocol has been burning ETH (crypto lingo for destroying) at a massive rate.

As per EIP-1559, a portion of all Ethereum transactions are destroyed: a piece of every NFT trade, yield strategy, and even simple token transfers. It’s all getting torched.

Since EIP-1559 was implemented, a grand total of 2.8 million ETH has been removed from circulation or roughly $4.6 billion at today’s prices.

In just the last seven days, the Ethereum protocol has destroyed more than 16,364 ETH at an estimated rate of 1.62 ETH per minute, according to Ultrasound Money.

This burn mechanism also means that there is more ETH being destroyed than being issued to miners. Supply growth has now dropped to -1.06% per year since EIP 1559. This makes Ethereum more deflationary than Bitcoin, which was heralded as the original sound money (hence the use of the ultrasound money meme by ETH heads).

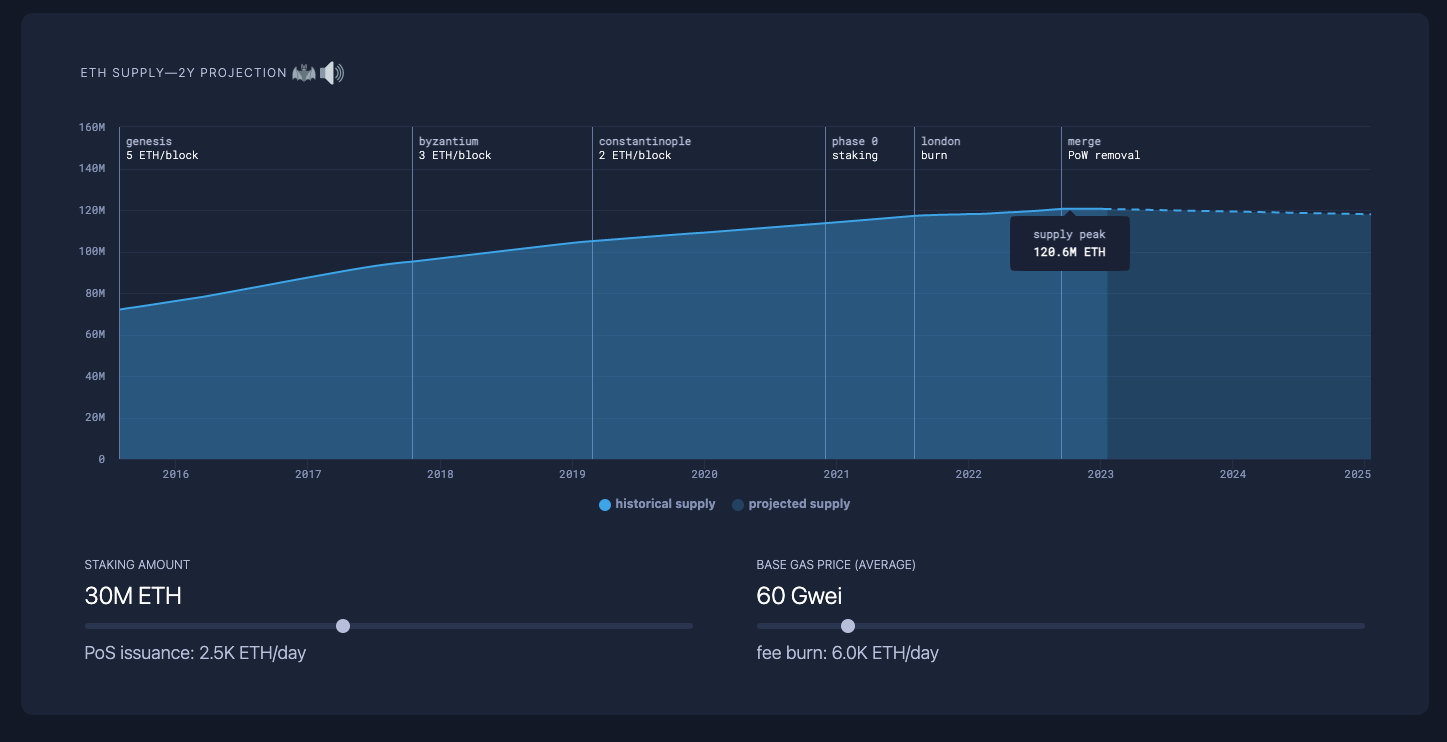

The below chart shows how the network’s token supply has changed over various checkpoints and upgrades. The dotted portion suggests that the deflationary trend is expected to continue over the next two years.

ETH supply projections via ultrasound.money.

The only real reason that this projection wouldn’t be fulfilled would be if ETH adoption and usage falls off a cliff. Remember: With every transaction on the network, ETH gets burned.

In this way, we might use this burn rate as another way to measure adoption for the network.

So, which use categories (as defined by Ultrasound Money) are leading adoption on Ethereum? Over the past week, it’s NFT and DeFi activity fueling Ethereum’s flame.

These two categories have been responsible for the destruction of almost 8,000 ETH this week, with the market leaders in each category—OpenSea (~1,298 ETH) and Uniswap V3 (~876 ETH)—being the key drivers of that.

This metric also gives us a touch more insight into the stablecoin battle between USDT and USDC. We all know that the former’s market cap is still miles ahead of the latter’s, but Tether’s offering is also responsible for more than three times the amount of Ethereum being burned.

USDT transfers burned roughly 705 ETH this week, while USDC transfers burned just 228 ETH. In other words, USDT continues to lead usage in terms of stablecoin adoption on Ethereum.

As network activity continues apace, the Ethereum community will continue to watch it burn.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond