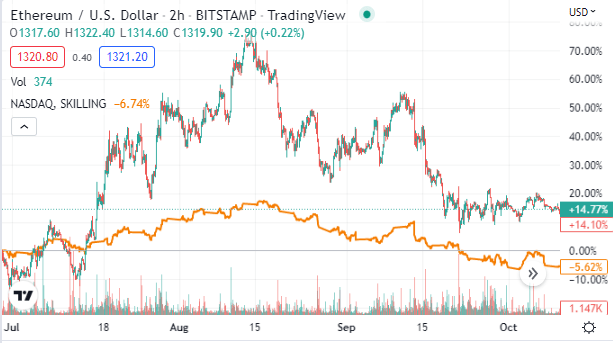

Ethereum outperforms Nasdaq by 20% during 3-month stock sell-off

Although the correlation between the stock market and Bitcoin (BTC) is often taken into account when analyzing the performance of the largest cryptocurrency, the second-ranked asset, Ethereum (ETH), is noticeably outperforming the Nasdaq index.

As it happens, Ethereum has been outdoing the Nasdaq by around 20% since mid-July, during which period the stock market has been recording a sell-off, Messari’s crypto analyst Tom Dunleavy pointed out on October 17.

According to Dunleavy:

“While stocks have sold off in the past 3 months, ETH has held up.”

Stock market’s poor performance

Indeed, as Finbold reported in August, Nasdaq was among the worst performing indices in the first seven months of 2022, losing -20.80% YTD, with Bitcoin in the leading position with losing -48.6%.

Meanwhile, the total returns of the Nasdaq 100 index, representing the technology industry, dropped 34.15% year-to-date (YTD) in 2022, despite recording an annualized return of over 23% for the past 13 consecutive years.

That said, the Nasdaq Index posted its best daily return since July during the trading session on October 17, leading to an increase in stock futures trading that continued the next day after a volatile week, but leaving analysts unconvinced of the rally’s longevity.

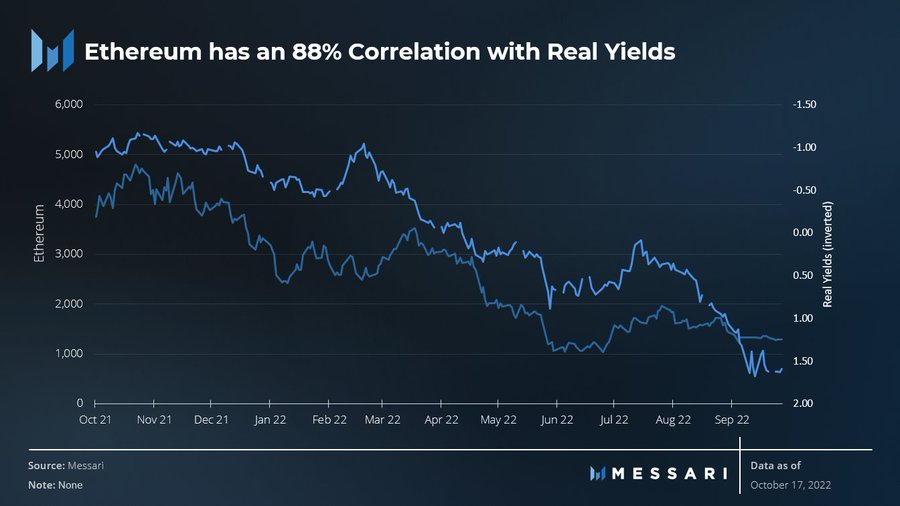

Ethereum vs. real yields

Interestingly, Dunleavy also noted that Ethereum was seeing an 88% correlation with real yields – the returns that investors earn from long-term government bonds after accounting for inflation, which have recently soared to their highest level since 2011, additionally eating away at the attractiveness of stocks.

Ethereum price analysis

At press time, Ethereum was trading at $1,327, up 0.72% on the day, as well as 3.24% across the previous week, according to CoinMarketCap data retrieved by Finbold on October 18.

Over the past five weeks, the price of the decentralized finance (DeFi) asset has been under increased pressure, seeing a decline of 25% due to shark and whale addresses dumping over $4 billion worth of ETH tokens during that period.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD