Maverick Protocol Shatters Records with $9M Funding Led by Peter Thiel’s Founders Fund

The round was led by Founders Fund, a venture capital firm co-founded by Peter Thiel, and also included Pantera Capital, Binance Labs, Coinbase Ventures, and Apollo Crypto. These investors have high hopes for the future of Maverick Protocol, which plans to utilize its new capital to develop more efficient liquid staking token infrastructure and address cross-chain liquidity inefficiencies.

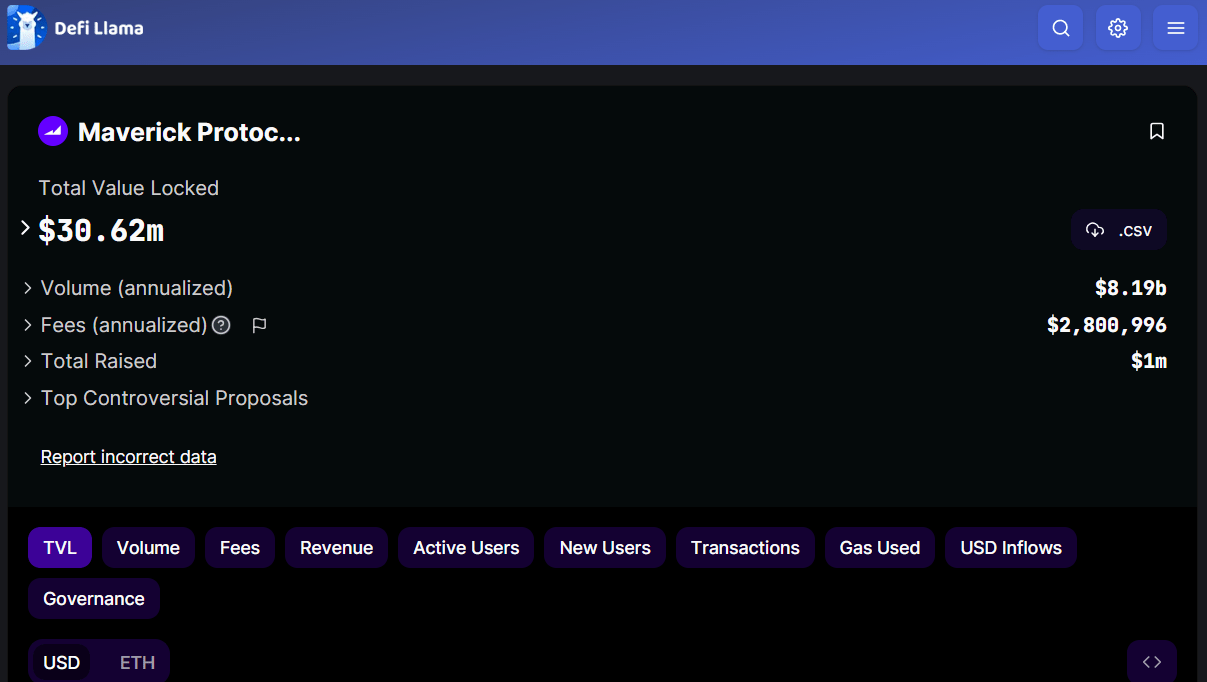

The concept of liquid staking protocols, which allow investors to earn rewards on their tokens without locking them up for a long period, has been growing in popularity. Experts have predicted that this sector will continue to expand following Ethereum’s Shanghai upgrade. Maverick Protocol aims to provide the necessary infrastructure to enhance the efficiency of decentralized finance (DeFi) markets, according to the company’s statement. To date, the protocol has accumulated over $30 million in total value locked (TVL), according to DeFiLlama.

In March of this year, Maverick Protocol launched its decentralized exchange (DEX) on Ethereum, which is powered by a smart contract-based automated market maker (AMM). This enables investors to increase their revenue through automating the ranges in which they put their tokens to work. Since then, Maverick has also collaborated with liquid staking projects such as Lido, Frax, Liquity, cbETH, Rocket Pool, and Swell, the statement said.

As concerns about the stability of centralized exchanges continue to grow, decentralized trading platforms are becoming increasingly popular among traders. The collapse of FTX last year and the recent regulatory backlash against Coinbase and Binance have highlighted the risks associated with centralized exchanges. Traders may, therefore, shift their focus towards platforms that are not dependent on individual large companies and are less vulnerable to sudden market fluctuations.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur